How specialised banks are lending a helping hand

Bangladesh is one of the most densely populated countries in the world with a population of 166 million living in an area of 56,977 square miles. The sex ratio of this massive population is almost 50/50. Thirty-five percent make up the urban population while 65 percent live in rural Bangladesh.

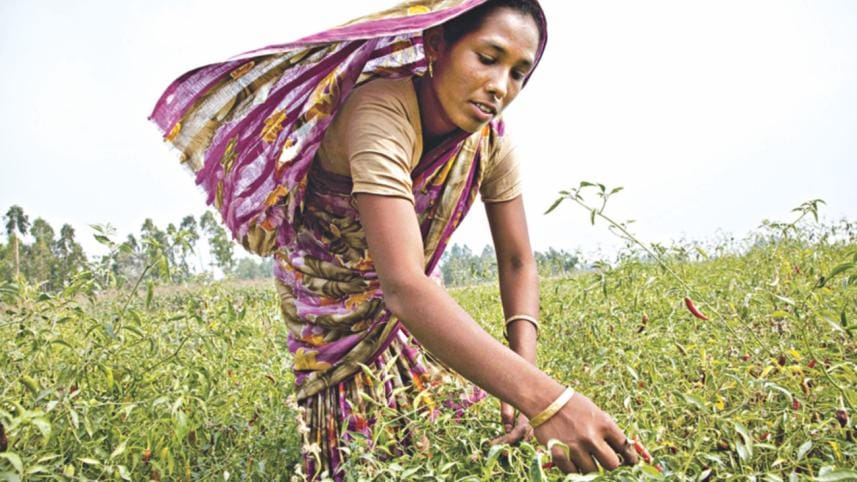

Rural men and women are heavily involved in agricultural farming and the cottage industry while the urban population is involved in business, trade and finance industries (cottage, small, medium and large) and other economic activities.

In order to achieve the Millennium Development Goals (MDGs) and for overall economic development of the country, the government gave special emphasis upon empowering women, since they make up half the total population, by creating more job opportunities for them both in rural and urban areas. As such, the government focused on developing a class of women entrepreneurs in the country.

Besides urban development, the government gave equal emphasis to the development of the rural agro-economy for which the administration has set aside a lot of incentives and announced policies geared towards it.

For rural economic development, the government established two specialised banks in the country, namely Bangladesh Krishi Bank (BKB) and Rajshahi Krishi Unnayan Bank (RAKUB) for the greater Rajshahi Division. These banks are mostly financing the agriculture and cottage industry in rural areas.

These two banks are financing the cottage, small, medium and large enterprises/industry in the agricultural sector such as cold storage, rice mill, spice grinding, wooden and cane furniture, utensils made of mud, bricks, etc., both for domestic use and export.

Bangladesh Bank, the regulatory body of all banks and financial institutions, in its circular SME SPD-1 dated January 7, 2016 instructed them to extend credit in agriculture, cottage, small and medium sector as per the target set by them. Bangladesh Bank in this circular also instructed them to extend their support, especially to women-headed enterprises. Besides, SME Foundation of Bangladesh gives financial support to rural and urban traders, businessmen and women, in the form of small (business) loans.

Development in the agricultural sector in the recent past was propelled by government incentives in the form of subsidies, government directives, Bangladesh Bank's policy guidelines and financial support for BKB/RAKUB and other non-banking financial institutions and NGOs like BRAC, ASA, BKSP, etc., as per Bangladesh Bureau of Statistics.

AGRICULTURE AND SME FINANCE

Bangladesh is on its way to achieve middle-income country status and its agricultural sector has continued to play a significant role by providing the largest share of employment in the country. Growth in agricultural and allied sectors along with agricultural-raw-materials-based micro and small industries/enterprises are the primary drivers of poverty reduction by dint of their creating employment opportunities. Review of annual reports of Bangladesh Bank reveals that adequate flow of low-cost (interest rate) credit is essential for smooth growth of these sectors. Bangladesh Bank since long has been focusing on ensuring availability of funds and banking services for these sectors by instituting an efficient and comprehensive credit delivery mechanism throughout the country, as, for instance, in 2016 efforts were made by Bangladesh Bank through its annual agricultural credit policy for creating a favourable environment for the flow of credit to the agricultural sector and for other rural-based activities.

CREDIT DISBURSEMENT

Private and foreign commercial banks along with state-owned banks have come forward to disburse agricultural credit in recent years as per the policy decision and directives of Bangladesh Bank and the concerned ministries/divisions/directorates. As a result, agricultural and rural finance programmes have seen an expansion.

About 81.7 percent of the disbursed loan of Tk 176.5 billion was in the form of short-term lending and the rest 18.3 percent was long-term loans for purchase of irrigation equipment, agricultural machinery, livestock, etc. Credit for production of crops constituted 56.2 percent and it was 6.6 percent for poverty alleviation programmes.

According to the Bangladesh Bank annual report, the total outstanding loan in the agriculture sector increased by 4.7 percent or Tk 15.4 billion from a total of Tk 329.4 billion in FY2015 to Tk 344.8 billion in FY2016.

Two specialised banks—BKB and RAKUB—along with four state-owned commercial banks played a key role in the disbursement of agricultural and rural credit. However, the state-owned commercial banks and RAKUB fell short of the target by 5.9 percent and 30.3 percent respectively; whereas BKB and foreign and private commercial banks exceeded the disbursement target by 2.9 percent, 29.8 percent and 24.5 percent respectively in FY2016.

CREDIT RECOVERY

Besides increase in disbursement, recovery of agricultural credit also increased by 10.7 percent from Tk 154.1 billion in FY2015 to Tk 170.6 billion in FY2016. This was possible because of comprehensive support to agricultural production thanks to subsidies for both input and output. The rate of recovery of agricultural credit was 74.8 percent during FY2016 which was higher than that of FY2015 which was 69.9 percent.

The overdue as a percentage of total outstanding agricultural loans decreased during the period under review from 20.4 percent in FY2015 to 16.5 percent in FY2016.

SOURCES OF AGRICULTURAL FINANCE

The primary source of agricultural credit in BKB was 28 percent, 6.3 percent in RAKUB and 47.4 percent in private commercial banks as per the disbursement record of FY2016. Besides, foreign banks (2.9 percent) and local state-owned commercial banks (15.4 percent) are also playing a vital role as a source of agricultural finance. The overdue loans of RAKUB and BKB were 29.8 percent and 15.4 percent respectively at the end of FY2016.

BANGLADESH BANK'S REFINANCE AGAINST AGRICULTURAL LOANS

Besides paid-up capital, BKB and RAKUB receive funds for lending purposes from their customer deposits and refinance facilities from Bangladesh Bank for lending in this sector in order to create employment opportunities in rural Bangladesh and for poverty alleviation. Only BKB, RAKUB and BRAC availed the benefit of refinancing facilities to the tune of Tk 6 billion from Bangladesh Bank during FY2016.

These banks also took refinance facilities for extending loans to the jute sector for purchase of raw jute, which helps farmers get a fair price for raw jute, and working capital loans to jute goods manufacturing companies/industries and jute exporters.

To boost the dairy farming industry RAKUB and BKB also avail refinance facilities from Bangladesh Bank as a revolving fund for a period of five years. This loan is meant to provide dairy farmers with easy and cheaper credit for milk production, rearing cows and cow breeding. They provide this loan at five percent cash subsidy against the disbursed loans.

Bangladesh Bank has also undertaken agricultural credit programmes and refinance schemes for small croppers, credit for SMEs, agro-based product processing industries and new entrepreneurs under the cottage, micro and small categories.

DEVELOPMENT OF WOMEN ENTREPRENEURS

For the development of women entrepreneurs, Bangladesh Bank encourages all banks including BKB and RAKUB and NBFIs to provide loans to women entrepreneurs at 10 percent interest rate. A dedicated women entrepreneurs' desk has been established in the SME and special programme department of Bangladesh Bank. All banks and NBFIs have been directed to do the same. They have also been instructed to keep as reserve 15 percent of total SME funds exclusively for women entrepreneurs as well as to give credit to new women entrepreneurs under the cottage, micro and small sectors. In addition, all banks and NBFIs have been directed to sanction loans of at least Tk 2.5 million to women entrepreneurs with personal guarantee but without collateral under refinance facilities provided by Bangladesh Bank. At the end of June 2016 an amount of Tk 16.4 billion was refinanced to women entrepreneurs against 16,028 enterprises.

MICROCREDIT OPERATIONS FOR WOMEN ENTREPRENEURS

In Bangladesh a large number of rural and urban poor are self-employed. For them access to credit is an important determinant of income generation opportunities. Microcredit provides a pathway of access to credit and is playing the predominant role in rural finance. It has been considered as a tool for poverty alleviation and income generation. It plays a productive role in the country's overall investment by increasing savings from remote areas. To improve access to credit and other financial services Bangladesh Bank has taken a proactive role, especially for the unbanked and poor segments of the population. New ICT-based financial services like mobile banking have already changed the landscape of financial services' access to the poor in both rural and urban areas.

GOVERNANCE ISSUES

Both the specialised banks i.e. BKB and RAKUB since their inception have been functioning under the guidance of the board of directors framed by the banking division of the Ministry of Finance and Bangladesh Bank, as per the Bangladesh Bank order amended from time to time and Bank Company Act 1991. The ministry nominates the chairman and directors to the board who give policy decisions and banks function under the managing director/CEO who is the administrative head.

In order to provide directional guidelines to improve the risk management culture and to establish an acceptable standard in running the day-to-day operations of these banks, the core risk guidelines of Bangladesh Bank—especially for credit risk management, asset liability management, internal control and compliance management, and ICT management—are followed.

It would appear that these specialised banks are following the guidelines and policy directives of government circulars issued from time to time by Bangladesh Bank meticulously, in performing their activities including lending, loan portfolio management, managing non-performing loans, loan recovery, loan classification, etc. But in reality there are shortfalls in their performance in terms of their overall operational activities and achievements.

BKB and RAKUB have experienced manpower (BKB: 8,964; RAKUB: 3,548) and they have a large number of branches (BKB: 1,031; RAKUB: 371) throughout the country; they also have a strong capital base, administrative setup, and board of directors headed by its chairman nominated by the banking division of the Ministry of Finance. These banks also have a vision and mission statement, set goals to achieve each year, rules and regulations, and procedural guidelines for sanction, disbursement and recovery of loan which they have prepared in line with the credit risk management manual of Bangladesh Bank. They deal with farmers more closely who have confidence in BKB and RAKUB when it comes to getting their hands on all types of agricultural credit under easy terms and lower interest rates compared to other banks and financial institutions. These two specialised banks are to implement government policies for the sustainable development of the country by way of attaining food sufficiency, employment generation in rural Bangladesh and reduction of poverty.

But both banks are suffering from a shortage in manpower. Not all the branches of BKB and RAKUB are fully computerised. As a result, they cannot deliver quality services promptly and efficiently to customers. They are also deprived of digital banking services, although they have taken up the scheme to bring all the branches under IT network.

The objective of both banks is to reduce poverty across the country by dint of higher production in the agricultural sector in rural Bangladesh. It is for this reason that BKB and RAKUB— disregarding profit earnings—are lending agricultural credit at lower interest rates compared to state-owned banks and private commercial banks. Moreover, each and every year they give waivers of a huge amount of interest receivable for farmers because of losses of production due to natural calamities like floods, cyclones, drought, attack of insects, and other diseases. As a result, recoveries of loan are less compared to other commercial banks. This may lead to decrease in profits resulting in accumulated loss. The government also interferes in their lending activities and loan recovery process compelling them to give waiver to marginal farmers. In short, they do not have full autonomy and they lack structural reforms as well.

Opportunities for BKB and RAKUB are unlimited when it comes to expanding their lending activities for more agricultural production—the end result being self-sufficiency when it comes to food.

With an aggressive marketing strategy BKB and RAKUB can easily bring almost all the households in rural Bangladesh under the banking umbrella and motivate them to take more agricultural loans to increase production. Keeping this is mind, BKB and RAKUB may take initiatives to motivate farmers for modern and mechanised agricultural farming, irrigation, and use of fertiliser and insecticides with financial assistance from them in the form of loans and advances at a subsidised rate of interest.

To expand their activities BKB and RAKUB may also go for formation of subsidiary companies for rendering services to different sectors of the agro-economy. For this to happen, the government may come forward to assist them by injecting more funds in the form of equity capital since 100 percent ownership lies with the government. This in turn will help them to have better financial health, marketing diversification and service delivery in the wider spectrum.

These newly established subsidiary companies with financial assistance from the government may go for lending to a specific segment of farmers for cultivation of export-oriented agricultural products and commodities with recruitment of more qualified and skilled manpower as per the job requirement.

There is also tremendous scope of lending of agro-credit for mechanisation of agricultural farming in all spheres of the sector to bring about self-sufficiency in food production in the country and to generate more employment opportunities.

BKB and RAKUB are eating up their equity capital because of losses they incurred due to waiver of interest of marginal famers due to natural calamities, instructions/directives of the government and Bangladesh Bank, failure of loan recovery from delinquent clients and willful defaulters resulting in loan losses due to loan classification leading to the creation of nonperforming loans.

NGOs are capturing a share of RAKUB/BKB customers/businesses because of their prompt services and because they are easily accessible without any bureaucratic tangles.

Since these banks are also collecting deposits at higher interest rates and competing with other banks, cost of fund will increase gradually reducing the spread between borrowing and lending rates.

Senior executives of these two banks are going into retirement but these banks cannot opt for large-scale recruitment of qualified executives to fill the gap because of intervention by the government and Bangladesh Bank and the lengthy timeframe required to complete the recruitment process through Bangladesh Bank.

In order to attain seven percent GDP growth rate and to keep up pace with the population growth in the country, the agriculture sector needs to grow at a constant rate of 4-4.5 percent per year. That's why the major challenges for Bangladesh's agriculture sector are to increase productivity and profitability, increase diversification of production in line with consumption, maintain food safety and quality, expand irrigation and mechanisation, and develop resilience to climate change impacts.

In conclusion, despite all odds, the country as well as the banking sector hope to see better performance of these two specialised banks in lending of agricultural credit in order to increase production in the agricultural sector, bring food self-sufficiency, create women entrepreneurs, generate employment and reduce poverty. To achieve all these objectives, what they need to do is re-structure the organisation, recruit skilled and qualified manpower, inject more funds, diversify marketing of loanable products, and increased autonomy for running its day-to-day activities. But most importantly, they need to ensure transparency and accountability in all their activities.

Syed Abu Naser Bukhtear Ahmed is a banker with more than four decades of experience in formulating policies and guidelines and promulgating laws relating to banking operations. He is currently an Independent Director of Dhaka Bank Limited.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments