banking sector crisis

Broken trust: New govt faces battle to clean up banks

Faruk Hasan lies bedridden in his home, recovering from bypass surgery. The 64-year-old heart patient needs regular medication to stay alive, but he cannot access the money to pay for it. His life savings -- Tk 80 lakh in fixed deposits -- remain frozen at Aviva Finance, a financial institution now on the verge of liquidation.

16 February 2026, 00:00 AM

Banking sector among most fragile as Bangladesh economy faces multiple risks: CPD

CPD said Bangladesh is at a ‘critical juncture of its journey'

10 January 2026, 11:48 AM

Banking crisis laid bare in 2025, lasting fixes hinge on next govt

When bankers entered the new year and opened their books for 2025, many quickly realised that the scale of long-buried damage was too large to hide any longer.

25 December 2025, 18:00 PM

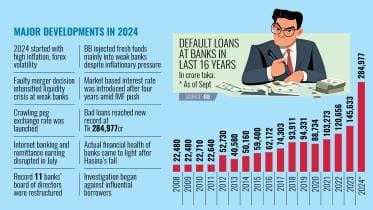

Bad loans continue to break records

Defaulted loans in the banking sector rose further to Tk 6.44 lakh crore, or nearly 36 percent of total disbursed loans, at the end of September, indicating the continued fragile state of the country’s financial sector.

26 November 2025, 18:10 PM

Fixing capital crisis of local banking sector

Bangladesh's banking sector faces a Tk 1.71 lakh crore capital shortfall

31 August 2025, 18:00 PM

Auditors, rating agencies fail to forecast banking woes

Banks have several layers of professionals to regularly assess their financial health and raise early warnings at the first sign of trouble.

21 July 2025, 18:00 PM

FY26 budget offers no new move to restore public confidence in banks

Around a dozen banks are currently struggling to repay depositors, eroding public trust

3 June 2025, 05:24 AM

Some banks hit by capital squeeze

State-owned, Islamic Shariah-based, and specialised banks have seen deeper deterioration in their financial positions, whereas private commercial banks and foreign banks remain on firmer ground.

4 May 2025, 18:01 PM

World Bank flags deepening crisis in banking sector

Bangladesh’s banking sector faces significant challenges due to longstanding structural weaknesses and recent emerging risks, according to the World Bank (WB).

23 April 2025, 18:00 PM

Bridge banks proposed to run failed banks

The Bangladesh Bank will be able to sell or liquidate weak banks by forming bridge banks—financial institutions that temporarily take over a failed bank, according to the draft Bank Resolution Ordinance.

23 February 2025, 18:00 PM

3 banks get Tk 12,500cr in emergency funds

Bangladesh Bank (BB) has extended a total of Tk 12,500 crore in emergency funds to three beleaguered banks to dress up their balance sheet ahead of the year’s end.

31 December 2024, 18:00 PM

A rush to heal exposed banking wounds

In October, a video on social media showed the manager of Social Islami Bank’s Agargaon branch breaking down in tears after enduring harsh verbal abuse from frustrated customers seeking to withdraw cash.

28 December 2024, 18:00 PM

Why is the banking sector crisis so deep-rooted?

The regime-sponsored immorality to protect or pamper the financial gangsters not only eroded the future of the banking sector, but also made the wound too difficult to recover from.

25 November 2024, 02:00 AM

BB’s leniency to blame for ailing banking sector

Banking rules and regulations stipulate a single borrower exposure limit but the banking regulator itself disregarded the rule routinely in the last 16 years.

23 November 2024, 18:00 PM

No bank closures despite financial struggles: Salehuddin

The adviser made these remarks today during a press conference at the Secretariat in Dhaka

19 November 2024, 07:13 AM

Exim Bank suffers a massive Tk 566 crore loss in Q3

The decline in NOCFPS was primarily due to increased investments in customers and a fall in deposits

28 October 2024, 08:43 AM

Banks mostly gave loans to their owners rather than creditworthy borrowers

Bangladesh’s banking sector was not well-managed in recent years. Banks mostly gave loans to their owners, rather than to creditworthy entities. Consequently, several banks are now in difficulty.

6 October 2024, 18:00 PM

Several banks are clinically dead: CPD

Several banks in Bangladesh are clinically dead but are being kept alive through bailouts, said Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD).

12 August 2024, 18:00 PM

Unrest in banking sector raises concerns

Unrest has gripped the banking sector at a time when several banks are burdened with huge default loans and are suffering from low asset quality.

11 August 2024, 18:00 PM

MPs blast govt for sorry state of banking sector

Three lawmakers in parliament yesterday blasted the government for the sorry state of the banking and financial sector.

2 July 2024, 18:00 PM