Finance at Every Stage of Life

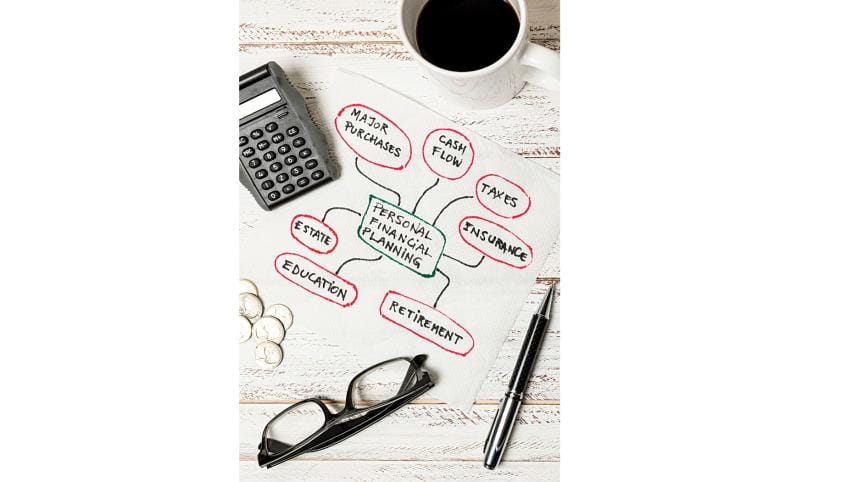

Financial security and the ability to achieve your dreams are not just about what you do today—they are about preparing for the life you envision tomorrow. Life is a journey filled with milestones, surprises, and changes, and your financial decisions lay the foundation for how you'll navigate those moments. Having long-term financial planning acts as your personalized roadmap, guiding you through each stage of life while helping you stay focused on your goals, no matter what comes your way.

From starting your career to building a family or planning for retirement, financial planning evolves with you. Your financial plan should not only meet your current needs but also grow and adapt as your life does.

Early-Stage Preparation

Your financial journey typically starts between the 20s and 30s when you are stepping into the corporate world and start earning. The early years of your career lay the foundation for your financial future. This is the time to develop good habits that will shape your financial well-being. Opening a savings account is the first step, followed by building an emergency fund to cover at least three to six months of living expenses. Syed Mahbubur Rahman, MD & CEO, Mutual Trust Bank emphasizes that budgeting is equally crucial. He further reveals, "The 50-30-20 rule is a tried-and-true method: allocate 50% of your income to essentials, 30% to discretionary spending, and 20% to savings".

Developing good credit is another critical task for young professionals. A strong credit score opens doors to future opportunities, such as buying a home or securing a car loan. Good credit is your financial reputation—it needs to be earned and maintained with discipline. For that, MTB's CEO advises, "Use credit cards responsibly, pay bills on time, and avoid accumulating unnecessary debt". He also suggests keeping an aim to save at least 20-30% of your income early in your career.

Mid-life Priorities

Your 30s and 40s are pivotal years for financial planning as you juggle the dual demands of growing family responsibilities and maximizing your earning potential. During this phase, expenses such as homeownership, childcare and education rise significantly, making it essential to create a robust financial strategy that balances immediate needs with long-term goals.

Owning a home is one of the most significant financial commitments you will make. It requires careful preparation to ensure a smooth transition from renting to homeownership. According to Ali Reza Iftekhar, Managing Director and CEO of Eastern Bank PLC, understanding your financial capacity is the first step. Track your income, expenses, and savings to determine how much you can comfortably afford.

He adds, "A down payment of 20% is typically recommended for securing favourable mortgage terms. Buyers can save it through various investment & saving schemes such as Millionaire scheme, DPS, Savings certificate, Fixed deposit, etc". Mortgage pre-approval is another essential step, as it not only clarifies your budget but also demonstrates your financial readiness to sellers.

Fixed-rate mortgages offer stability, making them ideal for long-term homeowners. In contrast, variable-rate mortgages can be beneficial for those who anticipate falling interest rates or are financially prepared for payment fluctuations. "Your mortgage choice should align with your lifestyle and risk appetite. If you plan to stay in your home for a long time, a fixed-rate mortgage might be better." says Ali Reza at EBL.

Planning for children's education is another critical milestone at this stage, yet many people underestimate its importance until the costs are imminent. The sooner you start saving, the more options you'll have when the time comes. Financial institutions like EBL offer dedicated plans such as Aspire DPS and Little Star DPS, which allow parents to make manageable monthly contributions while enjoying added benefits like complimentary insurance coverage.

"Starting early gives you a head start and the peace of mind that you're prepared for the future," notes Ali Reza. Beyond these plans, opening a savings account in your child's name can instil financial literacy and build a habit of saving. "Our newly launched EBL Little Star DPS is a specialized monthly scheme for newborn children up to five years old, with monthly instalments from BDT 1,000 to BDT 50,000. It also comes with a complimentary insurance package which includes Hospitalization coverage, outpatient care, and a daily allowance of BDT 2,500 during hospitalization," he adds.

Planning Retirement

50s mark a turning point as children leave the nest, careers peak, and retirement approaches, making focused financial planning more essential than ever. Samiul Kabir, Head of Agent Banking, Digital Banking & Products of AB Bank emphasizes, "In your 20s and 30s, it is important to start early with small, consistent savings, laying the foundation for long-term wealth. As you reach your 40s, consider increasing your contributions, taking advantage of your higher earning potential to boost your savings. Closer to retirement, shift focus to stable, low-risk investments to preserve the wealth you have accumulated and ensure a comfortable retirement," he adds.

Samiul Kabir further explains, "To stay on track with your retirement goals, it is essential to regularly review your retirement accounts and compare them against inflation-adjusted targets. This ensures your savings are growing at a pace that will meet your future needs, keeping up with the rising cost of living and helping you achieve a comfortable retirement".

"As you approach retirement, it is important to focus on stability. Diversifying your investments can help protect your savings from market volatility, while avoiding high-risk ventures ensures you do not jeopardize your hard-earned wealth. Exploring annuity plans can also provide a steady income stream, offering peace of mind and financial security in your retirement years," he shares.

Md. Mahiul Islam Deputy, Managing Director & Head of Retail Banking, BRAC Bank PLC says, "At different stages of life, people need different banking and financial services. Young professionals tend to avail of savings account, credit card, personal loan. As they grow old, they go for Auto Loan and Home Loan and avail financial services for their children. Later they usually avail more investment instrument as they prepare for retirement. At BRAC Bank, we have all solutions for customers required in different stages of life".

Financial planning is not just about saving money—it's about aligning your resources with your dreams. Each life stage brings its own financial demands, but by starting early, seeking expert advice, and staying adaptable, you can create a roadmap for success.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments