bb cyber crime

SWIFT to unveil new security plan after BB heist

The SWIFT secure messaging service that underpins international banking says it is planning to launch a new security programme as it fights to rebuild its reputation in the wake of the Bangladesh Bank heist.

24 May 2016, 06:37 AM

Bangladesh Bank heist trail goes cold in Manila as probes falter

More than three months have passed since $81 million was stolen in a brazen cyber-heist from Bangladesh's central bank and sent to Manila - yet authorities in the Philippines appear no closer to nabbing those who laundered most of the money through a bank and casinos.

24 May 2016, 04:54 AM

Dhaka bank sent 3 urgent messages

Three messages sent by the Bangladeshi central bank to the Rizal Commercial Banking Corp. (RCBC) on the morning of February 9, alerting the Yuchengco-controlled financial institution to the dubious provenance of the $81 million that was later revealed to be the largest money laundering caper in Philippine history.

13 April 2016, 05:33 AM

Reducing cyber risk of banks

Guidelines on Internal Control & Compliance for Banks were issued by the central bank on March 8, 2016, which recommended the commercial banks to take insurance as a risk mitigation measure. Such insurances are not over-the-counter products, and must be customised as per each bank's unique exposures.

23 March 2016, 18:00 PM

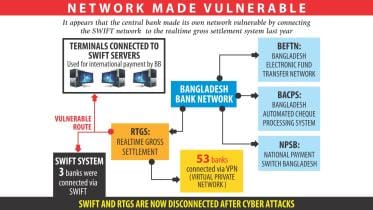

BB's Achilles' heel

Cyber thieves might have found it easier to break into the Bangladesh Bank system after its local area network (LAN) was connected with its SWIFT operation, according to central bankers and investigators.

21 March 2016, 18:00 PM

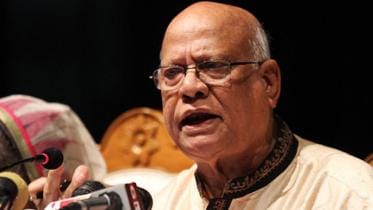

BB reserve heist: Muhith to brief media tomorrow

Finance Minister AMA Muhith will brief the media about the recent theft of US$101 million by hackers from Bangladesh Bank account at New York Federal Reserve Bank.

14 March 2016, 12:34 PM

$46m flew into Manila casinos

More than half of the $81 million Bangladesh Bank's money, which ended up in the Philippines through hacking, went to local casinos

11 March 2016, 18:00 PM