bank merger

Sammilito Islami Bank gets final licence

The bank was created through the merger of five troubled Islamic banks

30 November 2025, 15:19 PM

Shareholders lose around Tk 4,500cr

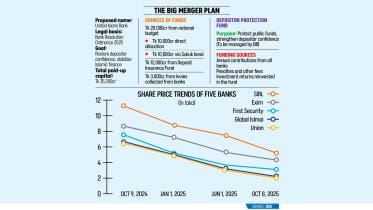

Shareholders of five shariah-based troubled lenders, which are being merged into a large Islamic bank, lost hundreds of crores as the central bank announced that the shares now carry no value.

6 November 2025, 18:00 PM

Govt may consider compensating small shareholders: BB

The central bank governor says about the to-be-merged banks

6 November 2025, 15:02 PM

Bad news for shareholders of to-be-merged banks

They will not get any share in the new bank

5 November 2025, 12:06 PM

Proposal to merge five Islamic banks gets go-ahead

The five are: First Security, Union, Global Islami, Social Islami, and Exim

9 October 2025, 12:52 PM

Shariah bank merger gains momentum

Merged lenders to be named United Islami Bank; ordinances on bank merger and depositor insurance to be placed at advisory council meeting today

8 October 2025, 18:00 PM

The promises and perils of a bank merger

Optimism regarding the merger of five struggling banks must be weighed against significant challenges.

30 September 2025, 02:00 AM

Merger plan for five Islamic banks gets clearance

BB to appoint administrative teams

16 September 2025, 18:00 PM

Working committee formed for bank merger

The interim government has formed an eight-member working committee to implement the merger of five Shariah-based banks.

9 September 2025, 18:00 PM

Largest Islamic bank in the making

The five banks slated for consolidation are First Security Islami Bank, Union Bank, Global Islami Bank, Social Islami Bank and Exim Bank.

7 September 2025, 18:14 PM

Depositors’ money in merged banks will remain completely safe: BB

Accountholders of merged banks will be able to maintain their respective accounts as before

23 April 2024, 12:14 PM

Bank mergers: All dimensions must be considered

In general, five issues need to be borne in mind when it comes to bank mergers in Bangladesh.

21 April 2024, 02:00 AM

Hurried mergers may prove counterproductive

Has the process of planning bank mergers been truly voluntary?

17 April 2024, 10:43 AM

Will bank mergers help?

The most recent bank merger proposal in Bangladesh reflects a pressing need for action due to Bangladesh Bank's determination to instill essential discipline and oversight in the financial sector, which is plagued by widespread irregularities.

6 April 2024, 18:03 PM

Banks can voluntarily merge until December: Bangladesh Bank

After December, the central bank will take decision on merger, acquisition

12 March 2024, 13:32 PM

Union Capital to merge with Prime Bank

Union Capital is going to merge with the Prime Bank as the central bank has approved the bid, according to BB officials.

14 February 2024, 05:27 AM

Will merger help solve the weaker banks’ problems?

Merger takes place when two or more companies combine together to strengthen capital base and asset size.

12 February 2024, 02:00 AM