Need favourable legal framework to recover NPLs

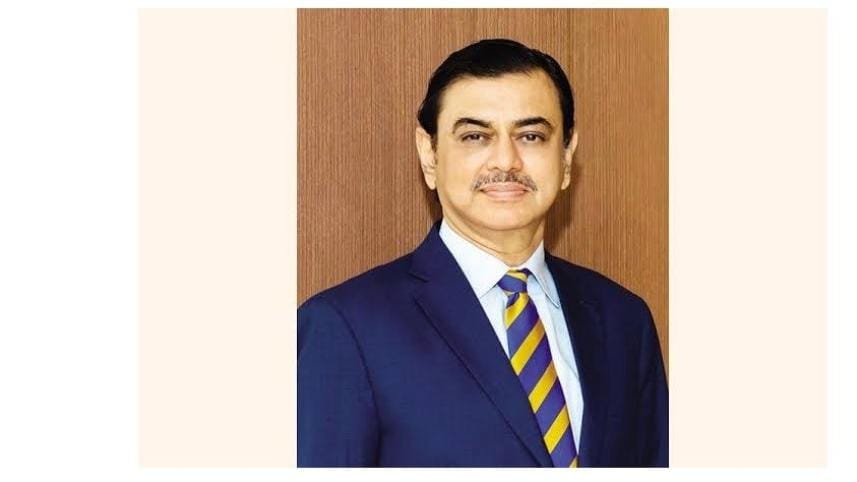

A favourable legal framework for facilitating the recovery of non-performing loans (NPLs) should be formed in consultation with the attorney general and legal experts, according to Selim RF Hussain, chairman of the Association of Bankers, Bangladesh (ABB).

Hussain, also managing director and chief executive officer of BRAC Bank, made this comment while informing journalists at his office about the outcome of a recent meeting with a delegation of bankers.

He said a lot of planning is needed to formulate the right legal framework and that officials responsible for dealing with NPL cases should have proper knowledge about the financial sector and related issues.

"Otherwise, it will not be possible to reduce NPLs," he added.

Regarding the crisis-hit shariah-based banks, Hussain said they should not have been kept alive through special liquidity support and instead be allowed to gradually die.

As per a report on Tuesday, S Alam Group and its concerns took Tk 95,331 crore from six banks between 2017 and June this year, with 79 percent of the sum coming from Islami Bank Bangladesh.

Hussain alleged that central bank officials were instrumental in allowing loan irregularities.

For example, a major conglomerate was able to pilfer money from several banks with the direct involvement of some senior central bank officials.

"The financial health of these banks started to deteriorate after the company took control of their operations. So, the culture of loan repayment was destroyed," he said.

Responding to a question on what steps should be taken for the crisis-hit shariah-based banks, he said each financial institution must become independent and sustainable in the long run.

"If they are not, then according to the market economy, those institutions should be allowed to gradually die as commonly seen in developed countries," Hussain added.

Citing how ailing it is not sustainable to keep ailing banks alive using public money, Hussain said the situation has worsened due to the poor macroeconomic policies adopted over the last two years.

"Steps should have been made much earlier to stop whatever created this situation. The Bangladesh Bank should not have been kept weak banks alive by supplying money," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments