Mobile wallets power Bangladesh’s new financial pulse

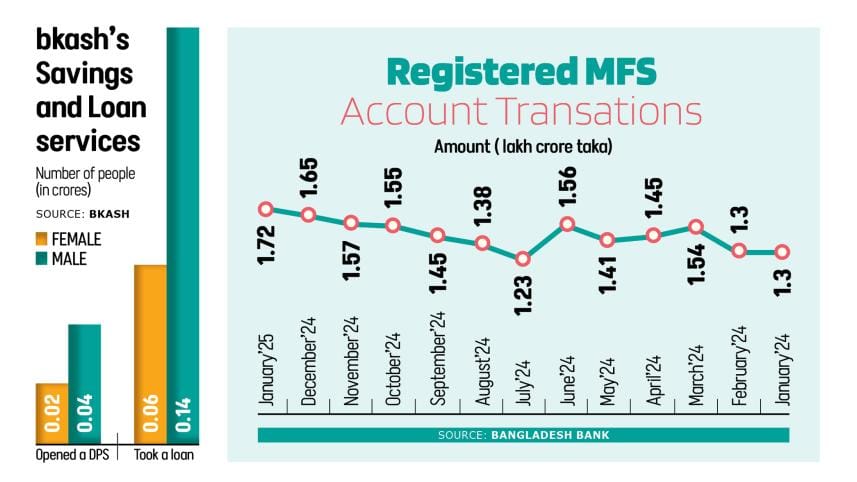

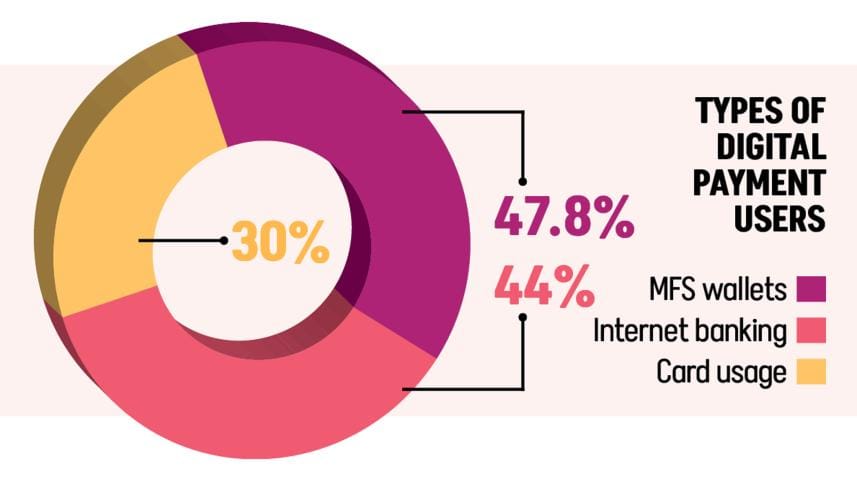

Mobile financial services (MFS) have become Bangladesh's fast lane to financial inclusion and economic mobility. According to the central bank report in 2024, MFS customer transactions hit Tk 17.37 lakh crore — a 28.42% jump from 2023 — while registered accounts topped 23.86 crore, showing how wallets moved from convenience to necessity. From DPS and salary disbursements to instant microloans and merchant QR payments, mobile platforms are stitching daily commerce into phone screens and tills across towns. This boom brings clear benefits like faster remittances, cheaper payments and income paths for agents and small traders, but also fresh frictions. Fragmented fee structures, uneven interoperability between providers and variable consumer protection leave gaps that could slow uptake or erode trust if left unaddressed. Millions of newly active users , including women and rural customers long kept out of traditional banking can now save, borrow, sell with a few taps, expanding livelihoods and creating financial trails that policymakers and firms can build on.

The challenge is to convert rapid adoption into durable benefits: better pricing, clearer protections and products designed for low-income users. Get that right and Bangladesh's cashless moment won't be a flash — it will be a new economic lifeline.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments