Bangladesh foreign exchange reserves

Taka firms in August as forex liquidity rises: report

The taka strengthened to 121.40 per US dollar on August 10 from 122.30 at the end of July

4 October 2025, 10:47 AM

Increased remittance inflow encouraging

Upskilling workers, easier migration process can further increase it.

4 November 2024, 14:00 PM

Currency swap pushes forex reserves above $20b

Bangladesh's foreign currency reserves have gone past the $20-billion mark after nearly a month thanks to the currency swap initiated by the central bank.

23 February 2024, 00:12 AM

Reserves remain under pressure

Pressure on the foreign exchange reserves remains high as the deficit in the financial account continues to widen despite the narrowing trade gap and a current account surplus.

6 December 2023, 18:00 PM

Forex reserve shrinks by $120m in a week

Bangladesh's foreign exchange reserve has fallen by nearly $120 million in the span of a week, central bank data showed.

30 November 2023, 11:44 AM

No IMF-prescribed reform before elections

The government has informed the International Monetary Fund (IMF) that it would not initiate any major reforms to enhance foreign exchange reserves and revenue earnings and reduce subsidies before the upcoming parliamentary elections..However, the government promised that drastic reforms w

18 October 2023, 18:10 PM

Market-driven exchange rate not before national polls

The exchange rate volatility and its strain on the foreign currency reserves would not disappear anytime soon after Bangladesh Bank Governor Abdur Rouf Talukder yesterday said a floating US dollar rate would not be materalised before the upcoming national election.

18 October 2023, 18:03 PM

IMF to suggest new exchange rate system

The IMF staff mission is willing to set a lower target for foreign currency reserves for this December and June next year provided the Bangladesh Bank adopts the crawling peg method to manage the exchange rate.

17 October 2023, 18:00 PM

Implement market-driven exchange rate fast: IMF

The International Monetary Fund (IMF) yesterday suggested that banks in Bangladesh should quicken the implementation of market-driven exchange rates as it would help alleviate the ongoing foreign currency crisis.

16 October 2023, 02:13 AM

IMF loan conditions: Govt seeks lower reserve target

Bangladesh has requested the visiting International Monetary Fund staff mission to revise down some of the targets as the existing numbers are not achievable in the present context.

15 October 2023, 18:00 PM

Falling reserve, rising bad loans worrying

The falling foreign exchange reserves and the ever-rising defaulted loans are very concerning for the economy, and the government should respond fast to avoid a looming crisis, eminent economist Prof Rehman Sobhan said yesterday.

9 October 2023, 18:00 PM

'Reserve below $18b if BB liability considered'

Bangladesh’s foreign currency reserves would be less than $18 billion if the central bank's liabilities are considered, according to Zahid Hussain, a former lead economist of the World Bank's Dhaka office..The central bank is regularly publishing its gross foreign reserves in line with the

4 October 2023, 18:38 PM

Bangladesh’s net forex reserve below $18 billion: Zahid Hussain

Bangladesh’s net foreign currency reserves would be less than $18 billion if the central bank’s liabilities are considered, said Zahid Hussain, a former lead economist of the World Bank's Dhaka office, today.

4 October 2023, 10:40 AM

S&P lowers Bangladesh's rating outlook to negative on liquidity risks

S&P Global Ratings on Tuesday lowered Bangladesh's long-term rating outlook to negative from stable, citing risks the country's external liquidity position could deteriorate in the next year while foreign exchange reserves remain under pressure

25 July 2023, 06:51 AM

Banks’ risky loans thrice as large

After the sudden drop in Bangladesh’s official foreign exchange reserves on July 13, another rude shock awaits: as per IMF conditions, the banking sector’s distressed assets will be published, in what would make for a grim reading about the industry’s health.

23 July 2023, 18:00 PM

Why the US dollar is an optimal reserve currency for Bangladesh

The proposition that Bangladesh will move away from the US dollar-based payment settlement to a new international payment settlement is of no economic substance.

16 May 2023, 02:15 AM

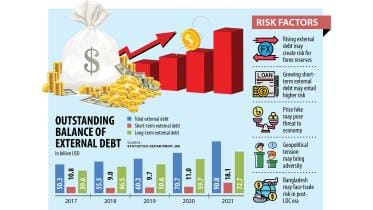

Rising external debt poses risks to forex reserves

Rising external debt may pose some risks to Bangladesh’s foreign exchange reserves in the future as higher debt servicing will be required on accumulated loans, said the Bangladesh Bank yesterday.

18 October 2022, 02:10 AM

Forex reserve still in comfort zone: Bangladesh Bank governor

Bangladesh Bank Governor Fazle Kabir today said the country’s foreign exchange reserves are still in a comfort zone.

12 June 2022, 07:46 AM

Bangladesh Bank says bankers can travel abroad at own expense

Just a day after restricting all sorts of foreign travels of bank employees, Bangladesh Bank yesterday (May 23, 2022) said bankers can travel abroad for essential personal purposes at their own expense.

23 May 2022, 18:12 PM

Managing exchange rate regime: any cause for panic?

Exchange rate management has become a frontline issue in Bangladesh in recent times. The sharp rise in the price of the dollar and the significant decline in the foreign exchange reserves within a short span of time have sent shock waves across the economy.

23 May 2022, 04:00 AM