corporate tax

Corporate tax may rise for non-listed firms

Meanwhile, the corporate tax rate for merchant banks has been proposed to be reduced to 27.5 per cent from the existing 37.5 per cent.

2 June 2025, 09:40 AM

No scope to cut corporate tax

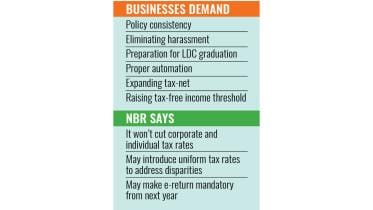

The National Board of Revenue (NBR) yesterday said there was no scope to reduce corporate or individual tax rates in the budget for the upcoming fiscal year, a stance that businesses opposed.

13 April 2025, 18:00 PM

Rate of corporate tax will not be reduced: NBR chairman

"Rather, we want a non-discriminatory tax regime for all sectors.”

13 April 2025, 07:58 AM

Govt may lower corporate tax to encourage compliance

The National Board of Revenue will likely propose reducing the tax on corporate profits by 2.5 percentage points for both listed and non-listed companies.

22 April 2024, 00:47 AM

Widen corporate tax gap between listed, non-listed firms

Stock market intermediaries yesterday urged the government to widen the corporate tax rate gap between listed and non-listed companies to encourage more companies to go public.

5 June 2023, 02:45 AM

Corporate tax rates remain unchanged for all

The government wants to keep the corporate tax rates unchanged for all sectors for the fiscal year 2023-24, said Finance Minister AHM Mustafa Kamal today.

1 June 2023, 08:59 AM

‘High corporate tax for banks, insurers, telcos illogical’

High corporate taxes on banks, non-bank financial institutions, merchant banks, insurance companies and telecommunication companies are not logical as their profit is not high compared to capital, said Shahidul Islam, chief executive officer of VIPB Asset Management Company.

31 May 2023, 18:00 PM

How do corporate tax burdens vary with firm size? and why that matters?

Corporate income tax is an important source of government revenue, especially in low and middle-income countries. However, effective tax rates are often far below statutory rates due to generous tax incentives provided to attract investments. These incentives include tax credits, income exemptions, and reduced rates.

13 April 2023, 06:17 AM

Firms prefer to remain non-listed despite tax benefit

Although the corporate tax levied on listed firms is lower than that of their non-listed counterparts, many companies in Bangladesh lack interest in joining the stock market as they want to avoid the obligation of ensuring good corporate governance, regularly disclosing financial information and complying with other rules.

22 May 2022, 03:30 AM

Bring corporate tax down to 10-15% for newspapers: Editors to finance minister

Editors yesterday urged the government to bring down the corporate tax for newspapers to 10-15 per cent from the fiscal year of 2022-23 to help the print media survive amid rising costs.

20 May 2022, 05:30 AM