Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

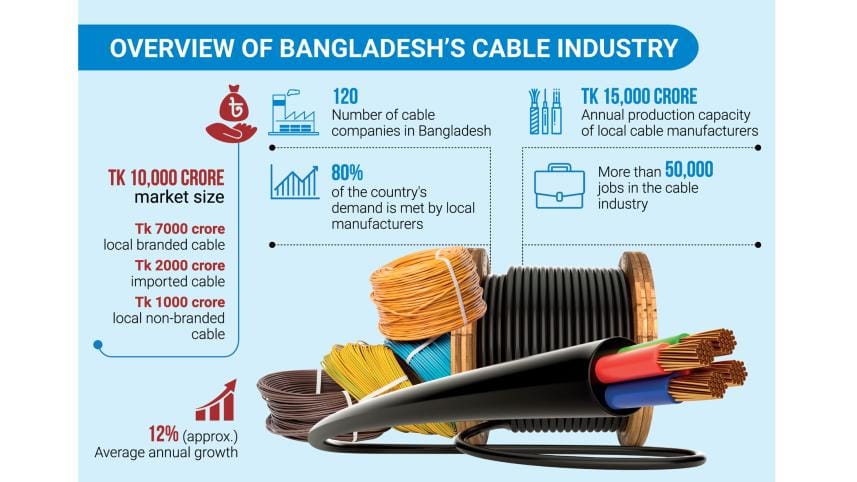

The cable industry in Bangladesh is experiencing an impressive growth trajectory, with a projected annual growth of at least 12 percent over the next two decades. This upward trend can be attributed to several key factors, including rapid urbanization, expanded power supply coverage in rural areas, rising demand for data and telecommunication services, and ongoing infrastructure development.

According to research by 6Wresearch, the Bangladesh cables market is poised for further growth during 2022-2028, primarily driven by the increasing demand for telecommunications and data services. This positive trajectory is further bolstered by government initiatives and increased investments in infrastructure by private companies, international investors, and government entities.

Bangladesh cable market and key players

The size of Bangladesh's cable market is around Tk 10,000 crore. Of the total market size, branded cable caters worth Tk 7000 crore, non-branded and substandard Tk 1000 crore, and the remaining Tk 2000 crore are imported.

The annual turnover in the sector stood at Tk 2,000 crore just a decade ago when few local manufacturers were involved in making household and industrial cables, according to industry insiders.

According to Mohit Chakraborty, head of marketing at Bizli Cables, a subsidiary of Pran-RFL Group, the cable industry has witnessed substantial growth, approximately 19 percent, over the past four years. This growth can be attributed to the expansion of power grids across the country and the increasing domestic wiring in alignment with urbanization trends.

The local companies now have the capacity to produce cables worth Tk 15,000 crore per year, fully meeting the cable demand in Bangladesh.

Rabiul Kamal, head of brand at BBS Cables, affirms, "Now we are capable of meeting 100 percent demand for cables in Bangladesh.

We produce all types of domestic cables, including low, medium, and high voltage cables for the Bangladesh market," he noted.

Around 120 cable manufacturers, including small-scale enterprises, operate in Bangladesh, with several major players dominating the market. Notable companies like BRB Cable Industries Ltd., Partex Cable, Bizli Cable, Eastern Cable, BBS, SQ, RR Electrical, and Poly Cable collectively meet 80 percent of the country's cable demand. The market leader, BRB, commands a 41 percent share, followed by Eastern Cable at 15 percent, BBS at 13 percent, and Partex and Bizli at 6.5 percent each. Other players collectively account for 22.2 percent of the market.

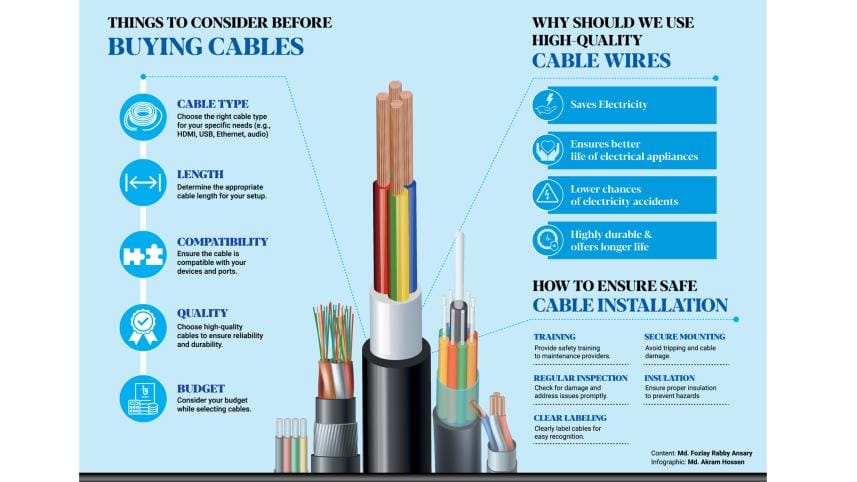

However, it's worth noting that only a handful of companies maintain international standard products. There are numerous small-scale companies that produce sub-standard cables to cater to those seeking cheaper house wiring options. However, opting for such cables can lead to significant risks and potential safety hazards.

Technological Advancements & Quality

Local manufacturers produce an extensive array of cables, including telephone wires, LAN cables, fiber optic cables, extra-high-voltage cables, and marine cables.

Bangladesh's cable industry has also made remarkable strides in technological advancements.

Highlighting this point Rabiul Kamal, head of brand, BBS Cables said "Now in Bangladesh, we have manufactured up to 245Kv high voltage cables. We use the world best Sikora technology to produce electric cables.

Similarly, Partex Cablex brought the CDCC CCV line in 2016 from Maillefer, Finland, informs A K M Ahsanul Haque, Chief Operations Officer, Partex Cables.

Challenges and Opportunities

The cable industry faced significant challenges during the pandemic, with halted production and temporary shutdowns due to a shortage of the workforce nationwide. However, despite such challenges, the local industry has shown resilience and continues to cater to most of the cable demand in Bangladesh.

However, industry insiders alleged that the government still needs to import electric and internet cables as the government is implementing a number of projects with bilateral financing. For this reason, the government is bound to import cables under the project as per the agreement, despite the local industry being capable of catering to 100 percent demand for cables in Bangladesh.

Rafiqul Islam Rony, director of marketing and sales at BRB Cable Industries Limited, echoes this sentiment, stating, 'Despite local manufacturers producing world-class cables, the government needs to import cables for foreign-funded projects.' He highlights that contractors in such projects often resort to using sub-standard products due to the lack of opportunities to inspect the quality.

Nevertheless, Rony mentions that the government has now shifted its focus towards emphasizing quality transmission and distribution to minimize system losses. In light of this development, he proposes that the government extend support to local companies to reduce their dependence on imports. According to him, these local manufacturers have already established the capacity to manufacture cables meeting international standards.

It may be noted here that the government is still the major client of local manufacturers, particularly Bangladesh Rural Electrification Board (REB).

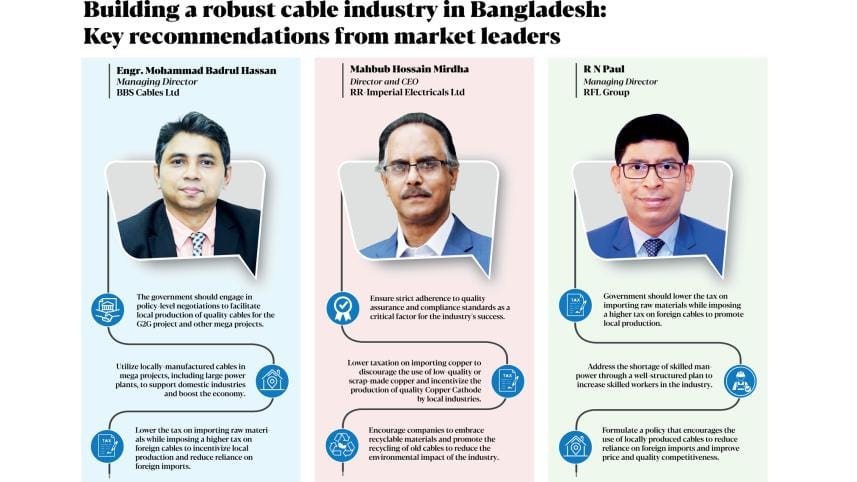

Local cable manufacturers heavily rely on raw material imports from countries like Chile, China, India, Oman, Malaysia, South Korea, and Singapore. Pointing to this fact, Mahbub Hossain Mirdha, Director, and CEO of RR-Imperial Electricals Ltd, suggests that if the government lowers taxation on importing copper, it will discourage the use of low-quality or scrap-made copper and incentivize the production of high-quality Copper Cathode by local industries.

The local producers have also urged the government to impose higher taxes on foreign cables to incentivize local production and reduce reliance on foreign imports. Additionally, they have requested the government to engage in policy-level negotiations with foreign donors to facilitate local production of quality cables for the G2G project and other mega projects.

The Bangladesh cable industry's journey has been marked by steady growth, spurred on by technological advancements, government initiatives, and increased investments. As the demand for telecommunications, data services, and power supply continues to rise, the industry has embraced opportunities to diversify its offerings. Local manufacturers have demonstrated their capacity to meet domestic demands and even export quality products. With a focus on research and development, along with government support, the future of Bangladesh's cable industry appears very promising.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments