A trailblazer in banking

Dutch-Bangla Bank has become a pioneer in introducing both digital banking means and financial inclusion programmes in order to cater financial services to both tech-savvy youths and underprivileged people.

The bank has never sought instant profit from its banking businesses, rather it had given efforts to the untapped arenas in advances to attract commoners to the banking system, Abul Kashem Md Shirin, managing director of DBBL, told The Daily Star in an interview recently.

Dutch-Bangla was the first among local banks to introduce automated teller machine (ATM) service in Bangladesh in 2004.

The lender has built the largest ATM network, setting up around 5,000 units from rural to urban areas.

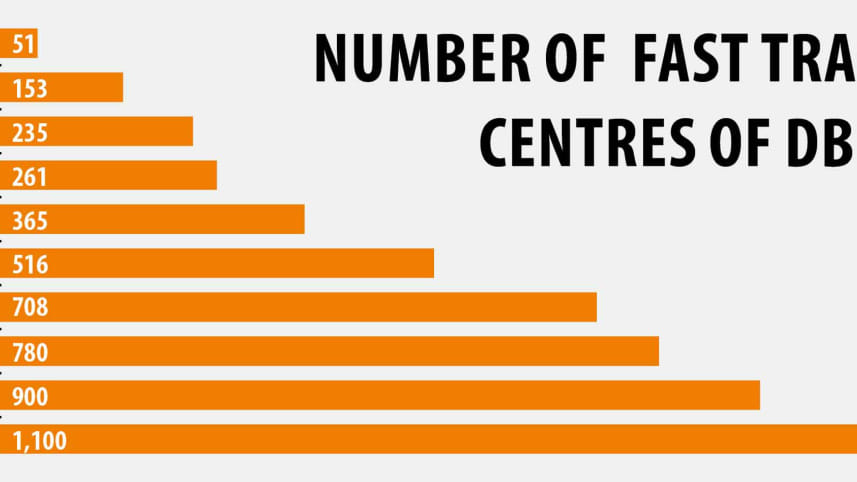

Fast track, which is comprised of a bunch of ATMs, has been set up by DBBL in every upazila, giving a boost to the country's financial inclusion.

The fast track offers clients the opportunity to withdraw and deposit money, open new account, collect bank statement and secure many other financial facilities.

DBBL is also the pioneer in rolling out debit card in 2004.

The lender has so far provided nearly 80 lakh debit cards, becoming the largest card issuer among local banks.

EMV chip-based debit card was also issued by the lender for the first time in the country in 2008.

EMV chip technology is the latest global standard for card payments in order to secure the clients' information.

EMV is an acronym for Europay, Mastercard and Visa, who developed this technology.

The lender is also a pioneer in introducing e-commerce in 2010 among banks when the digital platform was largely absent in the country.

Initially, it invested Tk 12 crore to roll out the service, but now it is earning huge return from the business.

In the arena of mobile financial services, the lender is also a torchbearer by embracing the branchless and digital banking model in 2011.

A tremendous success has been bagged by the lender in the field of agent banking as well.

DBBL, which started the digital banking operation two and a half years ago, is the second lender among banks to start the live operation of banking module.

The bank has already set up 4,500 agent outlets, the highest in terms of volume of the shops among the lenders that have had the digital banking window.

Clients now settle financial transaction to the tune of Tk 400 crore per day through agent banking of DBBL.

The majority of outlets have been set up in the remotest part of the country such that the unbanked people get financial services in an easy manner.

The bank rolled out NexusPay – a mobile application – two years ago and 36 lakh clients have already embraced the digital mean.

Clients have so far opened 3 crore accounts with the bank riding on its financial inclusion programmes and digital banking services.

The lender, which commenced its banking operation in 1996, now manages a large number of accounts by way of using the automated banking tools.

The tremendous success in different banking operations achieved by the bank helped it bag the DHL-The Daily Star Bangladesh Business Awards in 2019 in the category of the best financial institution.

The lender also got the same award in 2006 due to its immense effort to materialise automation process in its banking operation.

Shirin said that DBBL has recently rolled out a number of banking programmes, which are not considered as profitable ventures at this moment.

DBBL clients, who are using NexusPay, are now allowed to use fast-track lanes of five bridges by way of giving toll digitally.

Only DBBL among banks now provides such service to its clients and it will also try to add other bridges in phases.

The bank is now trying to ink agreements with the owners of petrol pumps such that drivers can refill fuel tank on their own responsibility by way of swiping debit or credit card.

DBBL has already started a pilot project with a petrol pump in Dhaka city in order to popularize the services.

"But owners of petrol pumps are showing reluctance to adopt the automated service. But, all pumps will have to accept the digital means if they want their businesses to survive in the days to come," Shirin said.

The lender will also operate the ticketing system of Dhaka Metro Rail project.

Commuters will have to collect a prepaid card from the bank to use the rail.

They will recharge the card for the purpose of travelling from one spot to another by metro rail.

DBBL's outstanding performance in the digital banking arena helped it win the tender to cater the service.

Shirin thinks the bank has gone forward a lot since 2006 when it achieved the DHL-The Daily Bangladesh Business Awards.

The number of branches stood at 195 at the end of last year in contrast to 30 in 2006.

But, the bank now no plans to expand its branch banking, rather it has adopted branchless banking by way of introducing diversified digital banking model.

As much as 80 per cent of deposits were mobilised by the bank in the form of fixed deposit receipts in 2006 and the rest was kept in the current account and savings account (CASA).

But, the structure of the deposits at the bank is now completely reversed, meaning that its cost of fund has decreased to a large extent.

A CASA account pays no interest—or, in some cases, low interest—on the current account and an above-average return on the savings portion.

Based on its extraordinary financial services, the bank now sees returns on those initiatives.

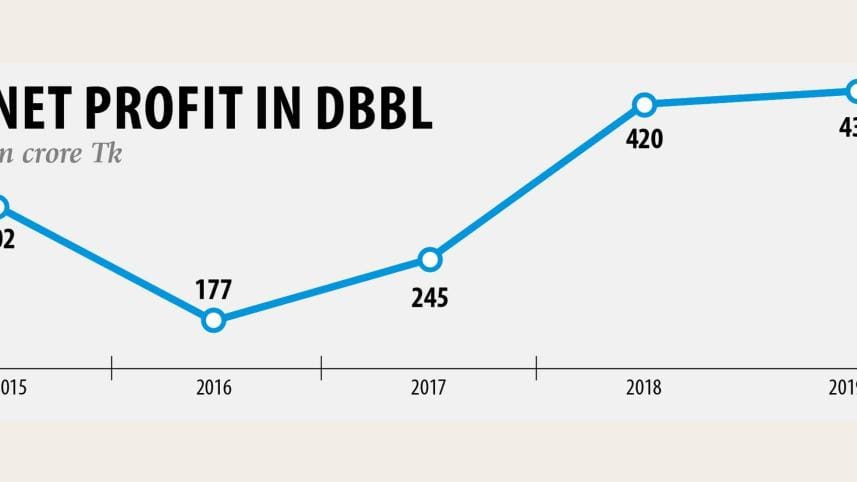

The bank's net profit stood at Tk 434 crore in 2019, up from Tk 420 crore the year before.

The bank has recruited 10,000 employees to operate its banking operation.

In addition, it has appointed more than 10,000 employees through the third party.

This means the bank has a total of 20,000 employees, which is one of the largest human resource volumes among lenders.

The lender has also been giving emphasis to corporate social responsibility programme for years.

It has so far donated Tk 900 crore, which is the highest amount given by a company in the private sector.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments