Non-Bank Financial Institutions in Bangladesh: Unsung Financial Heroes

Though less recognized than banks, Non-Bank Financial Institutions (NBFIs) have played a crucial role in shaping Bangladesh's economic landscape, acting as essential sources of lending and borrowing for the past four decades.

The approval of the first NBFI by the Bangladesh government in 1981 marked the beginning of a new era aimed at bridging the country's financial backwardness. Over time, a notable proliferation of NBFIs has occurred, collectively contributing to the sustainability of Bangladesh's economic growth.

However, this growth has also brought to light both the positive and negative aspects of the industry, revealing a persistent gap between expectations and accomplishments.

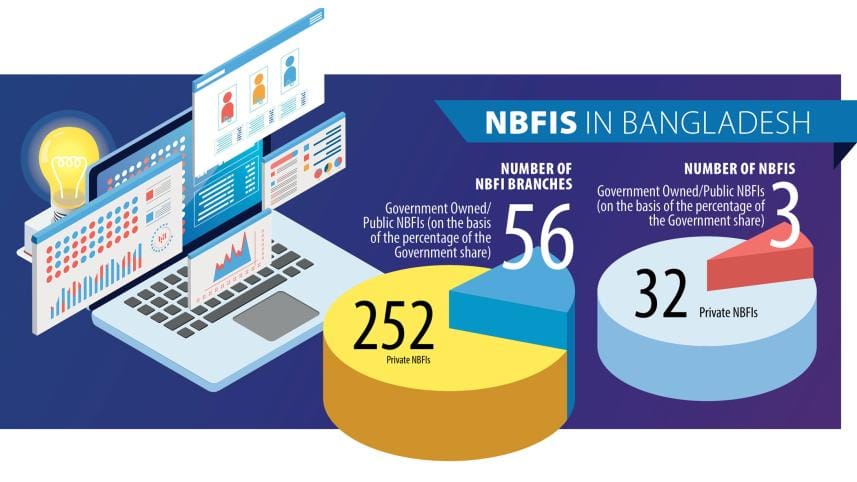

As of December 30, 2023, Bangladesh hosts a total of 35 NBFIs. This includes 3 government-owned entities and 32 private NBFIs. The total number of branches operated by these NBFIs amounts to 308. Among these branches, 56 are state-owned, while the remaining 252 belong to private NBFIs. The majority of these branches are concentrated in Dhaka and Chattogram. Specifically, Dhaka boasts 173 branches, Chattogram houses 47 branches, and the remaining 108 branches are dispersed throughout the rest of the country.

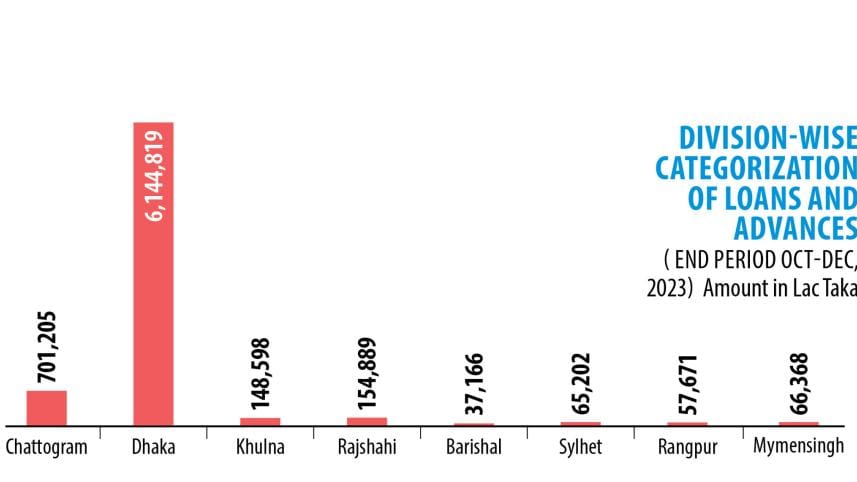

Strategically, NBFIs have traditionally concentrated their operations in Dhaka and Chattogram, the industrial and commercial hubs of the country. However, some NBFIs are now expanding beyond these mega-cities, extending their activities into rural areas and diversifying their product offerings. "IPDC SME has been working relentlessly to extend its facilities to entrepreneurs in rural areas through its linkages," adds Rizwan Dawood Shams, Managing Director of IPDC Finance Limited.

According to the latest data from the central bank, the total deposits in NBFIs amount to 4,483,018 Lac Taka, which holds 431,221 accounts, resulting in an average deposit per account of 10.40 Lac Taka. As for loans and advances, the total stands at 7,375,919 Lac Taka across 219,705 accounts, with an average loan and advance per account of 33.57 Lac Taka as of December 2023.

The importance of NBFIs is evident in their operational approach compared to other financial institutions. Their long-term loan disbursement is a key attractive feature for clients.

"Another positive aspect of NBFIs is their proactive client engagement. They reach out to clients directly, visiting their offices or workstations for onboarding. In contrast, banks require clients to visit their branches and often take a long time to make decisions, with approvals needed from branch to regional office to head office. NBFIs, however, work promptly as they focus on a limited range of services," says Nasimul Baten, Managing Director of DBH Finance.

"Unlike banks, we have in-house legal and engineering teams. This allows us to promptly conduct verification and evaluation internally, providing a hassle-free experience for our clients. As a result, we can determine the possible loan amount for our clients within 3-5 days," shares Mahbubur Rashid, Head of Business at National Housing Finance.

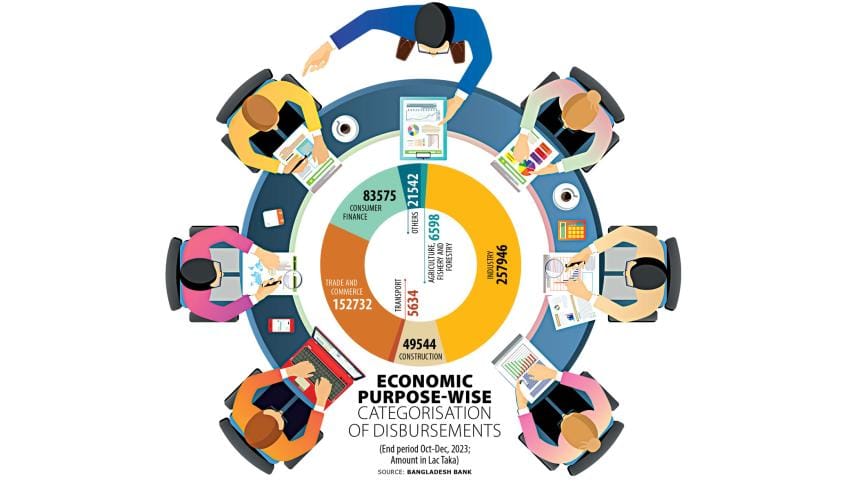

According to Bangladesh Bank's data in the 'NBFIs Statistics Quarterly: October-December 2023,' the majority of NBFI disbursements (45.60 percent) are allocated to industries, followed by trade and commerce (25.99 percent) and consumer finance (14.22 percent). Nevertheless, several prominent NBFIs are now emphasizing product diversification, expanding their service portfolios to include a wider range of offerings, with a particular focus on SMEs and microfinance.

"Our green financing options, SME loans, and affordable home loans drive growth and create opportunities, supporting businesses, promoting homeownership, and encouraging sustainability," shares Syed Javed Noor, Deputy Managing Director at IDLC Finance.

"IPDC actively engages in capacity-building initiatives for entrepreneurs, offering various training and knowledge-sharing programs aimed at enhancing their skills and fostering business development. Through these targeted efforts, IPDC Finance aims to empower SMEs, women entrepreneurs, and underserved youths, contributing to their economic growth and financial inclusion in Bangladesh," says Rizwan Dawood Shams, Managing Director of IPDC Finance.

As per Bangladesh Bank's annual report for 2023, out of the 35 NBFIs assessed in 2021, 11 received a composite CAMELS rating of '2' or 'Satisfactory', while 10 were rated '3' or 'Fair', 5 were rated '4' or 'Marginal', and 3 were rated '5' or 'Unsatisfactory'. Additionally, 5 NBFIs were undergoing the rating process, while 1 was exempted from it due to special circumstances. This diverse range of ratings underscores the mixed performance of NBFIs and reflects on the overall economic health of the sector.

"Perceptions of NBFIs have been tainted by isolated incidents involving a few institutions. It's crucial to note that certain NBFIs maintain portfolios that outshine those of some third-generation banks in terms of both quality and stability. The effectiveness of NBFIs often rests on management decisions," shares Imran Parvez, Senior Assistant Vice President overseeing Corporate and SME affairs at SFIL PLC.

Furthermore, the matter of non-performing loans (NPLs) continues to be a significant concern for NBFIs, serving as a vital indicator for their asset evaluation and overall performance as financial institutions. As of the end of June 2023, the NPL ratio for NBFIs was at 27.65%. However, by January 2024, it had risen by over three percent, reaching a record high of 30% of disbursed loans. Nonetheless, some institutions are adeptly managing their NPLs, keeping them at stable levels.

Kanti Kumar Saha, Chief Executive Officer of Alliance Finance states, "The primary challenges confronting NBFIs or finance companies stem from an image problem arising from governance issues within some of these institutions. The current Non-Performing Loan (NPL) rate, standing at around 30%, is largely attributed to scams, incorrect borrower selection, and the lack of a robust risk management culture."

"Over the past year, we have exercised greater due diligence amidst the various challenges in the market and NPL concerns. Despite unfavorable conditions, our NPL rate has remained consistently below five percent, indicating robust management in taking proactive steps and maintaining a quality portfolio. We strongly believe that a strong NPL monitoring process, accompanied by measures to ensure the highest corporate governance, allows us to have sustainable growth, eliminating any posing challenges," shares Rizwan Dawood Shams, Managing Director of IPDC.

The challenge persists notably for the NBFI sector amidst the country's broader economic struggles, marked by inflation nearing double-digit figures. To optimize the role of NBFIs, several key areas require attention. Addressing these areas effectively will guarantee a more robust and enduring contribution of NBFIs to the nation's economic advancement.

"In 2023, our total deposits increased by 15 percent, with 90 percent of our depositors participating in deposit schemes. Additionally, our NPL margin remained below one percent. However, the cost of funding is rising, and due to high inflation, the cost of materials for housing is increasing, leading to higher construction costs. This will likely result in a greater demand for loans, but incomes are not increasing at the same rate. Maintaining this balance is our main challenge, as we are solely focused on home loans. Government initiatives addressing macroeconomic issues would be helpful for us in managing these challenges," states Nasimul Baten, MD of DBH Finance.

He further adds, "Globally, NBFIs benefit from long-term funding sources like pensions and insurance since they provide long-term loans, unlike banks. However, here, NBFIs are providing long-term loans with short-term funds, while banks are offering short-term loans with the advantage of long-term funds. If the government revises the current regulations, it would significantly benefit NBFIs by allowing them access to long-term funding, which aligns with their long-term loan disbursement practices."

"The contribution of NBFIs to the financial assets of the country is around 5 percent, whereas in neighboring countries like India and Sri Lanka, the share of NBFIs is around 16 percent and 12 percent respectively. The role of NBFIs has not been robust due to a lack of good governance and policy support from the government, but they still have the potential to grow if the existing problems can be addressed fairly," mentions Kanti Kumar Saha, Chief Executive Officer of Alliance Finance PLC and Vice-Chairman of the Bangladesh Leasing and Finance Companies Association (BLFCA).

"Commercial banks worldwide primarily focus on short-term business activities, whereas Non-Bank Financial Institutions (NBFIs) specialize in long-term financing, offering additional features such as innovative startup funding to stimulate economic growth. Regrettably, the overall strength of our NBFIs mirrors that of our banks—they are not functioning properly and have become problematic institutions. Their challenges primarily stem from mismanagement, leading to a rise in bad loans and hindering the development of our economy," says Mustafa K. Mujeri, Executive Director of the Institute for Inclusive Finance and Development (InM), and former chief economist of Bangladesh Bank and director-general of Bangladesh Institute of Development Studies (BIDS).

He stresses the urgent necessity for a comprehensive overhaul and underscores the critical need for a robust regulatory mechanism to effectively supervise the activities of NBFIs and bolster governance practices, thereby ensuring optimal performance.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments