Financial inclusion: Banking going beyond banks

Despite a lot of loud discussions regarding financial inclusion, a large number of people in Bangladesh are far from being granted access to basic financial services, making financial inclusion development an essential project in the country. Women, marginal farmers and informal sector enterprises are affected the most in this case. Studies argue that supply-side initiatives must be accompanied by financial literacy to attain the main objectives of financial inclusivity.

According to the World Bank, "Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs—transactions, payments, savings, credit and insurance—delivered in a responsible and sustainable way." However, less inclusive financial systems lead to income inequality and slower economic growth. Therefore, financial inclusion is crucial for a country's economy and in enhancing welfare and ensuring consumption levelling amongst underprivileged people.

Bangladesh Bank and the government have been extensively trying to expand financial services for disadvantaged groups for the past few years, but it has been challenging to implement. This is due to low literacy amongst rural dwellers, large population and high-interest rates.

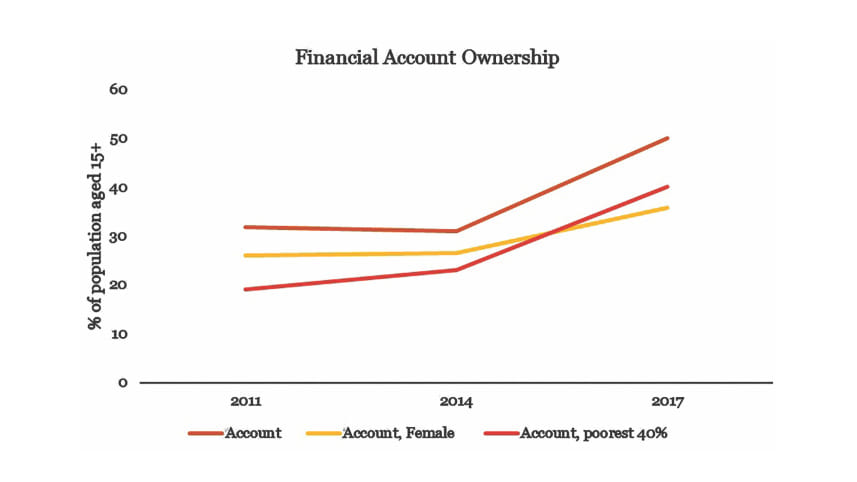

From the first graph, we observe a notable increase of financial account ownership, jumping from 31.74 percent in 2011 to 50.05 percent in 2017. Financial accounts may be a bank account, Microfinance Institution (MFI) membership or Mobile Finance Services (MFS) account (World Bank Group, 2018). Out of the total financial inclusion figure, 25 percent are through banks, 23 percent through Non-Bank Financial Institutions (NBFI's), and an impressive 17 percent through mobile money (Bangladesh Bank, 2019).

Agent banking

Commercial banks operate agent banking systems. This system offers a limited scale of financial services through engaged agents in rural areas. It allows the disbursement of inward foreign remittance, collection of cash deposits and withdrawals, utility bill payments, loan disbursement and more.

Bangladesh Bank recently reported that, although, Tk 5,248 crores worth of savings have been collected through agent banking in Bangladesh in the past year, only about Tk 237 crores have been disbursed in the form of loans. That is only 4.48 percent of the total amount. Moreover, as of June 2019, out of the total amount of bank loans, only 10 percent have been given about in rural areas. This failure to comprise the rural population into the financial system indicates a foremost loophole in the system which may be solved through the wide-scale advent of fintech.

Non-traditional banking

The introduction of microfinance programmes in rural Bangladesh led to the initial jump to a financially inclusive economy. Millions of people, especially rural dwellers, were granted access to credit, saving schemes and more.

Afterwards, the development of Financial Technology (FinTech) in Bangladesh contributed towards the project of achieving a financially inclusive economy further. FinTech is an evolving global sector which utilises technology to revamp financial services for both consumers and businesses, resulting in a remarkable influence on economic activities. It offers innovative platforms for savings and borrowings such as agent banking. This takes out the bank branches out of the equation. Bangladesh Bank believes these activities may help alleviate liquidity and credit risks and, therefore, improve financial stability.

Mobile Financial Services (MFS)

Digital Finance Services (DFS), a FinTech platform, allows individuals and businesses to have more hold over their personal finances and make timely decisions and transactions. This platform consists of a range of financial services which are accessed through digital channels like payments, savings, credit, insurance and remittances. Moreover, DFS also includes Mobile Financial Services (MFS). Using technology in business is one of the four core elements of the government's "Digital Bangladesh" vision. Since this was implemented, MFS has had the most significant improvement in years.

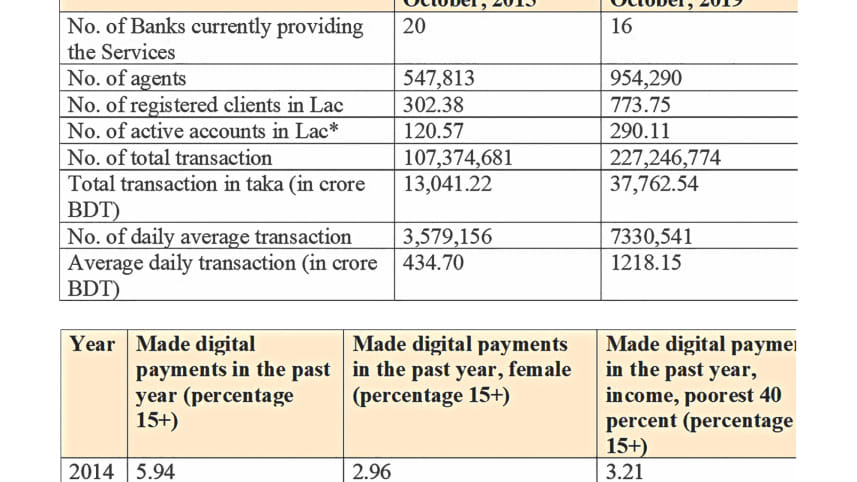

The table reflects the impressive leap in digital payments through the MFS industry from 2014 to 2017. With only the requirement of a national ID and mobile phone number, MFS allowed millions, who were financially excluded prior to this injection, to send and receive payments easily. bKash, Rocket and Nexus Pay are the top players of the current MFS industry.

The second table shows some key figure comparisons of the total MFS industry in Bangladesh of 2015 and 2019. The number of daily average transactions increased by 104.81 percent and a whopping 189.6 percent in total transaction value in the past 4 years.

Banking applications

With the launch of the smartphone apps by the industry players, many new features were introduced. Through the app, one can now instantly send money without having to visit a brick-and-mortar establishment. Moreover, people can now pay their utility bills, make merchant payments, recharge their phones and carry out other fundamental activities. The convenience gained through the usage of MFS has encouraged more people to utilise these services instead of relying on traditional banking services.

However, commercial banks have focused on digitising their services as well. People have benefitted greatly through banking apps and chat bots, launched in the recent years. Visiting bank branches for minor banking operations is no longer necessary as apps have a wide range of services to offer and chatbots which can automatically solve a client's frequently asked questions. Although, according to a Bangladesh Bank report, there are currently over 10,000 branches spread across the country. The high concentration of bank branches is deemed unnecessary and closure would greatly reduce the bank's costs given the high real estate costs in the country.

Unlike few other similar or developing countries, payment apps like Google Pay, Apple Pay and some more have not been launched in Bangladesh primarily due to the unavailability of contactless card machines. Moreover, these apps would not likely aid financial inclusion in the country as they require a formal bank card for payments. According to World Bank data, only 0.2 percent of the population own a credit card as of 2017. Instead, bKash, Rocket and many more applications can easily be used for payment through bar code and do not require an individual to possess a bank account.

Security concerns

Cyber security and operational risks are some major concerns of Bangladesh Bank stemming from fintech. Increased velocity may cause an increase in money supply. This results from the increasing usage of fintech such as ATMs and point of sales (POS) machines. This widespread use of fintech through credit cards for purchasing foreign products risk leakage of foreign currency from the country. Moreover, effortlessly accessible fintech solutions is likely to provoke transactions past legal boundaries like the practice of hundi. However, possible susceptibility of fintech on financial stability may convey essentially through a payment system mechanism.

The way forward

Financial inclusion in Bangladesh has significantly improved with the introduction of various non-traditional and mobile banking systems. This digital age demands uncomplicated access, convenience, efficiency and speed which have shaped a significant and massive market for the FinTech industry. MFS companies in Bangladesh may seek inspiration from others such as Ali Pay in China, M PESA in Africa, Paytm in India or as such few others to further innovate their services.

Just recently, in December 2019, the ICT Division and Bangladesh Bank signed a Memorandum of Understanding (MoU) with the objective to device an "Interoperable Digital Transaction Platform (IDTP)". Financial transactions, transfers, e-commerce, M-commerce, bill payment, merchant payments, remittance exchanges, machine-to-machine payments and other financial services can then be made by fin-tech organisations through this platform.

Successful implementation of the IDTP alongside further development and innovation in the current mobile financial services is essential in the upcoming years. This will help ensure financial inclusion, create a cashless society and impede financial fraud, terrorism financing, money laundering and various other economic crimes.

It would be also interesting to see how our banks and financial institutions are aligning themselves with newer technologies and the innovation industry at large. It is apparent that banks need to reorient themselves to the fast-shifting dynamics of the industry. This might inevitably entail looking beyond the traditional banking model to satisfy different markets and a new clientele.

Mamun Rashid is a partner at PwC Bangladesh. The views expressed in this article are his own.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments