How wheat fuels a Tk 16,000cr Industry

Bangladesh's appetite for wheat has grown steadily over the past decade, driven by shifting dietary preferences, expanding urban lifestyles, health concerns, and comparatively lower global prices. Once considered supplementary to rice, wheat has now cemented its position as the country's second most-consumed staple, reshaping both consumption patterns and trade flows.

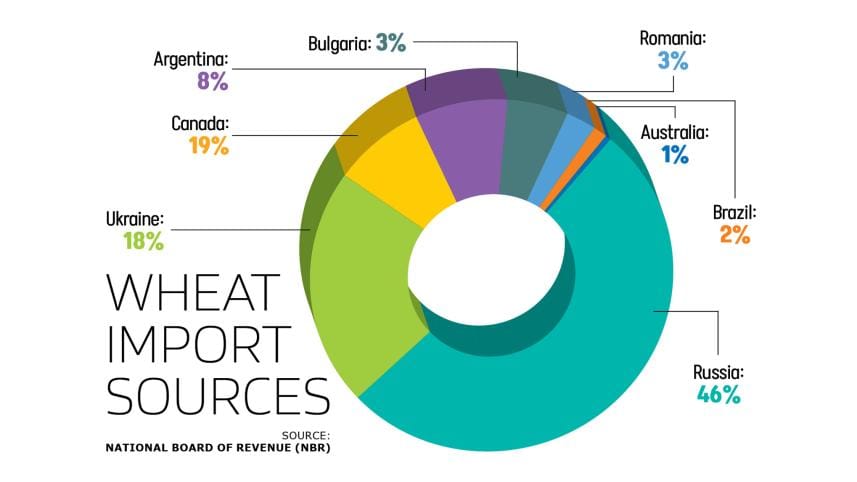

Growing Dependence on Imports

Domestic wheat production meets only 14–15 percent of annual demand, leaving Bangladesh heavily reliant on foreign supplies. "The country's annual demand stands at 74–75 lakh tonnes, most of which must be imported," said Taslim Shahriar, senior assistant general manager at Meghna Group of Industries. The private sector handles about 90 percent of imports, with the government procuring the rest. Following a slowdown in FY2021 and FY2022, imports rebounded in FY2023 on the back of softer international prices.

According to Jamal Razzak, senior general manager of IFAD Multi Products Limited, wheat purchases have risen by 10–15 percent annually over the past decade, underscoring entrenched reliance on overseas suppliers. IndexMundi ranks Bangladesh as the world's eighth-largest wheat importer. Egypt tops the list with 12.5 million tonnes annually, followed by Indonesia with 12 million tonnes.

Diet Shifts and Affordability

Health concerns are reshaping food consumption in Bangladesh. Nutritionists note that wheat offers more protein and less water than rice, making it attractive to consumers seeking balance. Rising rates of diabetes and obesity have also encouraged a shift towards whole grains.

According to the Directorate General of Food, per-capita wheat consumption nearly doubled in the last decade, from 72 grammes in FY2015 to 125 grammes today.

Affordability drives this shift. Trading Corporation of Bangladesh (TCB) data show flour is consistently Tk 10–12 cheaper per kg than medium-grade rice. On 30 August, medium rice retailed at Tk 60–75 per kg, coarse rice at Tk 55–60, while atta sold at Tk 45–65 and moida at Tk 55–75.

Demand for maida remains stronger than atta, with health-conscious consumers showing increasing preference for whole grain products.

Bakery Boom and Export Growth

The bakery industry has multiplied consumption of bread, biscuits, cakes, pizza, burgers and snacks several times over the past decade. Exports have also surged, rising from Tk 4.33 lakh in FY2015–16 to Tk 21 crore in FY2023–24, according to the Export Promotion Bureau. Wheat by-products also underpin the country's expanding animal feed industry, linking the crop to wider agribusiness dynamics.

Local Production: Stalled Progress

Bangladesh produces only 1.0–1.2 million tonnes annually, a figure largely unchanged for six years. USDA projects production at 1.1 million tonnes for MY 2024–25 and 2025–26. In FY2023–24, 1.2 million tonnes were harvested from roughly 350,000 hectares of land, slightly above 1.149 million tonnes from 329,000 hectares in FY2018–19. Officials promote high-yielding varieties such as BARI Gom-25 and BARI Gom-26, but output growth remains modest.

"Demand for wheat has doubled in recent years, yet local output has not kept pace," said Abul Bashar Chowdhury, chairman of BSM Group.

Expanding Market Players

Once dominated by a handful of firms, the market now features more than two dozen major players, including Meghna, City, Bashundhara, Akij, ACI, Pran-RFL, and IFAD. Large corporations typically import wheat via mother vessels carrying up to 60,000 tonnes, while smaller firms combine 10,000–20,000 tonne shipments to reduce costs.

Looking Ahead

With demand rising at 10–15 percent annually, dependence on imports will continue unless local production expands significantly. Yet the sector's resilience is evident in the booming bakery trade, growing exports, and rising consumer preference for branded flour. As ACI Foods' Yasmin notes, "The flour industry is now worth around Tk 16,000 crore, with the retail segment alone valued at Tk 1,340 crore."

Bangladesh's wheat story is thus one of opportunity as much as challenge. It is a vital food sector growing in size, sophistication, and strategic importance.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments