Gearing Bangladesh for a cashless tomorrow

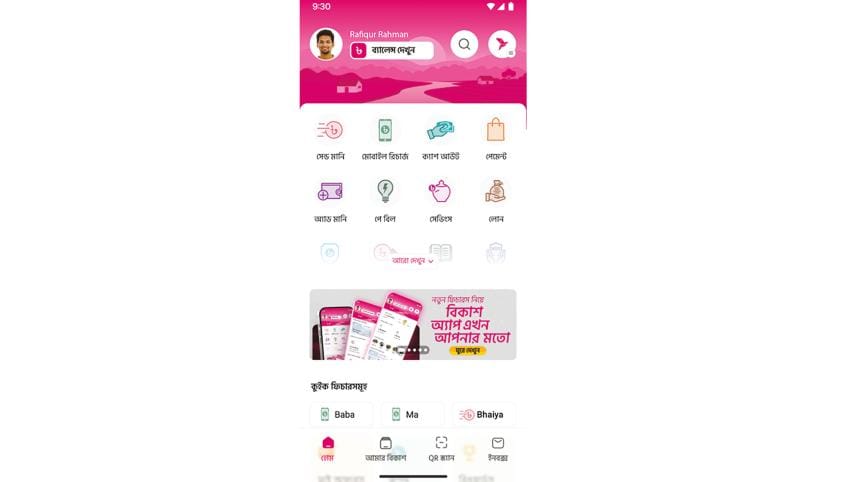

Imagine falling in love with a gadget or expensive jewellery at a shop, and instead of digging into your pocket, you simply scan a QR code or tap a few buttons on your phone. Yes, you guessed it right. bKash is turning that moment into a tiny delight and a habit. With Bank to bKash and Card to bKash transfers available around the clock, funds move from banks or cards into their mobile application instantly when you need them. A nationwide network of over 350,000 agents brings essential financial services to villages and small towns, and almost 1 million merchant QR points have turned tiny shops into digital shopfronts. As a result, millions of Bangladeshis now rely on it for everyday payments, mobile recharges, utility bill settlements, remittances, savings, loans, and more.

Loans At Your Fingertips

bKash is more than a payment tool. It is an on-demand credit engine supporting entrepreneurs, small businesses, and households. In partnership with City Bank, it enables instant collateral-free loans through the bKash app. Over Tk 50 billion has been disbursed to nearly 2 million customers across more than 12 million transactions, with about 25 per cent of borrowers being women, indicating reach among underserved groups. Quick approvals help shop owners restock and families manage unexpected expenses, stabilising cash flows. Digital scoring and usage histories allow informal entrepreneurs without traditional bank records to access credit and build financial profiles for better services.

Savings Made Simple

Saving is no longer limited to piggybanks. bKash's DPS lets users save weekly or monthly starting from only 250 taka per week, making disciplined saving realistic for low-income households. The platform partners with Mutual Trust Bank, Dhaka Bank, BRAC Bank, City Bank and IDLC Finance to let users move, hold and cash out savings easily through agent points without any change. More than 5 million DPS accounts have been opened, and about 30 percent are by women, reflecting rising financial participation among female savers. Friendly reminders, clear progress displays and agent coaching encourage long-term saving, helping families plan for school, festivals and medical expenses without relying on costly informal credit.

Cashless For Everyone

Inclusion is central to bKash's mission. Feature phone users can access services via USSD (*247#) without internet, while smartphone users have a full app with Bangla language support and voice prompts. Trained agents act as local financial guides in marginalised areas. 64 MFIs, serving millions, accept loan repayments and deposits through bKash, reducing travel time and costs for rural borrowers. Community outreach and literacy drives build trust among senior citizens and new users, helping rural and urban customers join the cashless economy. To drive cashless behaviour, bKash integrates key financial products into one app, enabling personal finance management for millions.

Boosting The Economy And Protecting Users

Digital payments reduce theft risk and cut the high costs of printing, transporting, and securing cash, easing pressure on the national economy. Merchants digitise sales, consumers pay utility bills and education fees through apps, and businesses receive funds faster, enabling reinvestment, hiring, and expansion. Digital transaction records improve transparency, reduce leakage in public disbursements, and help small sellers, including local e-commerce merchants and startups, reach wider markets at lower transaction costs.

Reduced cash handling also means fewer trips, less paper use, and lower transport emissions. At the same time, security measures such as PINs, eKYC, one-time passwords (OTP), device biometrics, and round-the-clock monitoring protect users, while fraud detection teams and responsive support limit scams and losses, building trust across urban and rural customers alike.

Everyday Scenes, National Change

The revolution appears in small scenes: a mother paying tuition from home, a man in Dubai sending remittance within minutes to cover his parents' treatment, an artisan turning social interest into a paid order overnight. By combining payments, savings, loans, remittances, and a wide agent network, bKash has woven financial services into daily life and nudged Bangladesh toward inclusive prosperity. QR payments, small DPS accounts, and Bank to bKash transfers turn routine actions into financial security, support local businesses, and strengthen household stability. Each transaction contributes to a cashless future that is more secure and accessible. Every account, deposit, and digital sale expands inclusion, creates income, and reinforces communities across cities and villages, showing how everyday choices can shape a national economy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments