Record February: remittances climb 25% to $2.52b

Remittances have become a much-anticipated relief for the economy reeling under macroeconomic stress, growing steadily since August last year and providing the interim government with a breather amid a rapid erosion of foreign exchange reserves.

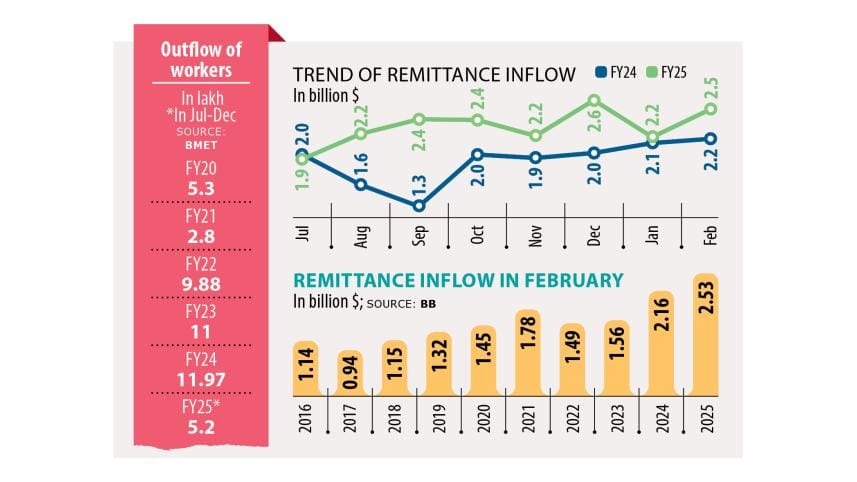

Last month, remittance inflows to Bangladesh rose by 25 percent year-on-year to $2.52 billion, as migrant Bangladeshi workers sent larger-than-expected amounts to their families back home for Ramadan related purchases and Eid shopping.

"This is the highest-ever remittance inflow in February in Bangladesh's history," said Arief Hossain Khan, spokesperson for the central bank.

In the eight months to February this year, inward remittances recorded a 23.8 percent year-on-year growth, according to Bangladesh Bank (BB) data.

Bangladesh received a total of $18.49 billion in remittances in the eight months, up from $14.93 billion in the same period the previous year.

"The surge in remittances is positive news, as it strengthens foreign exchange reserves and helps stabilise the exchange rate," said Professor Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), a leading civil society think tank in Bangladesh.

He said higher remittance inflows are also a relief for the government, as they ease the country's debt servicing burden.

When the interim government took office in early August last year, gross foreign exchange reserves were falling rapidly.

According to BB data, the country's forex reserves reached a record high of $48 billion in August 2021 but declined to $25.92 billion by July 2024.

Over the three years leading up to August 2024, local currency Taka weakened by 42 percent.

Foreign exchange reserves were so depleted that many banks struggled to open letters of credit (LCs). However, the situation has improved somewhat and the erosion of reserves has slowed, due mainly to strong remittance inflows and export growth.

As of 27 February 2025, foreign exchange reserves rose by 1.5 percent year-on-year to $26.13 billion. Under the BPM6 calculation method, reserves increased by 1.8 percent to $20.90 billion, according to BB data.

"Remittance inflows may rise next month as well," said Rahman, adding that remittances usually remain strong during Ramadan and peak before Eid.

According to central bank data, Bangladeshi migrants sent home $153 million in the last two days of February (27-28), indicating a surge in remittance inflows ahead of Ramadan.

"On the other hand, informal money transfer channels such as hundi and hawala have been disrupted since the fall of the Sheikh Hasina government, leading to more remittances being sent through formal banking channels," Rahman added.

In the last five and a half years, around 46 lakh Bangladeshis have gone abroad, contributing to the increase in remittance inflows. Initially, some struggled to find stable jobs, but many have now settled into their roles and are sending money home regularly.

According to central bank data, Bangladesh recorded its highest-ever monthly remittance inflow of $2.64 billion in December last year.

The second-highest monthly inflow was $2.59 billion in July 2020, while the third-highest was $2.54 billion in June 2024, the data showed.

To further increase remittance inflows, Professor Rahman suggested focusing on sending skilled workers abroad and ensuring they are placed in suitable jobs.

"The government needs to identify which countries require specific skills and send trained workers accordingly," he said.

For instance, Saudi Arabia is set to host the FIFA World Cup in 2034. To organise such a large event, it will make significant investments, creating job opportunities. Bangladesh should anticipate this demand, he added.

The economist also emphasised market diversification, suggesting that Bangladesh explore opportunities in countries such as South Korea and Japan.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments