How to make housing in Dhaka affordable

Just 51 years after Bangladesh gained independence, the number of people living in Dhaka is considerably higher than other parts of the country as all types of facilities are available in the capital, from employment opportunities and medical services to good educational institutions.

Many of them have a cherished dream to build their own home in the sprawling city and as such, areas like Lalbagh, Bangshal, Sabujbagh and Gandaria have become the most populous with a density of 700 to 800 people per acre, which is the highest in the world.

The government recently finalised a 20-year-long detailed area plan (DAP) so that they can make Dhaka city liveable by keeping the population density in different areas proportionate to the civic amenities available.

To ensure the proper utilisation of land, the government divided different areas into residential, commercial, industrial, institutional, agricultural, open space, waterbodies and flood-prone zones. It also identified some locations for affordable housing for low and middle-income people, where establishing flats within a size of 650-700 square feet is possible.

The purview of the city has also been increased in the new plan, which will cover 1,528 square kilometres.

The Gazipur and Narayanganj City Corporation areas, Banshi river in Savar, Kaliganj, Rupganj and Keraniganj were included in the RAJUK masterplan.

The authorities have adopted a block-based development system in place of plot-based development for the areas, according to an official of the DAP project.

He then said that they prepared the plan with more connecting and ring roads, rail lines, elevated expressways, educational institutions, hospitals, parks and playgrounds considering the future of Dhaka in 2035.

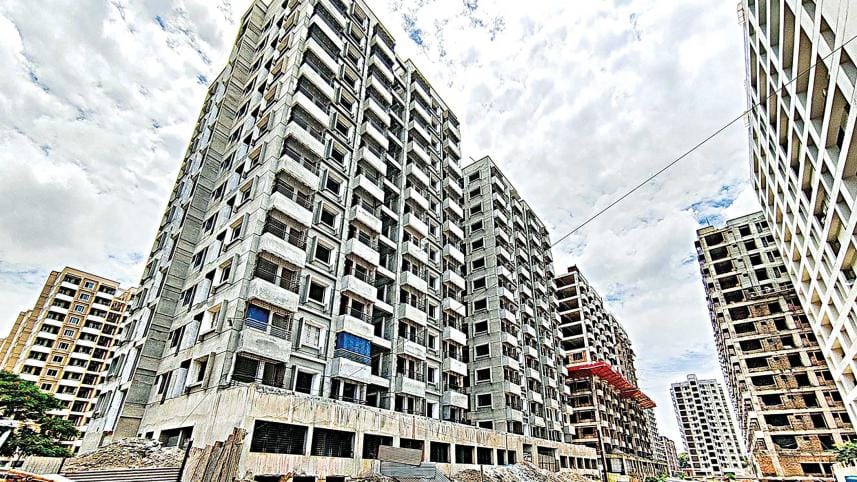

However, people working in the housing sector think that replacing the plot housing scheme with a block-based system will bar development in the housing sector. The size of buildings will be reduced by 33 per cent to 53 per cent, which will drive up flat prices by at least 50 per cent and put them out of reach for most people instead of ensuring sustainable and affordable housing, they said.

But in tandem, they said that if the government and developers can collectively work and take initiatives, then it is very much possible to make housing affordable in Dhaka.

M Hoque Faishal, senior general manager for sales and marketing, land acquisition and CR at Anwar Landmark, said the necessary initiatives should come from the government.

"The government is allocating plots among individuals in different areas through the Rajdhani Unnayan Kartipakkha (RAJUK). But rather than allocating lands of 10 katha, 5 katha, 3 katha and 2.5 katha, if the government gives allocation of flats through RAJUK or give the plots to reputed developers, they can develop those projects. Later they or RAJUK could distribute them through a lottery, which would easily accommodate many people."

"Now if a person provides 5 kathas of land, he takes Tk 5 crore [one crore per katha] from the developer after 10 years. The developer gives the money after signing while owners get an Tk 2-3 crore from each of flats purchased. In this way, the cost is increasing," he added.

From the point of costs, there are three types -- land cost, apartment cost and regulatory cost.

The regulatory cost includes project approval, apartment registration and permission cost. If the government makes regulatory cost flexible, one could save a lot of money and comfortably buy a flat.

On the other hand, the government has no authority over construction costs as it totally depends on the international market. But if the government reduces the tax levied on materials that are being used for construction purposes, then the cost would be less and help ensure affordable housing.

Home loans are currently at their lowest level in history (9.5 per cent) but if the government wishes, it could impose less interest on first time buyers. In developed countries, the government gives home loans with low interest rates of 1-2 per cent. So, if the government gives such loan, many people would be able to buy a flat at an affordable price.

Shihab Ahmed, head of sales and customer relations at Shanta Asset Management, said the number of financially solvent people is not that high compared to the number of middle and lower-middle class people.

In terms of income, people can be classified in the Tk 50,000 to Tk100,000, Tk 1,00,000 to Tk 150,000, Tk 150,000 to Tk 200,000 and over Tk 200,000 categories.

Of them, those who earn under Tk 50,000 find it very difficult to afford housing as they would first have to cater to their basic needs, including rent, transportation and other necessary expenses.

At the moment, these people cannot save much from their income. So, it will be very difficult for them to afford housing if they have no other source of income or family assets.

On the other hand, those who are in the second group with an income of between Tk 50,000 to Tk1,00,000 may have savings.

So, this class of people may be able to buy a home with the help of their savings or bank loans.

"If we think of building a house, the very first thing we need is land. But there is a big crisis of land in Dhaka city, where the government land is less than privately-owned land. There are government lands in Gulshan, Banani, Baridhara, Dhanmondi, Mohammadpur, Lalmatia and DIT plots. The price of land in these residential areas is high," Ahmed said.

"The size of land in privately-developed lands, including Bashundhara, Banossree, Aftabnagar, Mahanagar, Bosila, Mirpur and Purbachal is smaller, ranging between 2.5, 3, 5 and 10 kathas, and have comparatively lower prices."

Lands in Dhaka are being developed through both private and public initiatives, resulting in a scarcity of land for which landowners make big demands when developers approach them. For example, developers have to give 50 per cent of total development to landowners, which automatically doubles the cost.

"As per the instruction of the government, it is not possible to construct a building under Tk 1,500-2,000 per square feet if there are no other costs. So, if Tk 2,000 is needed for construction, 50 per cent of this amount goes to the landowner and then the developers have to raise their investment to make it up," he added.

Tajul Islam, a senior manager at Concord Group, said there are many aspects, such as the cost of cement, rod, fuel, manpower and transport, related to the development of sustainable and affordable housing. So, if the price of these things is increased, the housing cost will also increase.

"You already know that the cost-of-living in Bangladesh, like the other countries of the world, has increased a lot due to runaway inflation amid the Russia-Ukraine war. That is why developers have to increase flat prices," he said.

Islam went on to say that developers have to spend a lot of money on land registration, apartment registration, mutation and other things.

But if the government were to reduce or remove the related taxes and fees, it would make housing more affordable for the general people.

"There are many government lands in Dhaka and its suburban areas, which if given to developers for condominium projects, then housing could be affordable and sustainable. Under such projects, people get all kinds of facilities, including schools, colleges, universities, hospitals, parks, markets, recreation centres and more," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments