South Asia’s unfulfilled trade promise

South Asia stands at a paradox. The region is home to nearly two billion people, boasts one of the world's youngest workforces, and sits astride vital shipping lanes. Yet despite its scale and strategic location, South Asia has never managed to unlock its intra-regional trade potential.

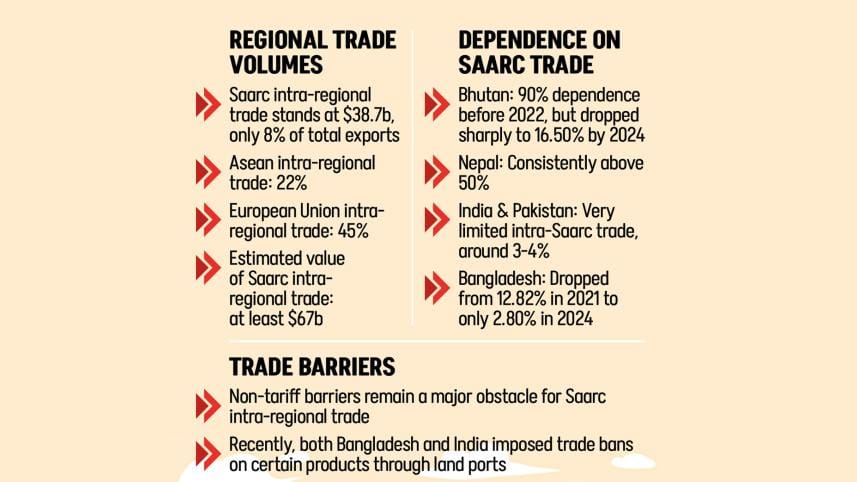

While China, Vietnam, Bangladesh and others have thrived by exporting to the West, commerce among South Asian nations themselves remains anaemic. Trade within Saarc (South Asian Association for Regional Cooperation) accounts for only 8 percent of the region's exports -- a mere $38.7 billion. By comparison, Asean (Association of Southeast Asian Nations) nations trade 22 percent of their goods with each other; in the European Union, the figure is nearly half. The shortfall reflects not just economics but politics: the region's trade has been hobbled by infrastructure bottlenecks, high tariffs, cumbersome non-tariff barriers, and entrenched rivalries.

Recent disputes illustrate how fragile cross-border commerce remains. In April, Bangladesh suspended yarn imports from India via land ports to shield its domestic spinning industry. New Delhi retaliated, suspending transshipment facilities and banning certain exports by Bangladesh through land crossings. Nearly $15 billion in bilateral trade was disrupted by these tit-for-tat moves.

The effects rippled through supply chains. Garment manufacturers in Bangladesh scrambled to secure inputs, while Indian exporters lost access to a lucrative nearby market. Such disputes highlight how quickly political or protectionist impulses can overwhelm commercial logic.

India and Pakistan, the region's two largest economies, remain locked in mutual suspicion. Their trade -- once modest -- has contracted further following border skirmishes and retaliatory restrictions. In May, renewed hostilities again dashed hopes of resuming normal commerce.

Despite regional stagnation, some bilateral links have strengthened. India has emerged as Bangladesh's second-largest import source after China, supplying cotton, chemicals, spare parts, and foodstuffs. In return, Bangladesh exports garments to the Indian market.

Bangladesh has expanded trade with Sri Lanka and Nepal; India's commerce with Colombo and Kathmandu has also grown. But without India-Pakistan normalisation, the core of South Asian trade remains fractured.

Selim Raihan, executive director of the South Asian Network on Economic Modeling (Sanem), argues that politics is the single biggest drag. South Asia's intra-regional trade share of 8 percent, he says, is "too poor compared to 22 percent among Asean members."

Even where there is no outright political blockade, protectionism impedes flows. Average tariffs in Bangladesh and Nepal remain among the highest in Asia. Non-tariff measures are equally onerous. Testing and certification are rarely recognised across borders. A Saarc common testing facility exists, but is ignored by members. Exporters complain of duplicative procedures that add weeks to delivery times and inflate costs.

Infrastructure shortcomings compound the problem. A large share of regional trade moves through land ports such as Benapole-Petrapole (Bangladesh-India), which face chronic congestion. Trucks queue for days, burdened by slow customs clearances, cumbersome paperwork, and informal payments. Poor logistics mean it is often cheaper for a Bangladeshi exporter to ship garments to Hamburg or New York than to Kolkata.

Humayun Rashid, chairman of Energypac Fashions, recounts how three of his containers, destined for India, were suddenly blocked at Benapole after Delhi's ban.

"It was all done all of a sudden, and finally, the goods were rerouted to Chattogram port," he says. "The interests of businessmen of both Bangladesh and India were affected a lot."

ASEAN AND EU: THE COUNTERFACTUAL

The contrast with Asean is striking. In the 1980s, Southeast Asia faced similar obstacles: political mistrust, poor infrastructure, and high tariffs. But sustained political will changed the trajectory. Member states harmonised standards, reduced tariffs, and invested in regional institutions. Three decades later, Asean intra-regional trade rose manifold.

The EU's success is even starker: intra-regional trade accounts for nearly half of exports, underpinned by common standards, a single market, and supranational institutions.

South Asia's failure is not due to a lack of attempts. Saarc was founded in 1985 to foster integration. Yet its progress has stalled. Political tensions, especially between India and Pakistan, have prevented summits from being held in recent years. "The Saarc is in the ICU," says Raihan.

With Saarc paralysed, sub-regional initiatives have been floated. The Bangladesh-Bhutan-India-Nepal (BBIN) corridor was meant to ease transport. But Bhutan declined to ratify the Motor Vehicle Agreement, citing environmental concerns. A smaller "BIN" framework foundered.

The Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (Bimstec), which includes South Asian and Southeast Asian states, has also failed to gain traction. Without binding mechanisms, these forums have delivered little.

For exporters, the consequences are tangible. Bangladesh's garment sector, the backbone of its economy, depends on smooth access to raw materials.

Bangladesh Garment Manufacturers and Exporters Association (BGMEA) President Mahmud Hasan Khan argues that bilateral trade with India will endure, even amid tensions, citing the example of India-China trade, which continues to expand despite fraught ties.

But others are less sanguine.

Asif Ashraf, managing director of Urmi Group, warns that "no trade tension brings any positive outcomes."

With Bangladesh targeting $100 billion in garment exports in the coming years, regional demand could prove vital. "We have to sit together and find out the windows of opportunity," he says.

SHIFTING GLOBAL DYNAMICS

The case for South Asian integration is growing stronger as global trade patterns shift. Conflicts in Ukraine and the Middle East have disrupted energy and food supplies. Supply chains are being restructured in response to US tariffs and growing geopolitical rivalry. Multinationals are pursuing "China Plus One" strategies, seeking new hubs.

Saarc Chamber of Commerce President Md Jashim Uddin says South Asia is ideally positioned.

"The world is looking for 'China Plus One'," he says. "With its nearly $5 trillion economy, two billion people, and strategic location, South Asia offers immense potential."

Yet, he also acknowledges the barriers: lack of coordinated standards, costly and duplicative testing, weak infrastructure, and cumbersome customs.

"These have kept us from becoming the next global supply chain hub," he warns.

Trade integration has not been uniform. Bhutan was once almost wholly reliant on regional trade -- 90 percent of its commerce before 2022 -- but this collapsed to 16.5 percent by 2024.

Nepal has fared better, consistently sourcing over half its imports from Saarc partners.

For Bangladesh, the trajectory is discouraging. Its share of exports to Saarc members fell from 12.8 percent in 2021 to just 2.8 percent in 2024. India and Pakistan remain at a paltry 3-4 percent.

Most South Asian nations rely far more on Europe, the US and China than on each other.

China, for instance, is Bangladesh's largest trading partner; the EU is its biggest export destination, and the US its single largest national market.

Economists emphasise that the economic case for integration is overwhelming, but political will is absent. Protectionism, mistrust and geopolitical rivalry take precedence over commercial logic.

Raihan says all barriers -- tariffs, non-tariff measures, customs inefficiencies, infrastructure bottlenecks -- ultimately trace back to politics. Without improved India-Pakistan relations, Saarc will remain inert.

The business community is blunt: diplomacy must take priority. "We need political and economic solutions," says Energypac's Rashid. "Otherwise, businessmen will be sufferers."

THE ROAD AHEAD

South Asia faces a choice. It can persist with fragmented trade, or it can harness its collective scale to become the next manufacturing hub, drawing investment from companies seeking alternatives to China. If South Asia fails to integrate, others will seize the opportunity.

Southeast Asia, already integrated, continues to attract investment. Africa, with its new continental free trade area, is positioning itself as the next frontier. Asean's lesson is that political will, once aligned, can overcome decades of mistrust. South Asia, however, has repeatedly stumbled.

South Asia's trade potential remains vast. With a large economy and a youthful workforce, the region could be a global supply chain hub. But politics continues to trump economics.

"There is a huge opportunity," says Raihan. "But we have backtracked and missed it because of our rivalries."

Unless tariffs are lowered, standards harmonised, and trust rebuilt, South Asia will remain an outlier: a region where geography and demographics suggest immense promise, but where history and politics deliver chronic disappointment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments