RMG unrest will hurt exports and industrial output

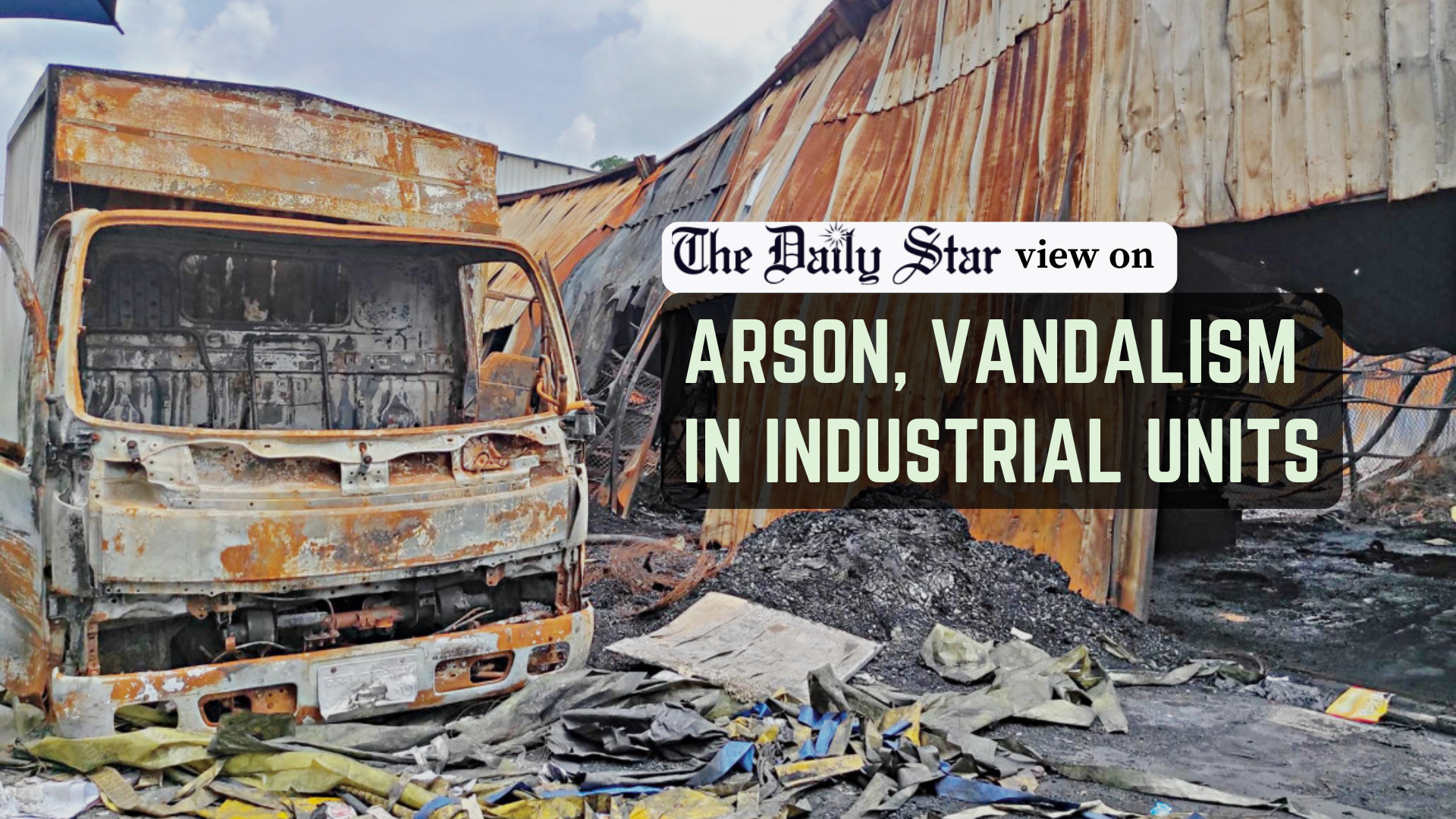

We are concerned about the outcome of recent disruptions in the ready-made garments (RMG) industry. This vital sector—which last year fetched an all-time high of about $47 billion from exports—could be in for a rude shock this year after being rocked by frequent protests, factory closures, and vandalism over the past month or so. This is already having an impact, with many international buyers who regularly visit Bangladesh to finalise work orders cancelling their trips, affecting their planning for upcoming seasons. Citing a representative of a major European buyer, a report by this daily even said that many requests for value-added garments have already been cancelled or postponed.

In an environment of uncertainty and insecurity, it is natural that buyers would have a Plan B for sourcing apparel from alternative destinations where they can safely place orders. As well as supply-chain disruptions, buyers also have to think about reputational risks arising from placing orders in restive countries. There is already a concern among some buyers that about 5 to 10 percent of their work orders placed in Bangladesh could be affected by the latest unrest and other hurdles. What this means for local producers is that they are having to deal with concerns not just about future orders but also the profitability of existing ones, as they may now have to provide discounts and expensive air shipments because of supply delays.

Ironically, the problems in Bangladesh have raised hopes for rival apparel suppliers, including India, who are expecting a boost in their work orders. Even though India's apparel exports remain significantly lower than Bangladesh's, the country's offer of various incentives and policy supports to its garment hubs and manufacturers contrasts the frequent challenges facing our manufacturers. This shows how our position as the world's second-largest garment exporter could be upended if we don't ensure stability and competitiveness fast enough. True, Bangladesh can still turn around. Its competitive pricing, improved safety and environmental compliance, and increased capacity for diversified products are still a potent mix. But to prevent the recent incidents of work orders being shifted elsewhere from becoming a trend, we must significantly improve safety, support our manufacturers, and remove all hurdles in the supply chain.

A lot has been said about the recent protests by workers. At a recent press conference, the IndustriALL Bangladesh Council, which represents 18 trader unions, blamed local youth gangs, garment waste traders, and unemployed individuals for instigating the demonstrations in Savar, Ashulia, and Gazipur. Going forward, we must approach these disruptions in a manner that both addresses the genuine grievances of workers—including delayed wage payments and unlawful dismissals—and persistent security issues. The interim government has reportedly set a 12.65 percent export growth target for this fiscal year, but without fixing the problems in our biggest export sector, such targets cannot be reached successfully.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments