capital flight from Bangladesh

NRBC branch covered up capital flight

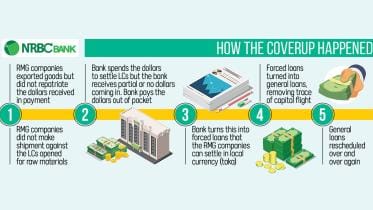

Export proceeds worth at least $3.45 million (Tk 34.41 crore) were not repatriated by six customers of NRB Commercial Bank’s Uttara branch, and the bank concealed the trail of the capital flight, according to the bank’s internal audit and case documents.

21 March 2024, 18:00 PM

Another bank falls by the wayside

National Bank’s plight is the result of poor banking governance

28 December 2023, 07:30 AM

IMF flags potential exodus of funds from Bangladesh

Bangladesh might have experienced capital flight in the last financial year evidenced from the unusual outflow of funds as well as unrealised export proceeds, said the International Monetary Fund (IMF).

26 December 2023, 00:52 AM

Issues our banking sector must address

As most of our economic sectors depend heavily on banks, it has created many problems for the banking sector and its depositors.

5 December 2023, 01:00 AM

Unraveling capital flight from Bangladesh

Capital flight, a growing concern for Bangladesh over the past few decades, refers to the outflow of financial assets from a country. While usual outflow may also be foreign direct investment, the problem arises when the fund transferred from a country does not have proper documentation of source and there is no intend of repatriation of the fund. This leads to loss of government revenue and depletion of foreign currency reserves.

19 August 2023, 18:00 PM

The urgent task of restrategising domestic resource mobilisation

Steps must be taken against those who have shifted money and wealth out of the country illegally.

29 April 2023, 15:00 PM