Why gold costs more in Bangladesh than in India, Dubai

Gold prices in Bangladesh continue to soar, leaving many to wonder why the precious metal costs more here than in neighbouring India or the global trading hub Dubai.

According to market data, gold now sells for $1,414 per bhori (11.664 grammes) in Bangladesh, compared to $1,189 in India and $1,137 in Dubai.

In local currency terms, that is around Tk 1.72 lakh per bhori in Bangladesh, while the same quantity would cost Tk 1.45 lakh in India and Tk 1.38 lakh in Dubai.

This sharp difference is not a recent development.

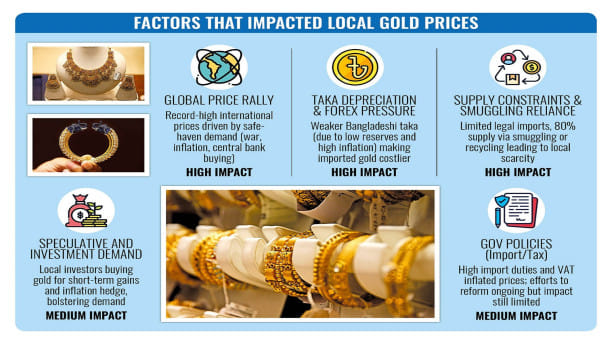

For more than a year, gold prices in the country have been climbing steadily, due mainly to a chronic mismatch between demand and supply.

Economists and jewellers point to a significant mismatch between domestic demand and the official supply of gold as the primary driver behind the unusually high prices.

Although domestic demand remains strong, legal imports have dwindled to almost nothing.

Traders say this shortfall has created a dependency on local sources that often operate outside formal structures.

"We must follow that process because we buy gold from the local market. Since we can't source gold legally, we are dependent on their pricing," said Masudur Rahman, vice-president and spokesperson of the Bangladesh Jewellers' Association (Bajus).

"That's why we cannot follow the international market for pricing."

Compounding the problem is the devaluation of the local currency.

Since 2022, the local currency, the taka, has depreciated by roughly 40 percent, significantly pushing up prices through exchange rate pass-through effects.

Even if global gold prices had remained flat, the weakening of the taka alone would have driven up local rates. Instead, both global prices and the exchange rate moved unfavourably — resulting in a double blow to local gold rates.

AN ALL-TIME HIGH

On Tuesday, gold reached a historic peak in Bangladesh, with the price climbing to Tk 1.77 lakh per bhori—the highest ever recorded. It dropped slightly to Tk 1.72 lakh yesterday.

The Bangladesh Jewellers' Association (Bajus) makes gold price announcements after meetings of its standing committee on pricing and price monitoring.

Bajus cited a surge in the price of pure gold in the local market as the reason for the hike.

Tuesday's price hike marked the 19th time this year that Bajus has raised gold prices, having reduced them only six times.

According to insiders, gold pricing decisions are largely influenced by traders in Old Dhaka's Tantibazar, who follow a routine schedule for setting daily rates.

A source involved in the trade said that traders in Kolkata usually determine their prices around midday, after which Dhaka traders announce local rates.

These rates are not for retail customers; rather, they are for jewellers who collect the metal from the local market.

Although the government does not prohibit gold imports, the jewellery sector is largely dependent on unofficial channels.

According to Masudur Rahman, the high tax on legally imported gold is the main deterrent.

While importing gold, jewellers have to pay Tk 2,000 as tax, 5 percent value-added tax (VAT), and advance income tax per bhori. Plus, there are also insurance costs on it.

Another barrier is that banks are not interested in opening letters of credit (LCs) for gold import due to the ongoing foreign currency crunch.

Traders said many companies turn to loopholes in customs rules, such as the National Board of Revenue's baggage rules, or other informal routes to bring in gold.

In 2018, the government introduced a gold policy to curb smuggling and increase transparency.

The following year, the Bangladesh Bank authorised 18 companies and one bank to import gold, with the licences valid until March this year.

Between 2020 and 2021, the central bank approved imports totalling 306.76 kilogrammes of gold bars across 12 companies.

However, only 160 kilogrammes were actually brought in during that time—nowhere near enough to meet annual demand, which the Gold Policy 2018 estimates at 20 to 40 tonnes.

According to industry insiders, about 80 percent of this demand is still met through smuggled gold, resulting in huge revenue losses for the state.

GLOBAL PRICES RETREAT

International gold prices dipped on Tuesday after briefly touching an all-time high.

According to Reuters, spot gold dropped 1.5 percent to $3,372.68 an ounce, following an earlier peak of $3,500.05. US gold futures also closed 0.2 percent lower at $3,419.40.

The dip came after US Treasury Secretary Scott Bessent made remarks suggesting a potential easing of trade tensions with China, which boosted confidence in equities and strengthened the dollar.

"Comments (of the US Treasury Secretary) this afternoon that hinted towards a possible thaw in the trade war with China were really when (gold) started to sell off," said Bob Haberkorn, senior market strategist at RJO Futures.

'WEAK OVERSIGHT DRIVING UP PRICES'

Rumana Huque, a professor at the Department of Economics at University of Dhaka, said there is no reliable data on gold imports, demand, and supply in the local market.

"Traders rely on their own estimates of market demand," she told The Daily Star, adding that pricing decisions are often based on informal assessments rather than official figures.

She blamed smuggling as a major force behind the way the gold trade currently operates. "If the government takes a firm stance, governance will be restored, and the market will become formalised," she said.

Although traders frequently claim that high taxes make legal imports unviable, Huque dismissed this as a weak justification. "Gold is not an essential commodity, so a higher tax structure is expected," she said.

She also pushed back against the claim that an informal market benefits consumers with cheaper prices. "It is not exactly the case that traders are keeping prices low because the market is informal. On the contrary, in many cases, they are charging higher prices."

However, she opined that the government might consider reviewing the current tax regime. "The government could review the tax rates in comparison with neighbouring countries. If any inconsistencies are found, appropriate measures can be taken accordingly," she added.

Turning to the global picture, Huque said gold tends to attract investors during times of economic uncertainty.

She said that the global supply of gold increases only marginally each year, by around 2 to 3 percent, which has further fuelled the rise in prices.

On the domestic front, weakening taka against the US dollar has added to the pressure. "The depreciation of the taka has also contributed to the price hike," she said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments