Bangladesh National Budget 2019-20

Tk 5,23,190cr budget passed in JS

Parliament passes the Tk 5,23,190 crore national budget for 2019-20 fiscal themed as “Bangladesh on a Pathway to Prosperity: Time is Ours, Time for Bangladesh.”

30 June 2019, 08:24 AM

NBR to lose Tk 400cr for pampering tobacco companies

The National Board of Revenue’s move to change the VAT and Supplementary Duty Act 2012 to offer input tax credit to cigarette

22 June 2019, 18:00 PM

New VAT system to bring in Tk 11,000cr more

The National Board of Revenue expects to collect about Tk 11,000 crore more for imposition of VAT on various goods and services and increasing rates on many others, said its officials.

19 June 2019, 18:00 PM

Textile millers seek exemption of 5% VAT on sale of local yarn

Textile millers demand an exemption of 5 per cent value added tax (VAT) on sale of local yarn to make the domestic yarn market more competitive.

19 June 2019, 08:38 AM

Budget Discussion: Opposition slams govt over paddy price

Opposition lawmakers yesterday came down heavily on the government for its failure to ensure fair price of paddy and check money laundering, soaring loan defaults and black money.

16 June 2019, 18:00 PM

New VAT law to hurt consumers: Analysts

The government’s move to implement the new VAT law without rebate facility for reduced rates will hurt consumers because of price spike of many goods and services, analysts say.

15 June 2019, 14:22 PM

Budget anti-people: Gonoforum

Gonoforum rejects the proposed national budget for 2019-20 fiscal terming it as frustrating and anti-people.

15 June 2019, 12:40 PM

Manage deficit financing from other sources rather than banking channel

The Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) urges the government to manage fund from other sources rather than banking channel to finance the deficit financing in 2019-20 fiscal.

15 June 2019, 09:12 AM

TIB slams amnesty for black money

Transparency International Bangladesh (TIB) yesterday strongly condemned the proposed amnesty for black money in the budget for fiscal 2019-20 and termed it “unconstitutional, immoral and discriminatory”.

14 June 2019, 18:00 PM

Pay more for digital delight

At a time when the government should be encouraging virtual businesses, Finance Minister AHM Mustafa Kamal has proposed 7.5 percent value-added tax on them in his budget for fiscal 2019-20, making their services dearer.

14 June 2019, 18:00 PM

Make new VAT law business-friendly

Leading business associations yesterday urged the government to ensure easy, hassle-free and business-friendly implementation of the new VAT law.

14 June 2019, 18:00 PM

New budget to increase inequality

Terming the proposed national budget “highly ambitious”, the BNP yesterday said the people of the country would not accept the budget as it would increase inequality.

14 June 2019, 18:00 PM

The affluent to benefit more

The budgetary measures for fiscal 2019-20 will favour the beneficiaries of “economic misrule” and hurt the middle and lower mid-income groups, the Centre for Policy Dialogue said yesterday.

14 June 2019, 18:00 PM

Online shopping getting costlier for VAT slap

Amid growing popularity, online shopping is getting costlier soon for the proposed value added tax (VAT) imposed on it in the budget for fiscal 2019-20.

14 June 2019, 11:13 AM

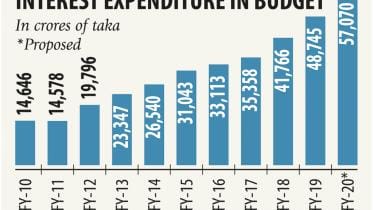

Deficit financing to be expensive

The government has resorted to deficit financing, largely through bank borrowing and sale of high-cost savings certificates, increasing the interest payment burden on its shoulders and fuelling inflation.

13 June 2019, 18:00 PM

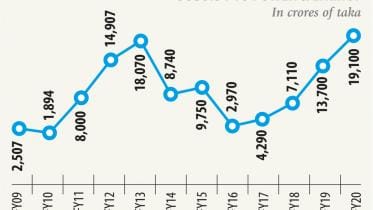

Gas subsidy to double

Finance Minister AHM Mustafa Kamal yesterday proposed doubling the subsidy for the gas sector to Tk 9,600 crore for 2019-20, from Tk 4,500 crore in the previous year.

13 June 2019, 18:00 PM

Long on promises, short on specifics

All eyes were on fever-stricken Finance Minister AHM Mustafa Kamal as he stepped into parliament to unveil his maiden national budget yesterday.

13 June 2019, 18:00 PM

A little for the jobless

More than a year ago, when Mohammad Zayed graduated from a university college in the capital, his family started expecting that he would soon take over the financial responsibility.

13 June 2019, 18:00 PM

Growth-friendly, albeit unrealistic

The new budget is growth-friendly and has set ambitious goals but shied away from addressing the key challenges confronting the economy, said a number of economists in their immediate reactions.

13 June 2019, 18:00 PM

Mega but slow

In 2010, the government decided to construct a 128-kilometre (km) metre gauge rail track to link Chattogram with tourist town Cox’s Bazar at a cost of Tk 1,852.35 crore.

13 June 2019, 18:00 PM