Bank interest rates

What the IMF said, our economists have said before

What Bangladeshi economists have been saying for a long time is pretty much what the International Monetary Fund (IMF) has told our central bank and the government.

3 November 2022, 16:30 PM

Interest Rate Cap: New headache for pvt banks

Most of the private banks are in trouble due to their recent decision to cap interest rate on deposits at 6 percent as the state-run organisations and corporate groups are unwilling to keep funds with them at such a low rate.

6 July 2018, 18:00 PM

Directed Interest Rate Reduction: Will it be counterproductive?

Recently, Bangladesh Association of Bankers (BAB), a body representing the owners of private commercial banks in Bangladesh, announced that interest rates charged by these financial institutions would be brought down to the single digits from July 1.

3 July 2018, 18:00 PM

Banks to lower interest rates

Both public and private banks have decided to lower lending rates to single digits from July 1 -- a move that comes weeks after the government showered them with a raft of privileges, drawing criticism from different quarters.

20 June 2018, 18:00 PM

Interest rates rattle people

Kaniz Fatima Binte Alam, a doctor, took Tk 48.50 lakh home loan at 8.5 percent interest in October last year from a lender with expertise in financing homes.

19 May 2018, 18:00 PM

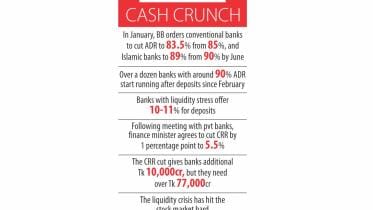

Will CRR cuts bring down lending rate?

The decision to reduce the Cash Reserve Ratio (CRR) by one percentage point constitutes quantitative easing of monetary policy. A key

1 April 2018, 18:00 PM

Private credit growth hits 18.36pc

Private sector credit growth continues its forward thrust despite liquidity crisis and rising interest rates as businesses jump into an

1 March 2018, 18:00 PM

Bank savers can smile again

Though the recent rise in interest rates has become a bane for borrowers, it is a boon for savers, especially for retirees and others who

14 February 2018, 18:00 PM