Why every startup founder must master Unit Economics

In the glittering world of startups—where valuations, funding rounds, and user growth often dominate headlines—what remains understated yet absolutely vital is the understanding of Unit Economics. For any founder serious about building a sustainable and scalable business, grasping this financial foundation is not optional; it's essential.

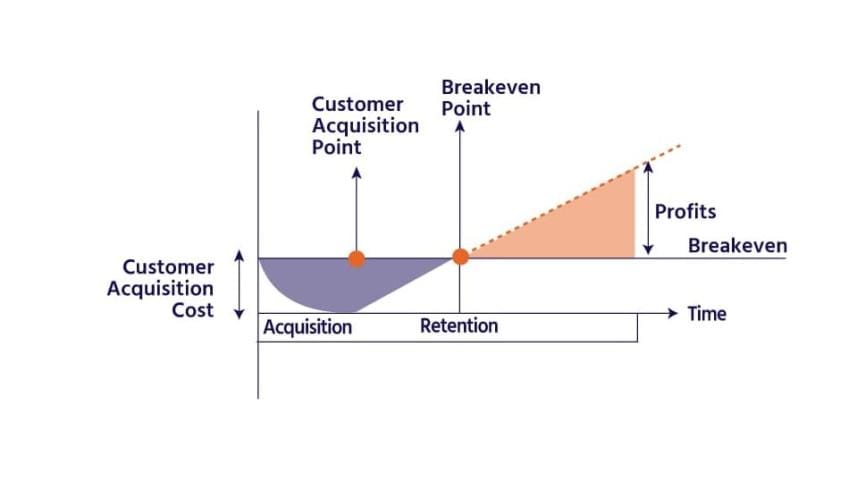

Unit Economics is, in essence, the financial anatomy of your product or service. It tells you how much it costs to acquire a customer (Customer Acquisition Cost or CAC), how much it takes to deliver the product (COGS), and what remains (Gross Margin and EBITDA) after subtracting those costs. These are not just numbers on a spreadsheet—they are the pulse of your business.

Take EBITDA, for example—Earnings Before Interest, Taxes, Depreciation, and Amortization. This simple metric gives you a clear picture of whether your business is capable of generating profits even before financial and accounting complexities come in. Any investor worth their salt will look at EBITDA before putting money on the table. Why? Because it reveals the core profitability of your operations, without the noise of interest payments or tax shields.

Then comes the Contribution Margin—how much you really earn from each unit after covering variable costs. This figure can help you determine breakeven points and understand how many units you need to sell before you actually start making a profit. More importantly, it signals whether your business model is viable in the long run or just temporarily sustained by external funding.

From the lens of a founder, understanding Unit Economics is like having night vision in a dark jungle. It helps you navigate decisions—whether it's pricing, marketing spend, or choosing between growth and profitability. It's easy to get lost in vanity metrics like app downloads or social media followers. But unless each unit sold pushes your business closer to profitability, growth is just an illusion.

In conclusion, startups shouldn't chase scale blindly. Before dreaming of being the next unicorn, a founder must ensure their Unit Economics make sense. Because in the end, sustainable growth isn't built on fundraising—it's built on fundamentals.

The author is the chief operating officer of Keeron.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments