PDB incurs record losses

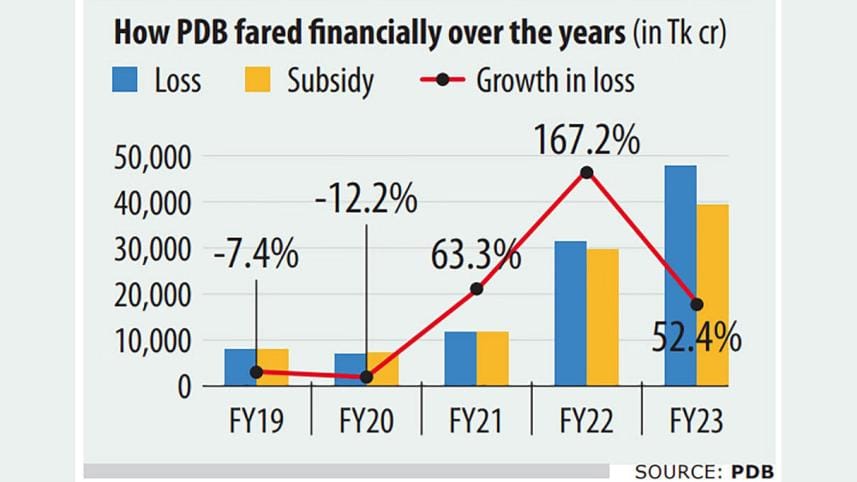

The Bangladesh Power Development Board's losses soared 52.4 percent to its highest level yet in fiscal 2022-23 -- a year that saw record subsidy and a 29.6 percent hike in the bulk electricity price.

Last fiscal year, the government agency under the ministry of power, energy and mineral resources logged a loss of Tk 47,788 crore mainly on the back of the depreciation of the taka, gas price hike and higher electricity import from India.

"None of these are reasons for the huge loss -- these are just symptoms of the faulty policy hinging on import-dependent fossil fuels," said Khondaker Golam Moazzem, research director for the Centre for Policy Dialogue.

In fiscal 2022-23, PDB's highest expense was on power purchases from independent power producers (Tk 59,022 crore), which increased 19.9 percent from fiscal 2021-22, according to its annual report.

This was followed by its own power generation (Tk 13,306.6 crore), which soared 66 percent from a year earlier, as its fuel cost more than doubled.

As much as 52.02 percent of the electricity generated last fiscal year came from gas, whose price was hiked 178 percent by the government in January.

PDB's power purchase from state-owned plants listed in the stock exchange cost Tk 10,788.25 crore last fiscal year, up 53.8 percent year-on-year.

Electricity imports from India between July last year and June this year cost Tk 9,223.4 crore, up by a staggering 97.4 percent from a year earlier.

About 10,515 gigawatt hours (GWh) of power came from India in the fiscal year and this includes 1,598 GWh from the Adani power plant, which began commissioning on April 4. In fiscal 2021-22, 7,644 GWh of electricity came from the neighbouring country.

About 2,987 GWh was purchased from quick rental power plants, which cost PDB Tk 3,743.9 crore.

Altogether, PDB spent Tk 96,084.9 crore for purchasing 88,450 GWh of electricity last fiscal year.

That electricity was sold to six distributors for Tk 50,858.25 crore.

PDB's average purchase cost last fiscal year was Tk 11.33 per KWh, up 28.2 percent from a year earlier. It sold electricity to distributors at the subsidised rate of Tk 6.70 per kWh after twice hiking the rate during the year.

The government furnished Tk 39,534 crore as subsidy last fiscal year, up 33.3 percent year-on-year.

"We have been telling the government since 2012 to get rid of the subsidy-based situation. If the same system continues, the losses will continue," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The main reason behind PDB racking up huge losses year after year is the government's weakness in negotiating contracts with the power producers.

"The power plants are making huge profits under these kinds of contracts and PDB is making losses. All those contracts need renegotiation," said Mansur, also a former economist of the International Monetary Fund.

Under the existing contracts, power producers get a certain fee even if they do not generate any power, in an arrangement that can be viewed as similar to the house rent that a tenant pays to the landlord every month as per the tenancy agreement regardless of whether they stay in the property or not.

This fee is called the capacity charge and it guarantees that the PDB will have the electricity from the power plants when the need arises.

While the annual report did not disclose the capacity charges paid to the power plants in fiscal 2022-23, Nasrul Hamid, the state minister for power, told the parliament in September that the government paid Tk 104,926 crore as capacity charges from 2009 to June this year.

Bangladesh's energy generation model, especially the one used to purchase power from independent power producers, is not only weakening the PDB but is also hurting the overall economy, according to Moazzem.

"In fact, one of the macroeconomic challenges we are facing at the moment is because of the import-dependent nature of the power and energy sector."

As the fossil fuel prices soared for the Ukraine war, so did Bangladesh's import bills, which gobbled up foreign currency reserves at an alarming rate.

"We have to come out of import-dependent fuels and go for cost-effective renewable energy."

Overcapacity is another big concern for the power sector, according to Moazzem.

The last fiscal year saw the addition of 3,149 MW of new generation capacity to take the total capacity to 24,911 MW. The highest electricity demand was on April 19: 15,648 MW.

As per the government's plan, reserve energy will exceed 50 percent by next year.

"This should be reduced," he said, while calling for reviewing the existing contracts with power plants, retiring old and inefficient plants and doing away with quick rentals. All contracts must have the no electricity, no pay clause added in.

He also called for while calling for scrapping the Quick Enhancement of Electricity and Energy Supply (Special Provision) Act 2010, also known as the indemnity law for the power sector.

"Because of the indemnity law, the power purchase agreements are not transparent and we are not able to get competitive pricing. Because of the indemnity law, PDB has to buy expensive power."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments