crawling peg

Govt to bank on crawling peg, global interest rate cuts to rebuild reserves

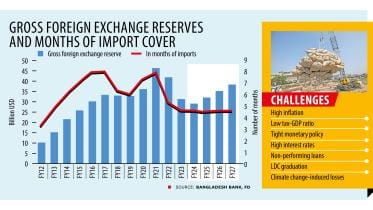

The revised gross forex reserves target for the current fiscal year ending on June 30 was $29.1 billion. It stood at $24.23 billion on June 5, according to the traditional calculation of the Bangladesh Bank. To meet the goal, another $4.87 billion will have to be added to the reserves by this month.

10 June 2024, 01:02 AM

Exporters cheer weaker taka

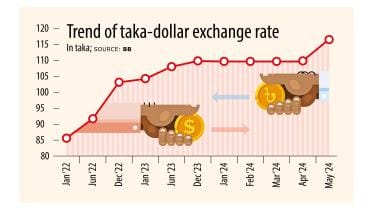

Owing to a chaotic and volatile exchange rate, local exporters were desperate for the introduction of a floating exchange rate so they could draw more money and be more competitive.

9 May 2024, 03:40 AM

Bangladesh Bank launches crawling peg, sets Tk 117 per USD as mid-point

Bangladesh Bank today introduced the crawling peg exchange rate system and allowed banks to buy and sell US dollars freely at around Tk 117.

8 May 2024, 09:28 AM

Crawling peg system: A welcome step but will it be enough to boost reserves?

The crawling peg system for the taka is a delayed and, perhaps, inadequate response to the bleeding of forex reserves. Some economists suggest the central bank should go beyond this formula and open the exchange rate to market forces to stop the continuous erosion of reserves. Either way, exporters and remitters will celebrate more flexibility in the exchange rate.

7 May 2024, 13:35 PM

Crawling peg system likely from 2024’s first quarter

BB sits with ABB, BAFEDA

24 January 2024, 15:29 PM

BB to adopt crawling peg to curb exchange rate volatility

The peg system would be linked to a carefully selected basket of currencies and operate within a predefined exchange rate corridor

17 January 2024, 09:51 AM

BB to adopt crawling peg. Can it end exchange rate volatility?

BB's adoption of crawling peg as per IMF prescription will possibly rule out a market-driven exchange rate, as suggested

14 January 2024, 00:30 AM

What is a crawling peg?

Its a system of exchange rate adjustments in which a currency with a fixed exchange rate is allowed to fluctuate within a band of rates.

14 January 2024, 00:15 AM