Diversifying funding sources is essential

Rizwan Dawood Shams

Managing Director, IPDC Finance

In the turbulent landscape of 2023, the financial sector faced challenges such as a surge in non-performing loans, contracting spreads, and liquidity constraints. While the banking sector rebounded in spreads after the first quarter, the third quarter saw a similar resurgence in Non-Banking Financial Institutions (NBFIs). Throughout the year, NBFIs encountered significant hurdles, mainly due to historically low-interest rate spreads. Despite deposit rate increases, lending rates remained capped until July, leading to a notable decline in various financial indicators. In June, NBFIs experienced a historic low-interest rate spread of only 0.27%, significantly impacting profitability. By December 2023, the interest rate spread for NBFIs contracted to a mere 3.23%, posing a significant obstacle to profitability and long-term sustainability.

To navigate the crisis and lead the finance sector in Bangladesh, NBFIs are poised to adopt strategic approaches. Prioritizing operational efficiency is crucial, involving cost reduction strategies, technological optimization, and exploring alternative revenue streams. Digitalization is also pivotal, empowering NBFIs to enhance efficiency, elevate customer experience, boost sustainable finance portfolios, and access untapped markets. Robust risk management practices, including strong credit assessment frameworks and prudent risk-taking, are indispensable for safeguarding financial stability.

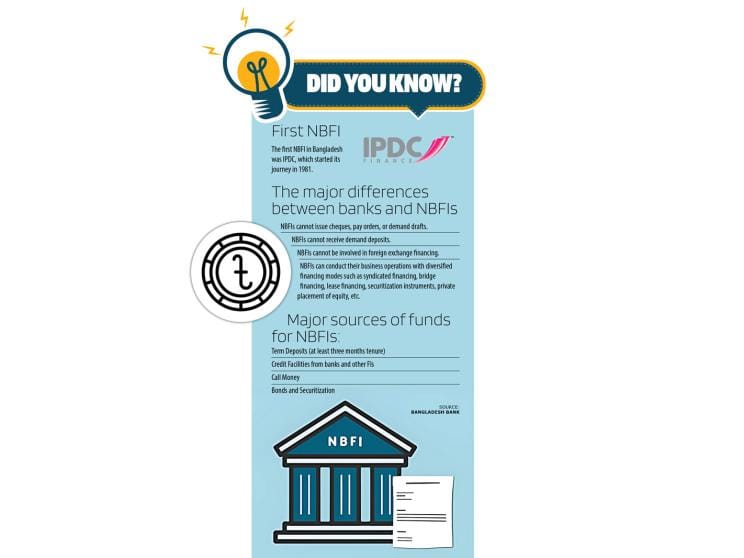

Diversifying funding sources is also essential. This could involve tapping into capital markets, forming strategic partnerships, and leveraging fintech solutions for innovative funding options. Furthermore, NBFIs should focus on enhancing their governance and transparency practices. This includes adhering to regulatory requirements, implementing robust internal controls, and maintaining clear communication with stakeholders. In recent times, we are facing a significant liquidity crisis, which underscores the need for these strategic approaches. Improving liquidity management is paramount; by adopting more rigorous forecasting and planning, NBFIs can ensure they have adequate resources to meet their obligations and support ongoing operations. Adopting these strategies will enable NBFIs to play a pivotal role in stabilizing and advancing the finance sector in Bangladesh amidst the ongoing challenges. By doing so, NBFIs can not only weather the current crisis but also emerge stronger and more resilient in the long term.

Government support is crucial for the further expansion of the financial sector, especially in addressing non-performing loans (NPLs) and improving the quality of financial portfolios. By focusing on policies to ease the current inflation and liquidity crisis, the government can create a more stable economic environment. Specifically, addressing NPLs through improved governance mechanisms will significantly contribute to the sector's expansion. Implementing stringent measures to handle default loans efficiently will enhance the overall quality of financial portfolios. This, in turn, will create a more conducive environment for the growth and stability of the financial sector, enabling it to better support economic development and resilience against future crises.

At a glance

- Established in 1981, IPDC has grown significantly over the decades, reflecting its commitment to excellence and customer satisfaction. With a total of 16 branches, 843 employees, 111,036 customers, a loan portfolio of Tk 69 billion, and a deposit portfolio of Tk 54 billion, IPDC has been going the extra mile for its stakeholders.

- IPDC offers an array of financial products and retail schemes to its customers. The retail schemes include Priti, Bhalo Basha Loan, IPDC Home Loan, IPDC Auto Loan, IPDC Personal Loan, IPDC Deposit Schemes, and IPDC Saving Schemes. Additionally, IPDC offers a total of 4 loan products specifically tailored for SMEs and women entrepreneurs, including Lease Finance, Long Term Finance, Short Term Finance, and Joyee for Women.

- Currently, IPDC is running 4 ongoing campaigns, which include IPDC Auto Loan with Audi, IPDC Auto Loan to own a pre-owned car, Bhalo Basha Home Loan to build a house in any area of the country, and availing exclusive offers with Priti Privilege Card.

.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments