IMF to give $645m in fourth tranche

The International Monetary Fund will give Bangladesh $645 million in the fourth tranche under the $4.7 billion loan programme, taking the total disbursement to $2.31 billion.

However, no decision has been made yet on Bangladesh's request for additional funds under the existing programme, as the visiting IMF staff team concluded its third loan review yesterday.

After assuming office, the interim government verbally requested the IMF to provide $3 billion in fresh loans for replenishing foreign currency reserves.

The government ultimately sought $750 million, the IMF staff team said in a statement at the conclusion of its 16-day visit to Dhaka.

"Amid significant macroeconomic challenges, the authorities requested an augmentation of SDR 567.2 million (approximately $750 million) in IMF financial support to Bangladesh," said the IMF staff team led by Chris Papageorgiou.

The SDR (Special Drawing Rights) is an international reserve asset created by the IMF to supplement the official reserves of its member countries.

If the IMF executive board approves the request for additional funds, its total loan package for Bangladesh will reach $5.3 billion from the existing $4.7 billion.

The formation of an interim government has "fostered a gradual return" to economic normalcy in Bangladesh, the statement said.

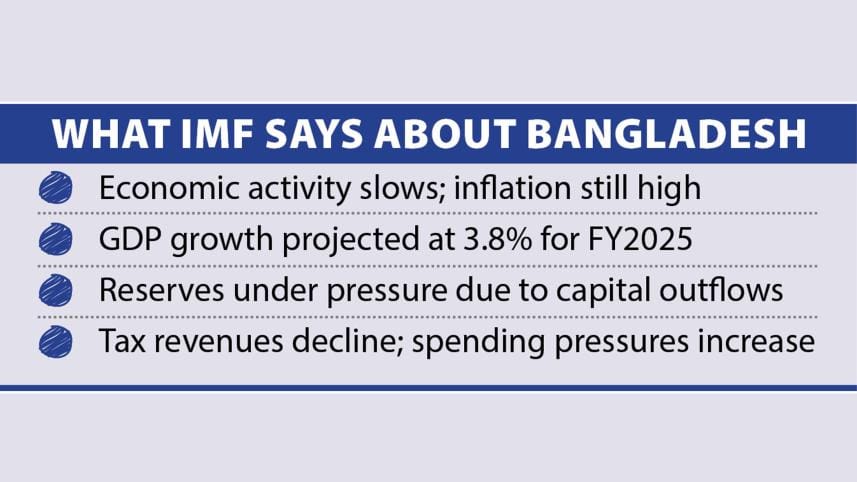

Economic activity in Bangladesh has slowed significantly and inflation remains elevated. Capital outflows, particularly from the banking sector, have put pressure on foreign exchange reserves.

Additionally, tax revenues have declined, while spending pressures have increased, it pointed out.

"These challenges are further exacerbated by stress in parts of the financial sector."

Real GDP growth is projected to slow to 3.8 percent in fiscal 2024-25 due to output losses caused by the public uprising, floods and tighter policies but is expected to rebound to 6.7 percent in fiscal 2025-26 as policies relax.

Inflation is anticipated to hover around 11 percent (annual average year-on-year) this fiscal year before declining to 5 percent next fiscal year, supported by tighter policies and easing supply pressures.

"However, the outlook remains highly uncertain, with risks skewed to the downside. To address the emerging external financing gap and persistently high inflation, near-term policy tightening is crucial."

Fiscal consolidation should prioritise the swift implementation of additional revenue measures, such as removing tax exemptions while restraining non-essential spending.

Coupled with monetary tightening, greater exchange rate flexibility and safeguarding foreign exchange reserve buffers will strengthen the economy's resilience to external shocks.

Bangladesh's low tax-to-GDP ratio calls for urgent tax reforms to establish a fairer, more transparent system, focusing on rationalising exemptions, improving compliance and separating tax policy from administration.

A comprehensive strategy is also needed to curb subsidy spending and address arrears in the electricity and fertiliser sectors, the statement said.

"Addressing vulnerabilities in the banking sector is essential."

Immediate priorities include accurately assessing defaulted loans, ensuring the effective implementation of existing regulations and formulating a roadmap for financial sector restructuring, it said.

Key actions involve conducting an asset quality review and adopting a recovery and resolution framework aligned with global standards.

Simultaneously, the authorities should advance risk-based supervision, while legal reforms are needed to strengthen corporate governance and regulatory frameworks.

"Institutional reforms to enhance the Bangladesh Bank's independence and governance will be critical for the successful implementation of financial sector reforms."

Enhancing governance, along with greater transparency, is critical to improving the investment climate, attracting foreign direct investment and diversifying exports beyond the garment sector, the statement said.

Furthermore, building resilience to climate change is vital to reduce macroeconomic and fiscal vulnerabilities.

Strengthening institutional capacity and optimising spending efficiency will aid in achieving climate goals.

The government should focus on implementing climate-sensitive fiscal reforms and investing in sustainable, resilient infrastructure.

Furthermore, robust management of climate-related risks will reinforce the stability of the financial sector, it added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments