Bad loans in Bangladesh

Bangladesh tops Asia’s bad loan charts

Bangladesh now has the highest non-performing loan (NPL) ratio in Asia, with defaults surging to 20.2 percent of total loans in 2024, according to a new Asian Development Bank report.

4 September 2025, 18:19 PM

Govt moves to expedite Tk 38,000cr bad loan cases

The interim government has moved to expedite long-pending lawsuits filed by 10 institutions, including state-owned banks and a non-bank financial institution (NBFI), against loan defaulters, in a bid to speed up the recovery of defaulted loans

4 September 2025, 18:00 PM

Banking reform roadmap is a welcome step, but success depends on implementation

Govt must get all stakeholders on board to ensure full implementation

8 July 2025, 05:00 AM

End the legacy of banking plunder

New data reveals how far the rot of bad loans reached under Awami regime

28 February 2025, 05:40 AM

Bad loans hit new record, hitting close to Tk 350,000 crore for the first time

Bangladesh Bank Governor Ahsan H Mansur revealed the figures at a press conference today

26 February 2025, 08:58 AM

The case for expanding bank deposit insurance in Bangladesh

As Bangladesh continues to develop, it is imperative to update existing financial safeguards to align with the economy’s growth trajectory.

9 February 2025, 09:30 AM

Viewing the defaulted loan saga through a micro lens

There’s a connection between non-payment of debt at micro and macro level.

16 January 2025, 05:00 AM

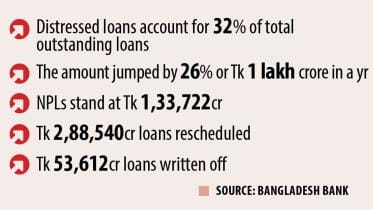

Distressed loans soar to a record Tk 4.75 lakh cr

Distressed loans at banks totalled over Tk 4.75 lakh crore at the end of 2023 – a revelation that makes for a sobering read of the actual health of this vital sector of the economy.

30 September 2024, 01:00 AM

BB relaxes loan write-off policy further

The Bangladesh Bank yesterday further relaxed its loan write-off policy as part of its roadmap to “artificially” reduce the higher volume of bad loans in the banking sector.

19 February 2024, 00:58 AM

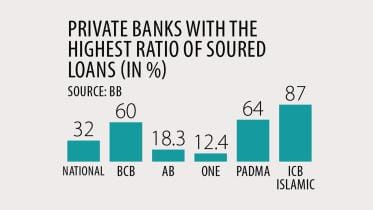

Six private banks’ bad loans soar 55pc in nine months

Bad loans in six private banks increased by about 55 percent in the first nine months of the year, raising further alarms about the health of the banking sector.

22 November 2023, 18:00 PM

Bad loans rise in private banks, but drop in state banks

Overall, banking sector's non-performing loans fall slightly

21 November 2023, 14:56 PM

25 banks keep NPLs below 5%

With the high rate of non-performing loans (NPLs) being a major challenge for the banking sector, just 25 of the 61 commercial banks in Bangladesh are managing to keep their NPL rates below 5 percent.

11 October 2023, 00:30 AM

Falling reserve, rising bad loans worrying

The falling foreign exchange reserves and the ever-rising defaulted loans are very concerning for the economy, and the government should respond fast to avoid a looming crisis, eminent economist Prof Rehman Sobhan said yesterday.

9 October 2023, 18:00 PM

Big rise in 10 banks’ bad loans

The defaulted loans in 10 banks, including four state-run lenders, increased at an alarming rate in fiscal 2022-23, indicating their worsening financial health.

7 October 2023, 18:00 PM

IMF Staff Mission: Concern raised over inflation, reserves, bad loans

The International Monetary Fund staff mission yesterday raised four burning issues in their meetings with the Bangladesh Bank and the finance ministry: foreign currency reserves, inflation, banking sector and revenue collection.

4 October 2023, 18:00 PM

Default loans hit an all-time high

Non-performing loans (NPLs) in Bangladesh’s banking sector hit a new record in June as withdrawal of a relaxed central bank policy, slowdown in business sales and deliberate non-payments pushed up the volume of bad loans to Tk 1,56,039 crore, central bank data showed.

2 October 2023, 00:00 AM

Default loans reach record Tk 1.56 lakh crore

The bad loans rose by Tk 24,419 crore in the last three months to June

1 October 2023, 14:20 PM

Banking sector reform can no longer be delayed

To better understand corporate default risks, generate more data and produce greater information

10 September 2023, 00:00 AM

Drowning in a sea of distressed assets

It is high time our authorities dealt with loan defaulters and money launderers with utmost importance.

23 August 2023, 04:00 AM