New Shariah-compliant Products Needed

TDS: What is the current state of Islamic banking in Bangladesh?

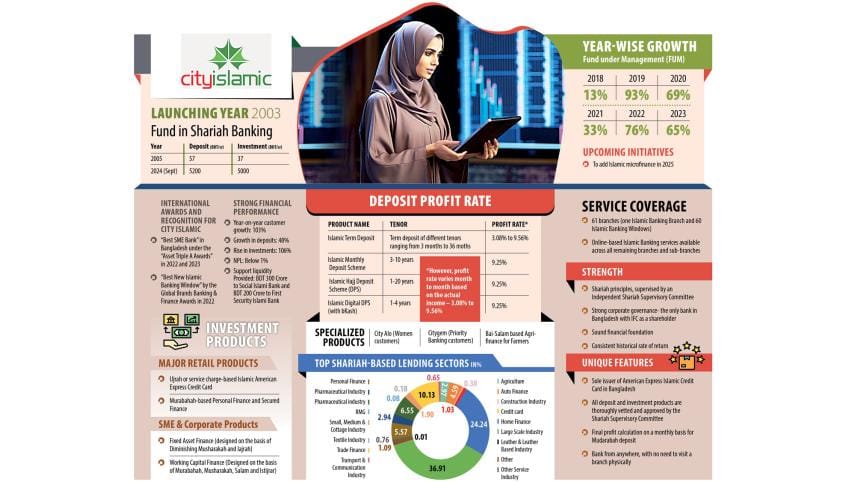

Mashrur Arefin (MA): The country's Islamic banking industry is in a mixed state. Most full-fledged Islamic banks are experiencing severe liquidity crisis and a certain erosion of public trust due to unprecedented corruption and malpractice under the previous regime. However, the situation has begun to improve, albeit slowly, and I believe it can be managed over time. This is not the typical scenario for the Islamic banking industry. Other banks, specifically most of the conventional banks offering Islamic banking services, are performing quite well. For example, on average the deposit and investment portfolio of City Islamic has experienced a growth rate of over 55% during the last five years, with current funds under management exceeding BDT 10,000 crore. This consistent growth has been possible due to the trust of our customers, fostered by our strong corporate governance, solid financial foundation, and adherence to Shari'ah principles that uphold the religious values of our Islamic customers.

TDS: What types of Shariah-compliant services does your bank offer?

MA: City Islamic operates as a "bank within a bank", providing a comprehensive range of Shari'ah-compliant products and services, strictly adhering to Shari'ah principles while respecting religious values of customers and addressing their evolving demands. Notably, we are the only bank in Bangladesh offering American Express Islamic Credit Cards, a unique product under the Ujrah (fee-based) model. Our digital presence is another standout feature, with 'Citytouch' widely regarded as the best digital banking app in Bangladesh, offering more than 100 services to ensure a seamless digital banking experience.

City Islamic offers Islamic Current Accounts, designed based on the Al-Wadee'ah (safe-keeping) principle, for all customer segments. Besides, for individuals, we provide Mudarabah-based Islamic Savings, Fixed Deposit, and DPS accounts with various options and tenors to meet diverse needs. In collaboration with bKash, City Islamic has launched the first-ever Islamic digital DPS product, expanding access to financial services and promoting inclusivity. Individual financing options include Shari'ah compliant Personal Finance, Home Finance, and Auto Finance.

To support MSMEs and corporate clients, City Islamic offers products like Islamic Current Accounts, SND Accounts, and Islamic Term Deposit Accounts on the deposit side. We also provide Shari'ah compliant different packages under our Islamic Employee Banking Services. On the financing side, we provide products such as Murabahah, Musharakah, Salam, and Istijrar for working capital requirements. For fixed asset financing, we offer Diminishing Musharakah, Hire Purchase under Shirkatul Milk (HPSM), and Asset-Backed Finance, among others. We also provide a seamless banking experience for our corporate customers through Islamic Cash Management and Islamic City Live facilities, enabling remote access to financial services.

TDS: What challenges does Islamic banking currently face?

MA: The challenges currently facing Islamic banking can be grouped into two categories. The first category includes general challenges for the Islamic banking industry, such as the absence of Islamic banking law, comprehensive regulatory guidelines that align with global best practices, and a lack of sufficient Shari'ah-compliant financial products. A common challenge Islamic banking operators in Bangladesh face under normal circumstances is a deposit surplus, which often remains idle due to limited Shari'ah-compliant money market instrument. While it is encouraging that Islamic banking laws and updated guidelines have been drafted, their swift implementation is crucial to address these challenges effectively. Given Islamic banking's 25% share in the overall banking sector, having a Deputy Governor dedicated to Islamic banking oversight could help address these broader issues and foster sustainable growth.

The second category involves the liquidity crisis in some full-fledged Islamic banks, resulting from unprecedented corruption and mismanagement. This has partially eroded public trust, leading to withdrawal of funds and creating instability in the sector. Rebuilding public confidence is essential, and this can only be achieved through robust governance, transparency, and strict compliance measures.

TDS: Are there any plans to enhance your Islamic banking services further?

MA: City Bank is committed to enhancing its Islamic banking services, with a strong focus on digital innovation. Currently, we are operating 60 Islamic banking windows and one dedicated Islamic banking branch, and also planning to expand further to reach more customers. Our digital platform, Citytouch, continues to evolve, with new features regularly added to provide a seamless digital experience for customers. We are also focused on developing new Shari'ah-compliant products, especially targeting the agriculture and microfinance sectors, to promote financial inclusion for underserved communities. In addition, City Islamic plans to bridge the knowledge gap through regular workshops for both customers and employees, reinforcing the importance of Shari'ah compliance and fostering greater trust in our services.

TDS: What are the prospects for the growth of Islamic banking in Bangladesh?

MA: Bangladesh's Islamic banking sector has significant growth potential, given that over 90% of the country's population is Muslim, and there is increasing demand for Shari'ah-compliant financial services. Even non-Muslims are attracted to the sector due to its ethical and equity-based principles. Senior citizens, women, and notably young people are increasingly drawn to Islamic banking, as they prefer to avoid conventional banking due to its use of 'interest,' which contradicts their religious beliefs. This suggests that the Islamic banking industry has significant future prospects in Bangladesh.

If we consider the example of Malaysia, where around 62% of the population is Muslim, the Islamic banking industry there has already achieved more than 42% market share and registered over 12% growth in 2022 in both deposits and investments, compared to less than 2% growth in conventional banking.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments