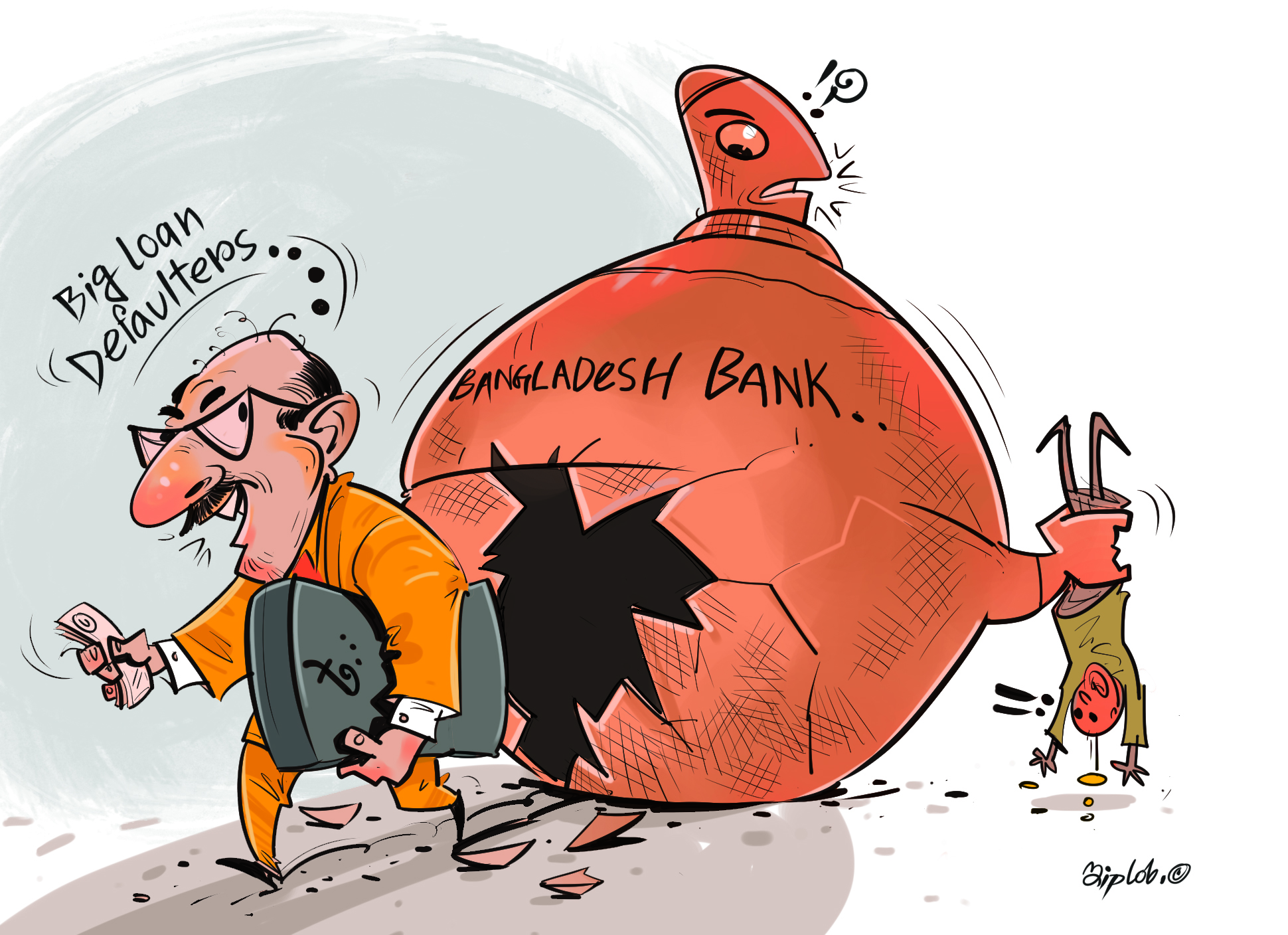

Same rules should apply to all debtors

This week, when the High Court blasted the Anti-Corruption Commission (ACC) for failing to take effective measures against big loan defaulters, one of the issues it flagged was that the commission is too busy catching small-time loan defaulters while letting major defaulters go free. We applaud the court for expressing concerns that mirror those of the ordinary citizens. The contrast between the plight of small debtors and defaulters and the exemptions enjoyed by big defaulters is one that has been discussed frequently. Most recently, it came into renewed focus after two developments connecting the two groups.

In one, we came to know about a PK Halder-style scam in which Tk 9,500 crore was allegedly embezzled from three Islamic banking institutions by business entities using fake addresses/identities. In the second development, we came to know about the fate of 12 farmers who were arrested after warrants were issued against 37 of them, who each took loans ranging from Tk 30,000 to 40,000 in 2016. The total loan amount taken was Tk 15 lakh, of which Tk 2 lakh had not been repaid.

The prompt arrest of farmers for not being able to repay such a small amount, that too in relation to loans that they allege they were duped into accepting by a local UP member, seems absurd given that the ACC has failed to even submit a charge sheet in any of the cases related to the Basic Bank scam after seven years. In that scam, around Tk 4,500 crore was siphoned out of the bank between 2009 and 2013. The High Court rightly reprimanded the ACC for this failure as well as its inexplicable refusal to file a case against the bank's then chairman. The disparity between the treatments given to debtors from the most marginalised communities and debtors from influential quarters with known political connections could not be starker.

Yesterday, this daily also reported on how fishermen across coastal belts are falling into a spiralling debt trap due to inadequate support during the fishing ban period, and that the lack of a regulatory framework on labour rights has made them highly vulnerable to human rights abuse. Is it in any way just and fair that fishermen are failing to feed their families or farmers are being dragged to jail for a few thousand takas, while thousands of crores are leaving our banking sector without the authorities barely batting an eyelid? Why has the government normalised a state of affairs where there is one rule for the many, and one rule for the powerful few? As the HC augustly observed, does that mean the big loan defaulters are above the law?

If the government truly believes in the rule of law, then it is high time it implemented measures that bridge the gap between promises and actions that seems to characterise its so-called "zero tolerance" for corruption. The big defaulters are why the banking sector is in such turmoil today. And they must be brought to book on a priority basis.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments