Rewarding yet relentless: The Chartered Accountancy journey in Bangladesh

Chartered Accountancy is one of the most prestigious and demanding qualifications in Bangladesh. This is due to the vital role played by Chartered Accountants (CAs) in auditing, taxation, and advising businesses, thus, contributing to the financial strength and transparency of both organisations and the wider economy.

Contrary to popular belief, CAs are not just employed in Chartered Accountancy firms. Multi-national corporations (MNCs), non-profit organisations, retail chains, and many other organisations also need CAs to run their operations – especially the financial side of things – smoothly.

Yet, despite the rising demand, the number of qualified CAs in Bangladesh remains far too low.

A shortage of qualified CAs

According to the Institute of Chartered Accountants of Bangladesh (ICAB), the country needs 10,000 to 12,000 qualified professionals to meet the demands of its expanding economy. However, despite the growing demand, Bangladesh only has 1,967 CAs qualified by ICAB — the regulatory body that provides the professional qualification and sets the standards for chartered accountancy in the country — since the Liberation War. This is despite the fact that a CA qualification is open to students from all academic backgrounds and not just Accounting and Finance, as many might assume. In fact, there are many routes one can traverse if they are looking to pursue a career as a CA.

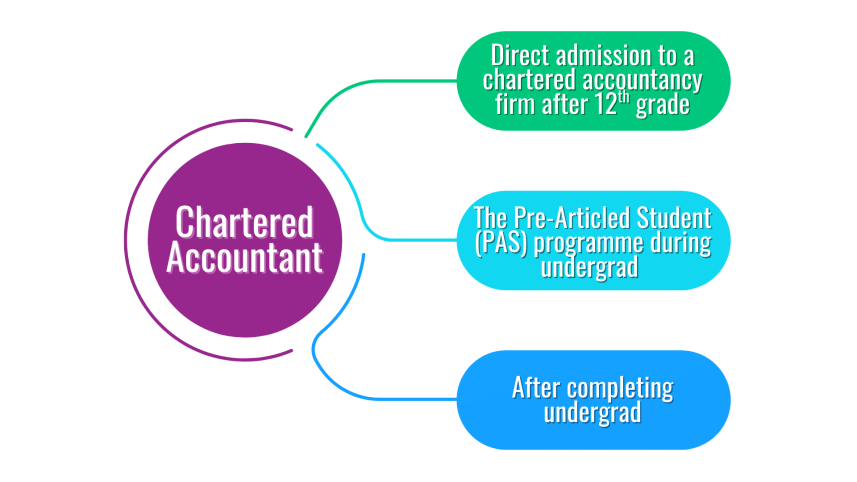

Pathways to becoming a CA

Currently, there are three popular routes to becoming a Chartered Accountant. Some, like Ahmed Zabir, Associate Chartered Accountant (ACA), directly get admitted to a registered Chartered Accountancy firm right after HSC or A level.

According to Zabir, a lot of the materials covered in the Certificate Level ICAB Manual overlapped with his A level Accounting coursework. Hence, pursuing Chartered Accountancy right after A levels seemed the smartest and most feasible career pathway for him. According to Zabir, who is one of the youngest Chartered Accountants in Bangladesh, securing a decent, high-paying job can be quite difficult even after pursuing BBA and MBA degrees.

Zabir said, "The career projection in this profession is very fast. Qualified professionals often enjoy a six-digit starting salary. There aren't many jobs in Bangladesh that pay as much, that too at the initial stage."

Anwar Hossain, Fellow Chartered Accountant (FCA), a CA who also pursued this pathway after completing his 12th grade, said, "The financial rewards and prestige associated with this profession are well known by now. ICAB regularly organises training programmes and has signed MOUs (Memorandum of understanding) with Chartered Accountancy and Certified Public Accountancy (CPA) institutes in developed countries, enabling Bangladeshi CAs to work abroad through skilled staff programmes. In recent years, many chartered accountants have moved to first-world countries, and ICAB has played a vital role in shaping them into the well-rounded professionals they are today."

After completing HSC or equivalent exams, students can join ICAB if they have a minimum aggregated GPA of 8.0 (for SSC and HSC) or an equivalent O/A level score. They then apply to ICAB-registered CA firms to begin a four-year articleship, starting with a probation period. During the articleship, students gain practical experience in auditing, taxation, and financial reporting while studying for ICAB's three exam levels: Certificate, Professional, and Advanced.

However, those who directly pursue Chartered Accountancy after 12th grade miss out on the experiences of university life, and the transition from a classroom to an office directly can feel quite gloomy.

"It's almost as if I transitioned into a grown adult overnight," said Zabir. "From going to coaching centres for tuition, hanging out with my friends, and stressing over quizzes, I was suddenly expected to chase after deadlines, attend meetings, engage in on-the-job learning, and negotiate with clients. I felt like I completely skipped a chapter of my life. Most of my batch mates from school are in university now, and I just can't relate to them at all. It feels as if we are on completely different timelines."

To make it easier to pursue Chartered Accountancy for students who don't want to sacrifice having a university life, the Pre-Articled Student (PAS) programme was introduced by ICAB in September 2021. The PAS programme allows students to register with ICAB and start studying for the Certificate Level exams while still in university, appear for Certificate Level exams without being registered with a CA firm, and receive academic exemptions and recognition for completed exams when they eventually join a CA firm for articleship.

Ahmad Muhtasim Ishraque, a BBA student enrolled in a public university, said, "Although the students studying at my department are allowed an exemption of four subjects out of seven in Certificate Level, I chose to not go for the exemptions. My university allows students not only from Science but also from Humanities to get admitted here. As a result, a lot of the courses in our first and second years are diluted and simplified to make it easier for them to grasp. Most of the courses that we got an exemption from were taught in our early years at university. Hence, I soon figured that I would have to start studying from the Certificate Level ICAB manual anyway to pass my Professional Level exams. So, I appeared for all seven exams in Certificate Level as I would, either way, have needed to pay the registration fees for the courses I have been offered an exemption."

In order to ensure that all students are on the same pace, ICAB arranges mandatory lecture sessions for students to attend. How fruitful these classes are and whether they are able to deliver what was expected of them are up for debate. Ishraque said, "I have noticed a lack of coherence in the lecture flow. Different teachers take classes for the same course and cover whatever they wish to without following any order. These teachers, who are CAs themselves, might be amazing as CAs, but a lot of the time, they don't really have a knack for teaching. They utilise the lecture hours as an ice-breaking session instead."

Moreover, the academic structures at most universities are rarely flexible. In case the CA exams clash with any sort of academic obligations, students are left to choose either one, and it is usually not possible to negotiate with the authority to reschedule the quizzes or exams at a later date. This discourages many university students from pursuing this particular Chartered Accountancy route.

Finally, the remaining aspirants pursue Chartered Accountancy after completing their bachelor's degree, having utilised their university years to explore who they are as individuals and which career pathway would be a good fit for them. This also has its potential downsides, one of which is the allowance offered during articleships.

The articleship allowance challenge

The allowance offered by most Chartered Accountancy firms during the articleship period is considered extremely low compared to standard living costs. The starting allowance for a first-year articled student is BDT 7000 as set by ICAB. Many aspiring CAs hesitate to embark on this route as the allowance scale makes it challenging to sustain in a city like Dhaka. The exams are also quite rigorous, and sometimes, it can take multiple attempts to clear a paper. Combining both of these factors, it can be quite difficult for aspirants to hold on to the CA career path.

Regarding the allowance, Anwar notes, "I agree that the ICAB minimum articleship allowance is low compared to Dhaka's living costs. However, it's important to remember that this is just the minimum, not the maximum. To attract talented students to the profession, many firms now offer higher allowances, especially to those with strong academic records. Some firms even cover registration costs and exam fees for students who pass fully, partly, or subject-wise during their articleship. Additionally, ICAB provides Quard-e-Hasana, an interest-free loan, to support brilliant but financially constrained students. The low allowance often reflects the generally low audit fee culture in Bangladesh. Ideally, if audit fees were increased, it would create scope for higher allowances."

However, raising audit fees can create several challenges in a country like Bangladesh, with the most crucial one being that businesses would avoid audits altogether. This lack of transparency can lead to fraud and corruption, which is likely to erode local and foreign investor confidence.

Struggles faced by women in the CA profession

As explained earlier, Chartered Accountancy is a demanding career path, but for women in Bangladesh, the journey often comes with additional social and cultural hurdles that make it even more challenging.

"The number of CAs in Bangladesh is far below the required level, and the number of qualified women CAs is even lower, with only 159 (as of July 2024) across the entire country," said Sabah Alam, ACA, an alumnus of Bangladesh University of Professionals (BUP). "I was one of the first CAs to qualify from my university, and unfortunately, the numbers haven't grown significantly since then. One of the main reasons behind this is the additional hurdles women face along the way. For instance, many women are pressured to get married earlier than their male counterparts, often right after graduation. When that happens, new responsibilities and challenges arise, making it incredibly difficult to prepare for such a mentally demanding professional degree. From this perspective, pursuing Chartered Accountancy is still a privilege.

Another overlooked fact is that the working environment for CA students in firms can be quite unpleasant sometimes.

"An associate at a large audit firm once fainted at the office and had to be hospitalised," said Rishad*, an articled student. "The work culture is often fast-paced, and breaks can feel limited, which may lead to burnout according to some students"

"On top of offering very low pay for such draining tasks, many firms tend to find reasons for small deductions," Rishad added. "Earlier this year, a group of articled students were involved in an accident on the premises while hurrying to avoid being late, as lateness could result in losing an entire day's allowance. Despite concerns raised by students, the firm continued operating under less-than-ideal conditions. Management often frames certain policies as measures to ensure smooth operations and promote professionalism and punctuality among students. However, when such policies are enforced without taking genuine concerns into consideration, they can feel exploitative to some."

Despite the challenges, Chartered Accountancy remains one of the most rewarding professions in Bangladesh, both financially and in terms of prestige. As the demand for qualified CAs continues to grow, it is vital for both ICAB and firms to work together to make the journey more accessible and sustainable for aspiring professionals.

Reference:

ICAB (July 1, 2024). ICAB - Membership Statistics.

*Name has been changed upon request

Tazrin is a Contributing Writer at The Daily Star. Remind her to take regular breaks at rashidtazrin1@gmail.com

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments