budget

Why teaching kids about money is more important than ever

Financial literacy is crucial for personal well-being, yet often overlooked in many cultures, including Bangladesh. Teaching children about money management from a young age — through practical experiences like shopping and banking — can help them make informed decisions and avoid financial pitfalls later in life.

6 November 2025, 10:35 AM

Restaurant hype vs. reality: Are we overspending?

Dhaka’s booming restaurant culture drives rising monthly expenses, often Tk 10,000–15,000 for couples. While dining out feels recreational, mindful spending, saving, or investing in travel or hobbies offers better long-term satisfaction and financial balance.

11 October 2025, 09:54 AM

Look rich, spend less: Thrifting in Bangladesh

Thrifting in Bangladesh is gaining popularity for its affordability, sustainability, and unique fashion appeal. Once stigmatized, second-hand shopping now thrives on platforms like Dhaka Thrift, blending climate consciousness, creativity, and smart consumer habits.

4 May 2025, 08:44 AM

Dhaka bourse’s major index hits 38-month low

The major index of the Dhaka bourse fell significantly today, the first trading day after the proposed national budget was placed in parliament on June 6

9 June 2024, 10:38 AM

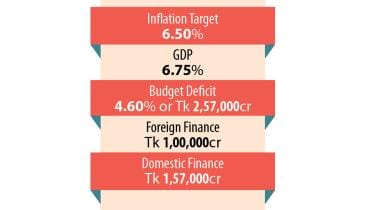

Tight budget in austere times

With an aim to restore macroeconomic stability, reduce inflation, and contain pressure on foreign currency reserves, Finance Minister Abul Hassan Mahmood Ali is going to place a Tk 7,96,900 crore budget for the 2024-25 fiscal year tomorrow.

4 June 2024, 18:00 PM

Next budget to be slightly expansionary

However, the minister did not respond when journalists asked how the budget could be expansionary when it will increase by only four percent compared to the current budget.

27 May 2024, 04:17 AM

Govt sees budget surplus of Tk 11,865cr in Q1

The government saw a budget surplus of Tk 11,865 crore in the first quarter of the current FY due to lower spending

2 January 2024, 00:41 AM

Gadgets on a budget: Things you need to know about geysers and heaters

Geysers and room heaters are not just appliances; they bring comfort and warmth to families.

21 December 2023, 11:25 AM

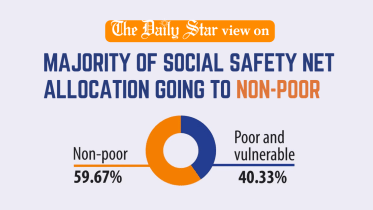

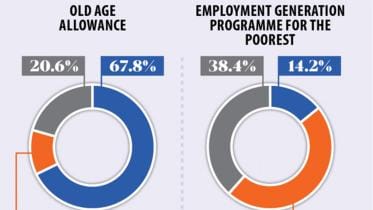

Why is government support for poor going to non-poor?

Only 40 percent of social safety net budget catering to poor, vulnerable groups

4 June 2023, 16:00 PM

Utilising Funds: Health ministry fares worst, yet again

The health ministry continues to struggle with utilisation of funds allocated in the national budget, like it did in the past few years.

30 May 2023, 01:20 AM

Reining in inflation top priority

The government is going to unveil a Tk 7,61,785 crore budget for the next fiscal year on Thursday, setting containment of high inflation as a major target.

29 May 2023, 01:00 AM

Raging Inflation: Not much help on the way for the poor

Even though poor people are struggling to make ends meet amid runaway inflation, the government allocation for social safety net programmes may not increase much in the next fiscal year.

24 May 2023, 01:00 AM

Budget FY 23-24: IMF conditions, inflation, polls 3 key issues

Three issues would be dictating the upcoming fiscal year’s budget, the last of the Awami League government’s present five-year term: the International Monetary Fund’s conditions, the persistently high inflation and next year’s national election.

19 March 2023, 01:20 AM

Record subsidy allocation not enough

The record subsidy allocation of Tk 82,745 crore is set to be topped up with another Tk 27,360 crore in the revised budget in the face of demands from ministries even after the notable price hike of gas, electricity and fuel.

9 February 2023, 01:00 AM

2023 will be the year of inflation and financial turpitude

While the government is distracted by elections, the financial economy will suffer

1 January 2023, 02:00 AM

Dollar crisis to go by next June

Bangladesh Bank is anticipating the pressure on the balance of payments will blow over by the end of this fiscal year thanks to hearty assistance from development partners –-- an outlook termed wishful by economists.

2 November 2022, 02:00 AM

What you need to know about inflation

Inflation leads to the devaluation of a particular currency.

18 August 2022, 00:00 AM

Perks of living in Dhaka City

Take the recent and absurd fuel price hike, for example. The country's people are focusing on and monitoring how we, the citizens of Dhaka, will handle this situation so they can follow suit. To them, we say, “Hold my Borhani.” The fuel price hike gave an extra flare to the attitude of operators of CNG-run auto-rickshaws, Uber cars, and Pathao bikes, thus rendering the daily commute undesirable. Yet, most fail to grasp the opportunities we are presented with, such as being innovative and healthy. Power walking or riding your bicycle for commute is your divine solution.

7 August 2022, 12:45 PM

Travelling on an ‘almost empty’ wallet

What do you do when wanderlust strikes, but you have just hit rock bottom on your wallet? Feed the lust, is what. Of course, travelling first class, shopping at branded stores and staying at five-star accommodation may not be on the cards for you but none of those things have anything to do with actual travelling. If you are already laughing, save the giggles for we may just change your mind by the end of this article.

4 August 2022, 12:35 PM

Can local laptop and smartphone manufacturers make the most of the price increase?

We still have to wait and see how it will actually impact the market.

9 June 2022, 14:02 PM