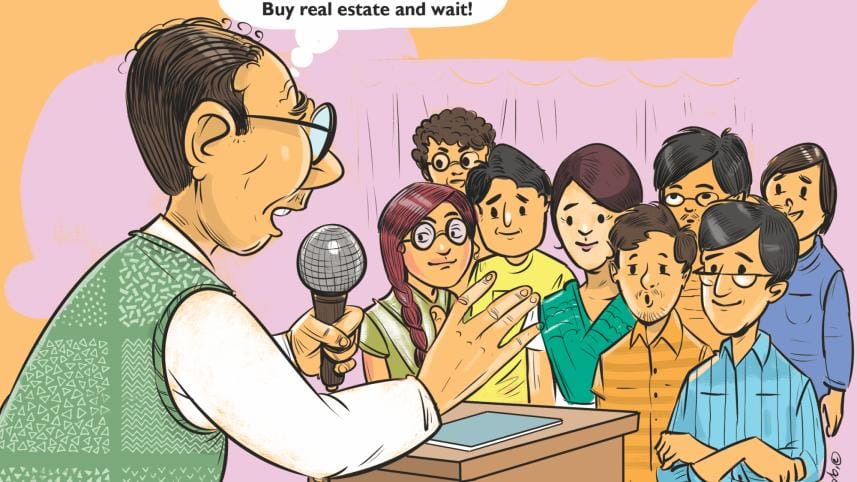

For young couples, buying over renting is wise

There is something permanent, and something extremely profound, in owning a home, the popular American educator and politician Kenny Guinn once said. It is a piercing nugget of wisdom, one that young couples can take to heart.

In Bangladesh, newly-married and young couples invariably opt for rental properties when it comes to setting up their first homes.

Despite the inherent flexibility of changing addresses to suit any developments in occupational requirements, rentals pose a host of problems, and not just due to the intrinsic feature of being someone else’s property.

Due to the unregulated nature of the Bangladeshi rental market, homeowners charge whatever they can from different tenants, depending on their desperation or need, much to the frustration of renters.

The added worry of random jumps in the monthly rent, owing to the owner’s whimsy, and lack of proper support during the need for occasional maintenance, and inane conditions like lack of access to the roof are just some of the issues of renting in an unregulated market.

Regardless, the vital issue for most young couples, who also tend to be just starting out in their professional careers, is the comparative weight of the rent expense against their monthly incomes.

No matter how well a starting or mid-level job or business pays, rent is an expense without any future returns. In other words, it is a sunk cost -- and hence irrecoverable.

And this is where home loans come into play, cropping up as a godsend in the lives of modern and young families.

Given stable jobs or source of income, most private banks allow young couples and first-time buyers to take out loans worth between 50 and 100 percent of the value of the property being purchased.

The loans come with long-term and relatively easy equal monthly instalments, which end up being the same outlay as the rent of a house or apartment of the same size.

This way, the steady outflow of income is the same as that of a renter, but with a decidedly more attractive outcome of gradual ownership of an own home.

What is more, with the development of the country’s financial sector, a myriad of products have been created to suit the varying needs of young couples and families.

For example, IDLC offers home loans in categories like Apartment Purchase, Affordable Home, Home Equity, Home Loan Shield, Construction, Registra and even Land Purchase.

Among these, IDLC’s Home Loan Shield, interestingly, provides life insurance coverage equivalent to outstanding home loans, to create a protection in case of an accident or untimely demise of the family’s main breadwinner.

City Bank’s home loan eligibility criteria is expansive: anyone aged 22-65 with incomes of Tk 50,000 and above can apply.

On the other hand, Delta-Brac Housing -- apart from the usual apartment and land purchase loans -- also offers home extension loans, meaning homeowners can take out loans to finance renovations or extensions in their current properties.

This is a particularly thorny issue for renters, as landlords are often reticent or unwilling to make any major changes to the interior of their homes regardless of the needs of a long time tenant.

With an owned property, it becomes easy to adjust and reshape the space to suit the changing needs of a couple, beginning with starting their family to eventually empty nests.

For example, an open plan house will work wonderfully for a young couple, but to add more privacy and specify space for various purposes, the same space may be renovated to accommodate a nursery or play area, or a reading room and den.

As a tenant, landlords can be reticent to even change the malfunctioning shower pipes, or replace the cracked kitchen counter, and that expense for the tenant is unavoidable, yet pointless, especially if the duration of tenancy is not assuredly long enough to outweigh the costs.

On the part of the home owner, the refusal to allow major changes may well be reasonable too, depending on the demands of the tenant, and again, the duration of tenancy.

All in all, for young families, it is preferable to own a home as soon as possible.

And, owning a home early on need not be a shackle to mobility given the: scarcity of real estate in Dhaka city and the various banks’ offer of sizeable loans for buying pre-owned properties and takeover of loans from other banks for minimal to no fee.

In other words, offloading real estate may not take as much time as one would think, and they almost always yield a premium.

Besides, the government has cut property taxes from this fiscal year.

Property registration taxes and fees amounted to 14-16 percent of total property value, but will now be much less.

The stamp duty was slashed to 1.5 percent from 3 percnt, registration fee to 1 percent from 2 percent, and local government tax to 1.5 percent from 2 percent.

Little or large, realtors are now developing apartments for all budgets, according to the Real Estate and Housing Association of Bangladesh.

So, it is never too early to get in on the property ladder, as owning a home is a keystone of wealth -- both financial affluence and emotional security, in the words of noted American financial expert Suze Orman.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments