Saudi crown prince seeks soft power in game hub Japan

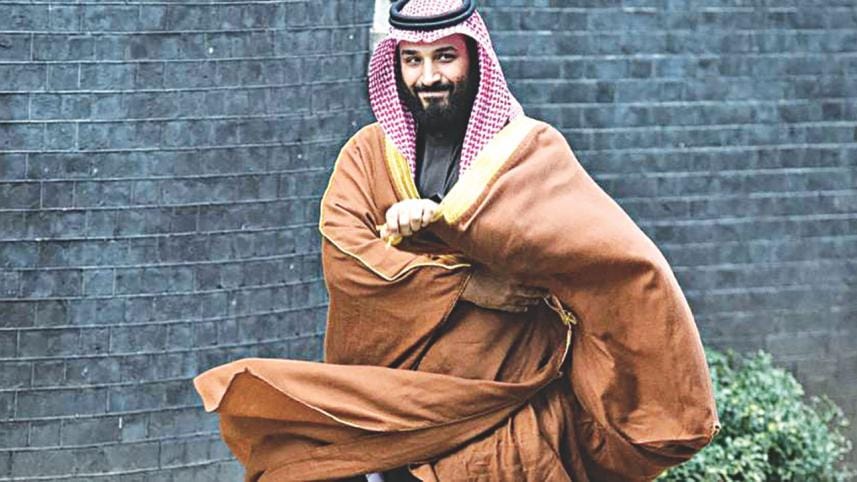

Crown Prince Mohammed bin Salman visits Japan next week, where he will hold talks on energy while hunting more opportunities in gaming as he seeks to improve Saudi Arabia's image.

The reputed "Call of Duty" fan has launched a multi-billion-dollar push into the gaming sector -- from tiny eSports to game development -- as part of his Vision 2030 transformation strategy for the oil-rich kingdom.

Saudi Arabia's sovereign wealth fund holds around eight percent stake in Nintendo, and the country is planning a theme park based on Japan's "Dragon Ball" manga franchise in a new "entertainment city" outside Riyadh.

The kingdom is also organising an eSports World Cup starting this year to become the industry's "premier global hub".

"The Saudi Crown Prince finds Japanese soft power, particularly in gaming and eSports, highly appealing," said Mohammed Soliman from the Middle East Institute in Washington.

"It aligns with Saudi Arabia's Vision 2030 and builds the kingdom's soft power in this rapidly growing area beyond Riyadh's religious leadership," he told AFP.

Prince Mohammed, 38, known by his initials MBS, will meet Prime Minister Fumio Kishida and the emperor on his first visit to Japan since 2019.

When Kishida visited Saudi Arabia last July, the focus was on energy, particularly green energy and decarbonisation.

But this time the scope will likely be broader "as Riyadh eyes partnerships with major Asian powers -- chiefly Japan and Korea -- on manufacturing, trade, and technologies," Soliman said.

The country's de facto leader in 2022 announced a $38-billion investment strategy for the kingdom's Savvy Games Group, owned by the deep-pocketed sovereign wealth fund.

As well as Nintendo, Saudi Arabia's Public Investment Fund also reportedly holds stakes in Japanese "Street Fighter" maker Capcom, and US giants Electronic Arts and Activision Blizzard.

Serkan Toto of Tokyo-based firm Kantan Games said there was ample potential for Prince Mohammed to meet gaming executives in Japan.

"Japan is the third biggest gaming market in the world, there are thousands of game companies here, and Saudi Arabia already has experience investing and... outright acquiring Japanese game companies," he said.

"So of course Japan might be on the map for Savvy."

David Gibson, senior analyst at MST Financial, said Prince Mohammed will also want to encourage Japanese gaming companies to invest in Saudi Arabia's "game development capability".

But this could be "challenging" as the gaming industry faces upheaval with restructuring and layoffs worldwide, he said.

Campaigners say Saudi's quest for soft power belies a dire rights record, and Human Rights Watch this week called on Kishida to press Prince Mohammed on the issue.

"Saudi Arabia has experienced the worst period of repression in the country's modern history" since Prince Mohammed became its de facto leader in 2017, the group said.

Saudi dissident journalist Jamal Khashoggi was murdered in 2018 after he entered the Saudi consulate in Turkey to obtain travel documents.

But a lot is at stake for Japan. Saudi Arabia is the biggest oil exporter to the resource-poor country, fulfilling 40 percent of its total needs.

Analyst Toto said Japanese companies might face lower "moral hurdles" to doing deals with Saudi Arabia, which "doesn't have that super bad image that it has in the West".

And Soliman said that, given destabilising geopolitical shifts, Saudi Arabia -- "an influential leader among Arab and Muslim nations, the architect of global energy policy, a financial powerhouse, and a nation in a major socioeconomic transition" -- can be a desirable partner.

"Tokyo will make a mistake in not solidifying its partnership with Riyadh," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments