digital banking

App-based banking gains traction as customers go digital

Banking is no longer limited to brick-and-mortar branches. People are banking remotely using the internet more and more. Of late, mobile applications have come up as a new and inviting option, and a growing number of customers are using apps for banking in Bangladesh.

28 January 2026, 00:00 AM

Bank Asia ramps up retail-SME drive, bets on digital banking

Bank Asia plans to accelerate the expansion of retail and SME lending, strengthen its presence at home and abroad, widen its agent network, and continue leading digital innovation in the coming years. The private bank wants to expand SME and retail loans to at least 50 percent of the total portfolio within the next three years.

26 November 2025, 18:00 PM

The future of retail banking

Retail banking in Bangladesh is entering a moment of reckoning. With the Bangladesh Bank (BB) preparing to issue digital banking licences, and with more organised mobile financial services, AI and platform technology becoming mainstream, it is no longer enough for a bank to be a place where peop

1 November 2025, 19:48 PM

Key reforms needed to salvage the banking sector

The banking industry as a business is inherently risky.

14 October 2024, 06:00 AM

Our youth needs financial literacy to combat banking scams

The banking scams and digital financial crimes plaguing our country are not just economic issues; they're a threat to our aspirations for a reformed Bangladesh.

14 September 2024, 06:00 AM

IMF asks about NPL classification, write-off policies

The IMF mission met with the deputy governors, policy advisor, executive directors and directors in different meetings at the central bank headquarters.

30 April 2024, 00:54 AM

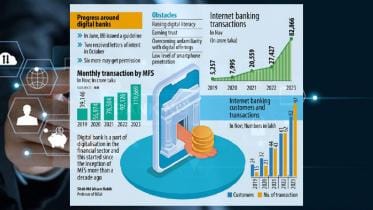

Bangladesh plans more licences for digital banks in push to go cashless

BB plans to offer more permissions for digital banks in order to pave the way for full-fledged financial services based on a 100 percent branchless banking system

25 January 2024, 01:00 AM

Digital banks aim to create space for all

It took decades for Bangladesh to bring around 10 percent of the adult population under the banking system before the mobile financial service (MFS) accelerated the pace in the past decade.

24 January 2024, 20:00 PM

Digital banks will bring a revolution in Bangladesh

Once the digital banks are launched, poultry vendors at bustling hubs like Kawran Bazar and even vegetable growers in rural villages will be brought under the banking umbrella

19 November 2023, 02:00 AM

Genex Infosys, Navana Pharma, Aramit to invest in UPAY Digital Bank

Genex Infosys Ltd, Navana Pharmaceuticals Ltd and Aramit Ltd have decided to invest in the proposed digital bank named UPAY Digital Bank PLC.

20 August 2023, 08:38 AM

Internet banking transactions hit nearly Tk 50,000cr

Internet banking transactions reached a record high amount of nearly Tk 50,000 crore in May, signifying the enhanced cost and time savings and convenience enabled over visits to brick-and-mortar branches for a growing number of bank account holders.

18 July 2023, 01:20 AM

Bank Asia to invest in digital bank

Bank Asia has decided to be a sponsor shareholder of a proposed digital bank by investing Tk 12.50 crore, said the private bank today.

16 July 2023, 08:45 AM

The ins and outs of banking, simplified

“I got the courage to start writing and felt that, if the market practices and regulations of a particular issue are in one place it may help the bankers, customers as well as students”, the author writes.

2 March 2023, 08:00 AM