Toothpaste, detergents or food: Japanese firms bet bigger on Bangladesh

- Japanese firms expand operations in Bangladesh

- Investors target domestic market over exports

- Lion and Kewpie deepen local presence

- EPA, special zone expected boost investment

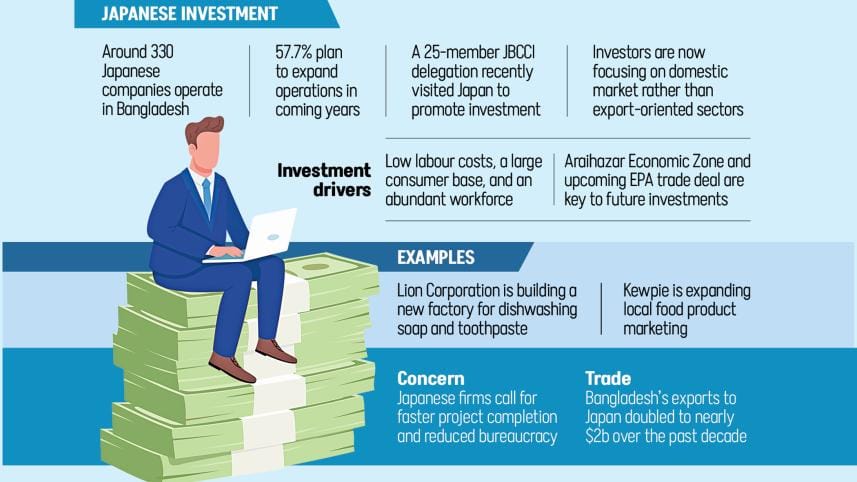

Japanese companies are showing more interest in investing in Bangladesh, expanding existing operations and launching new ventures as they tap into the country's large consumer base and competitive labour market, according to Japanese trade officials and business leaders.

They say many investors from the island nation are choosing to produce goods and services in Bangladesh for local consumers rather than exporting those to other countries.

One example is Lion Corporation, which formed a joint venture with local Kallol Group in 2022 to produce detergents. The partnership is now setting up a new factory to manufacture dishwashing soap and toothpaste.

Another Japanese company, Kewpie, is marketing food products in Bangladesh.

"Japanese investors are showing interest in Bangladesh because of advantages such as low labour costs, abundant human resources and a large domestic market," said Kazuiki Kataoka, country representative of the Japan External Trade Organisation (Jetro).

Jetro is a Japanese government body that promotes trade and investment between Japan and other countries.

The Jetro country representative said 330 Japanese companies currently operate in Bangladesh, though only a few focus on export-oriented production.

A 2024 survey by Jetro found that 57.7 percent of Japanese companies plan to expand their operations in Bangladesh.

Recently, the Japan-Bangladesh Chamber of Commerce and Industry (JBCCI) led a 25-member delegation to Japan to attract new investment. The group participated in seminars in Tokyo and Osaka, where, Kataoka said, many Japanese firms expressed strong interest in Bangladesh.

He said the number of Japanese companies in Bangladesh has continued to grow over the past year, even as many local and foreign investors held back amid political uncertainty.

According to him, the new entrants to the Bangladesh market believe a smooth political transition through elections would help accelerate further expansion.

Kataoka said the 20 percent tariff imposed on Bangladesh by the Trump administration provides some advantage in international trade, but it is not a decisive factor for Japanese companies since they have limited export volumes from Bangladesh to the United States.

He added that the full operation of the Japan-dedicated Special Economic Zone at Araihazar on Dhaka's outskirts Narayanganj, along with the signing of a proposed Economic Partnership Agreement (EPA) between Dhaka and Tokyo, would help attract more Japanese investment.

Meanwhile, JBCCI President Tareq Rafi Bhuiyan (Jun) said they have just concluded a "highly successful" visit to Japan with the 25-member JBCCI delegation.

"We held two major seminars titled 'Business Opportunities and Investment in Bangladesh' in Tokyo and Osaka," he said.

The seminars, jointly organised by Jetro, the Bangladesh Embassy in Japan, and the Osaka Chamber of Commerce and Industry, were attended by hundreds of Japanese companies keen to explore businesses in Bangladesh, Jun said.

He mentioned both sides highlighted the importance of addressing delays in some ongoing major projects, such as the metro rail and the third terminal at Dhaka airport, to preserve the strong partnership Japan and Bangladesh have maintained since independence.

He added that the delegation also held meetings with the Osaka Chamber of Commerce, UNIDO, Marubeni, NEXI, and Chori Co Ltd to discuss ways to increase Japanese investment and expand industrial collaboration.

JBCCI Secretary General Maria Howlader, who joined the visit, said Japanese firms view Bangladesh positively because of strategic location, growing consumer market, cost competitiveness. However bureaucratic delays, complex administrative procedures, Inconsistent policies remain challenges that slow investment decision.

Japanese investors interest are increasing in ICT, health sector, agri and food interested, light engineering while continuing expansion for RMG and automobiles, said Howladar who is a former president of the Institute of Chartered Accountants of Bangladesh.

Japan is the only Asian country where Bangladesh first crossed the $1 billion export milestone about a decade ago. Exports have since risen to nearly $2 billion, supported by growing demand for Bangladeshi-made garments that enjoy zero-tariff access to the Japanese market.

To retain this zero-duty benefit after Bangladesh graduates from Least Developed Country (LDC) status in November next year, Dhaka has completed negotiations to sign the Economic Partnership Agreement (EPA) with Japan.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments