Pandemic induced accelerated adoption to stay, or revert?

The onset of the Coronavirus pandemic at the beginning of the year 2020 has affected human civilisation like no other since the Spanish Flu pandemic exactly a hundred years ago. Global trade ground to a halt, global travel all seized up, all places of public gathering closed for extended periods of time, small merchants and wage workers bore the brunt of living without any earnings and older people filled up hospitals and mortuaries faster than the system could handle.

In such a scenario of pan-global gloom and doom, one ray of hope has been the constant connectedness afforded by the internet—a crisscross web of digital networks enveloping the whole world. Despite restrictions on physical movements, proximity to others and in-person interactions, the world did not collapse into cocoons of isolation because we had the internet.

Remote work, online meetings and online ordering enabled by the internet and a slew of apps together with AI-enabled routing for deliveries of food, medicine and personal effects at home kept the world chugging along through thousands of miles of cold plastic fibres frenetically moving digitals bits of information in a cyber-world seemingly unaffected by the agony and fear of an unseen microbe terrorising human habitations on every continent far and wide.

The setting and the findings

Bangladesh is a developing country in South Asia. With 164 million populating a small landmass measuring 147,000 square kilometres, Bangladesh has the dubious distinction of being the most densely populated country in the world aside from city states such as Singapore or the Vatican. In Bangladesh e-commerce footprint is still very low given that the internet penetration until last year has languished below 25 percent. E-commerce, however, has been growing very fast in the country.

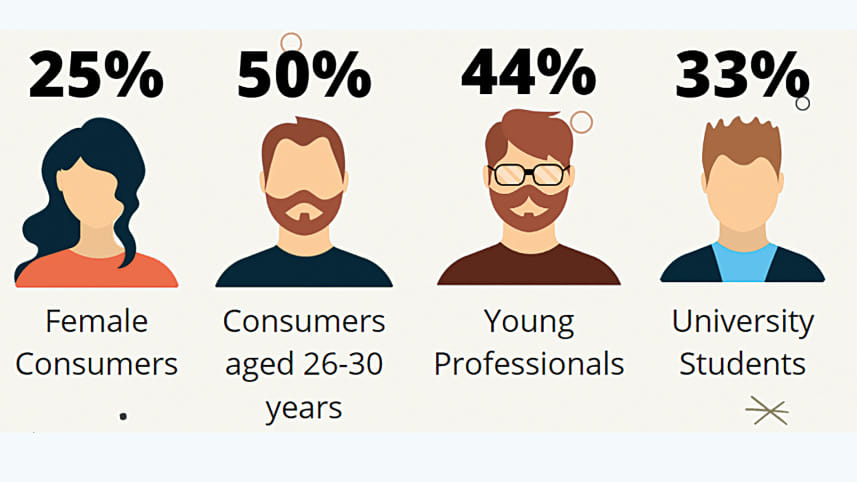

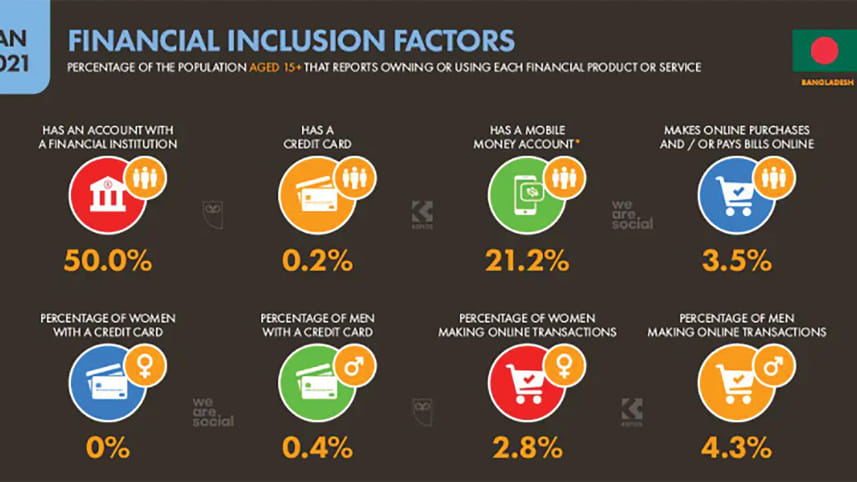

Let us look at some indicators that throw light on financial inclusion, customer demographic and online payments that provide a glimpse into the overall financial and trading ecosystem. The financial inclusion indicators in Bangladesh are shown in Table 1.

The customer demographic in Table 2 shows that majority of consumers are below the age of 30 and this young slice of the population is becoming increasingly net savvy which is driving the boost in digital lifestyle.

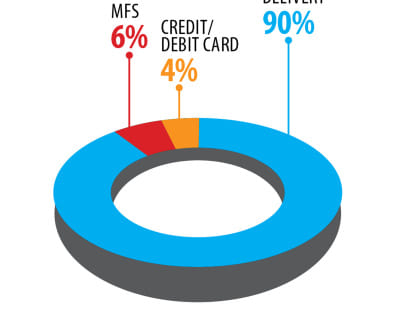

The online payments scenario in this developing economy, shown in Table 3, is largely dominated by Cash on Delivery (COD) which accounts for nine-tenths of all online trade. This can be ascribed to a number of factors including low card penetration and lack of trust in online merchants. However, the young demographic can be enticed into making payments using mobile financial services (MFS) and credit/debit cards when given steep discounts as has been seen in a spate of recent online scams.

Digital order fulfilment scenario in Bangladesh

The rapid rise in online order fulfilment necessitated by high double-digit growth in the last 10 years has created more than 50,000 jobs for people engaged in delivery services alone.

From a tiny volume a decade ago, the e-commerce market in Bangladesh has grown to more than 20,000 orders a day which are distributed and conveyed to all parts of the country.

On March 23, 2020 Bangladesh government announced a general lockdown throughout the country to arrest the transmission of the coronavirus and the lockdown continued till July 2020. General lockdowns have been imposed for shorter durations two more times since then—in October 2020 and April 2021, as the coronavirus reared its ugly head time and time again through several known mutations. The continuing and unprecedented pandemic heaped many new challenges on the struggling economy of Bangladesh. Except for essential services providers most offices, factories, restaurants, hotels, shops, malls, public transportation, air-rail-river-road links came to a standstill. The government had to bail out many factory-workers, economically marginalised wage-laborers and small shop owners to keep the economy afloat.

However, the lockdowns and near-lockdowns brought on by the pandemic sparked a boom in e-commerce transactions for essential daily necessities. Aside from the formal e-commerce market there has been a huge surge in informal online entrepreneurs selling products on Facebook that number over half a million today. Online transactions have grown by 50 percent from month to month during this period. The f-commerce market has seen double digit growth according to a report in the Financial Express. The government projects half a million new jobs related to e-commerce in the next five years.

According to e-CAB (e-Commerce Association of Bangladesh) vice president Sahab Uddin, the e-commerce market nearly doubled during the pandemic to Tk 160 billion (USD 1.86 billion).

Internet penetration

Bangladesh has been experiencing rapid rise in internet penetration even before the pandemic primarily due to increased accessibility and lowered cost of services. However, in the wake of the pandemic, internet penetration saw a further boost. According to data from Bangladesh Telecom Regulatory Commission (BTRC), the number of internet subscribers in the country in 2020 was nearly a hundred million, most of them accessing the internet through mobile devices while the number of broadband (ISP) subscribers was 5.74 million. As of June 2020, even though mobile internet subscribers rose only 0.2 percent, ISP subscriber growth was an impressive 49.24 percent. By August 2021 as pandemic restrictions eased, the total internet subscribers rose to 125.46 million, a massive 20 percent growth from the figures before the pandemic. This growth is especially significant as internet service is the sine qua non of accessing online platforms.

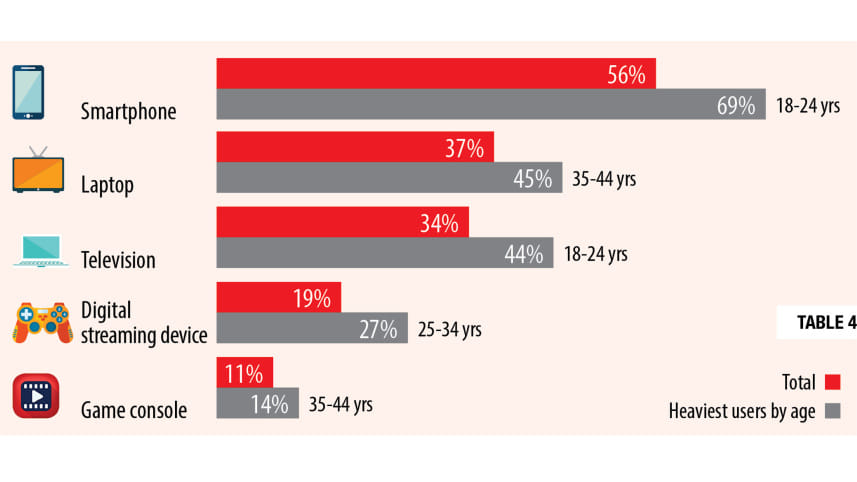

Continued surge in the use of smartphones among the youth

Smartphones are a key enabler of digital lifestyle. It is heartening to see from various studies that more than half of all users have switched to smartphones but more than two-thirds of the youth have made the switch already. As these youths age the overall usage of smartphones will become mainstream facilitating digital lifestyles on a massive scale.

Mobile financial services (MFS)

Adoption of MFS services during the pandemic has been a recurring theme. Social distancing mandates have forced individuals and businesses to contemplate alternative ways of financial transactions. For example, in January 2020, the total transaction volume was Tk 406 billion before Covid-19 overwhelmed the country. As the coronavirus crisis unfolded, the MFS transaction volume steadily grew and by July the transaction volume recorded 150 percent growth at nearly Tk 630 billion. Online merchant payments as of May 2020 was Tk 2.33 billion which more than quadrupled in July 2020 at Tk 11.34 billion. These trends indicate staggering adoption of MFS services and e-commerce transactions according to data from Bangladesh Bank.

Telehealth services

These services have seen accelerated adoption during the pandemic. Research by Rahman and Amit (2020) suggested that increased use of telehealth services was a direct outcome of the pandemic. The research also suggested a correlation between technical literacy and adoption of telehealth services with a clear bias towards the educated young demographic of 16-25 years. The increased traction in this sector has attracted investments as well. According to LightCastle (2020) telehealth is third, after ride-sharing/logistics and fintech, most-preferred sector for venture investment. Maya, a women's health startup, has raised USD 180,000, while Praava, an online medical testing startup, has raised USD 10.6 million in funding in recent times.

Digital services in education

Ed-tech and video conferencing are two of the most common services used in the education sector. As schools were closed for social distancing mandates, educators often resorted to video conferencing to finish the curricula in time. People, being stuck at home, had a considerable amount of time in their hands and focused on skill development, and that's where the ed-tech platforms came in. These platforms were quite popular among students as well. However, according to research by Khan, Rahman, and Islam (2021), digital education was not perceived to be as effective as its physical counterpart. However, online education was perceived to be successful by more than half of the survey participants, which not only indicates increased adoption of this technology but also its acceptability among the masses. This has raised optimism for a boom in Ed tech as is borne out in a study by Mukit (2020) who valued the Bangladesh edtech market at nearly USD 729 million by 2025. Another research by Zubairi et al (2021) points to concern over digital divide in public universities as almost 30 percent of students from rural and disadvantaged backgrounds were found not to have the means to attend online classes.

Online meetings and collaboration

One amazing outcome of the pandemic has been the discovery that public services can remain available with little impediment even when the physical offices remain closed or inaccessible. Even in a developing country like Bangladesh all essential services were available during the worst of the pandemic through online platforms. Most citizen services are today handled through online portals mobilised through the "Digital Bangladesh" drive of the government since 2009. Such online services garnered huge traction during the pandemic and once people become used to the convenience and efficiency of such online platforms, they are sticking with it even when the pandemic restrictions are lifted.

The government offices, international development agencies and private enterprises alike carried on their day-to-day business virtually without interruptions even during lockdowns which has been a great boon for online meetings and collaborations which are found to be much more convenient and effective than attending in-person meetings that require driving through interminable traffic jams or straggling through endless pandemic formalities at airports to travel abroad.

Even remote work, something scoffed at only a couple of years ago, is finding a lot of adherents both in public and private sectors. The trend of combining physical office attendance with remote work from home or elsewhere is gaining such traction that work environments are never going to go back to the pre-pandemic conditions ever again.

Stickiness of digital lifestyle changes

The digital lifestyle changes brought on by the lockdowns have largely stayed with us even after the lifting of lockdowns. In a report by digital identity provider ForgeRock based on a study of consumers in four economies with high e-commerce adoption rates, it was found that the pandemic has shifted the trajectory of daily life for all, creating new societal norms of remote living, socially-distanced activities and updated hygiene standards. Their report titled "The New Normal—Living Life Online," investigated how consumer behaviours are adapting in response to Covid-19. The study of 5,000 consumers from the United States, United Kingdom, Germany, Australia and Singapore discovered how people's routines, experiences and preferences have changed as a result of Covid-19 and how they plan to continue to engage with the world digitally in a post-pandemic future.

In Bangladesh also, the extraordinary growth in e-commerce, f-commerce, online payments and online order fulfilment in the last year attest to a similar pattern and e-CAB is confident that the behavioural changes will stay with us. After lifting of Covid-19 restrictions, even though e-commerce growth is not as fantastic, the overall demand for e-commerce has not reverted to pre-pandemic days. Rather, according to the same interview by e-CAB vice president the market has matured and would venture into new territories like overseas e-commerce.

Digital services like MFS which grew at a healthy rate during the pandemic restrictions have seen a slight dip after easing of movement restrictions. For example, average monthly growth in total transaction amounts for April to July 2021 was 5.82 percent. This growth stagnated in the later months while August recorded a 6.3 percent decrease. Merchant payments recorded an average growth of 32 percent in the months of February-April but slowly withered in the later months while June-August period recorded a slight negative growth. This data shows that there have been some behavioural corrections in digital lifestyles but the stickiness of pre-pandemic lifestyle was not strong enough to negate the changes overall.

Conclusion

The findings in this study show that the pandemic induced moderate to rapid rise in the adoption of various online platforms, making an indelible impact on the lifestyle of people in a developing country. Such digital lifestyles cut across all sections of the population but the tech-savvy segment—the youth and middle-to-upper-income families—made better progress in this regard.

It is also evident that smartphones are becoming as ubiquitous and commonplace as a feature phone of early mobile generation while internet access is becoming as cheap and universal as dial tones of land-line era.

The data bears out that such digital lifestyle changes are here to stay and get further entrenched in the lives of the people across all generations and income levels, despite some challenges of digital literacy and accessibility.

Habibullah N Karim is an IT entrepreneur, investor and author;

Mobashwira Urmi is a final year CSE student at BUET;

Fahmid Shahriar is a final year BBA student at IBA, University of Dhaka.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments