Pvt banks given more benefits

In yet another compromise with directors of private commercial banks, the government yesterday decided to slash the cash reserve requirement or CRR of banks by one percentage point to 5.5 percent for their benefit.

The decision came just two months after the announcement of the monetary policy that advocates measures for reining in soaring private sector credit.

Many experts say the move goes against the monetary policy, and it may hurt the depositors' interest.

As per the existing rules, banks have to keep with Bangladesh Bank 6.5 percent of clients' deposits. Once the new system takes effect, they will need to keep with the BB 5.5 percent of the deposits. Around 90 percent of the banks' funds are depositors' money and the rest are directors' equity.

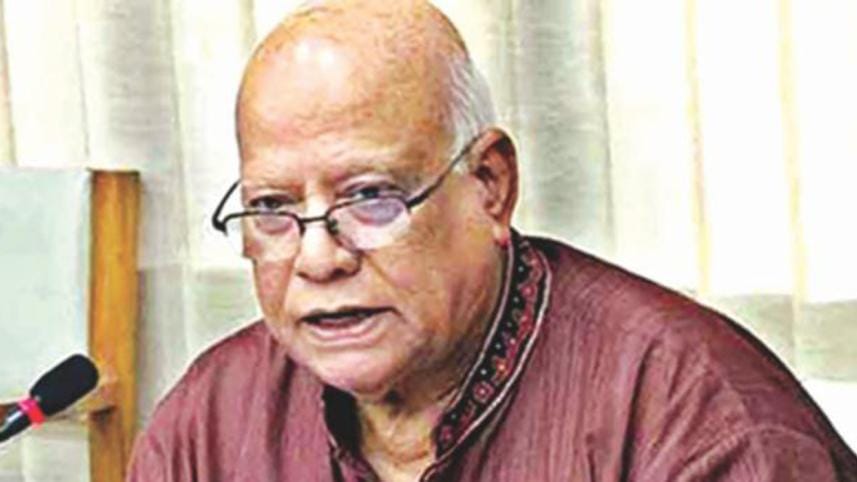

Justifying the decision to cut the CRR, Finance Minister AMA Muhith yesterday said this would help banks address their ongoing liquidity crisis within a short time.

“We have made the decision, considering the proposals of different quarters, including directors of private commercial banks,” he told reporters after a closed-door meeting with directors of various private banks at the capital's Pan Pacific Sonargaon Hotel.

BB Governor Fazle Kabir and Bangladesh Association of Banks Chairman Nazrul Islam Mazumder, among others, were present.

Earlier at a meeting with directors and managing directors of different banks on Friday, Muhith had agreed to double the government deposits for private banks to 50 percent.

In January this year, the government amended the banking law to allow private banks to have four directors from a family instead of two, a move many analysts believe will establish family control over operation of the banks.

All these benefits are being given to the banks without making any move to reform the ailing banking sector. And no visible step has been taken yet to punish the wilful loan defaulters.

At yesterday's briefing, Muhith said the responsibility of reducing the CRR lies with the BB as it is the regulator, and that he can only influence the BB to do so.

“Directors demanded slashing the CRR by 3 percentage points, but we decided to cut it by 1 percentage point.”

Muhith further said, “We will review the impacts of the CRR cut in June.” This review proposal came from Salman F Rahman, IFIC Bank chairman and private sector affairs adviser to Awami League President Sheikh Hasina.

“I think this is a very good suggestion. We will review it and see how it works. If we find that something further needs to be done, we will do that.”

Asked whether the CRR cut would fuel inflation, Muhith said it will not create any inflationary pressure.

“Impossible, [inflation] won't increase for sure,” the finance minister said.

Earlier at a programme yesterday morning, Muhith said directors of different banks had promised to bring down the interest rate to a single digit within a month.

Muhith made the comment referring to his Friday's meeting with directors of various banks.

When reporters at yesterday's briefing drew the BAB chairman's attention to Muhith's comment on lending rate, he said nobody could say for sure when it would come down to a single digit.

He said the CRR cut would help banks get an additional Tk 10,000 crore in investible funds, and it would mitigate the liquidity crunch.

“This is our money that we deposit with the central bank in the form of CRR. The fund cannot be invested, and it doesn't play any role in containing inflation. We also don't get any interest from the funds,” he said.

A private bank recently ran into trouble. This is just “an accident” but many state organisations withdrew deposits from other private banks, he mentioned.

“The lending rate has increased significantly in recent months. No businessman can run a business, paying interest at a rate of 14-15 percent.”

The state banks now have excess funds of over Tk 1 lakh crore, but they charge private banks more than 10 percent in interest on loans, Nazrul said.

“The finance minister has assured us that he will talk to the state banks about it,” he added.

Premier Bank Chairman HBM Iqbal, Standard Bank Chairman Kazi Akram Uddin Ahmed, Chairman of the Association of Bankers Bangladesh Syed Mahbubur Rahman, and Mutual Trust Bank Managing Director Anis Khan were present at yesterday's meeting.

A number of economists and experts have criticised the decision to slash the CRR, saying this is an unprecedented move as the BB has never set the CRR upon discussions with directors of banks and the finance ministry.

The decision will have an adverse impact on the depositors' interest and also fuel inflation. The banks may go for an aggressive lending policy which will subsequently push up defaulted loans, they believe.

Salehuddin Ahmed, ex-governor of the BB, said the finance minister's announcement about the CRR cut was illogical as the BB is the sole authority for restructuring the CRR.

The BB announced a tightened monetary policy two months ago with a view to containing inflation, he said.

“Now the banks may adopt an aggressive lending policy because of the latest move that may also increase defaulted loans further.”

The depositors' interest will be at stake as the clients' obligatory demand is fulfilled by taking funds from the CRR when a bank faces crisis, he added.

Zahid Hussain, lead economist at the World Bank's Dhaka office, said most analysts agree that the underlying cause of liquidity crisis is deficit in corporate governance in these banks, particularly in the areas of loan risk management and collection of non-performing loans.

“Banks who have done badly in these areas are the ones having the most difficulty in complying with the CRR. The CRR reduction will help them avoid the penalties for non-compliance, but it does little to incentivise improvements in corporate governance”.

Khondkar Ibrahim Khaled, ex-deputy governor of the BB, said it was an exception that the CRR was cut following pressure from directors of private banks and businesspeople.

It's not possible for the BB governor to reset the CRR freely if the finance minister intervenes in decision-making, he said.

“If this trend continues, the very existence of the central bank will be at stake.”

He opposed the decision to slash the CRR, and said if it is done, a large amount of funds might be diverted to fictitious firms.

The banking sector will face a risky situation as the CRR cut will harm the depositors' interest, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments