Major scams cost banks Tk 22,502cr: CPD

Scams in 14 banks cost Tk 22,502 crore in the past decade, which is about four-fifth the project cost for Padma bridge and two-fifth of Sonadia deep-sea port, according to a report of the Centre for Policy Dialogue.

The amount lost to a handful of frauds is more than one-third of the country's income tax receipts in 2017-18, said the report titled 'Banking Sector in Bangladesh: Moving from Diagnosis to Action'.

It is also more than the cost for Dhaka Mass Rapid Transit Project, according to report, which was unveiled yesterday at Khazana Gardenia Hall in Dhaka.

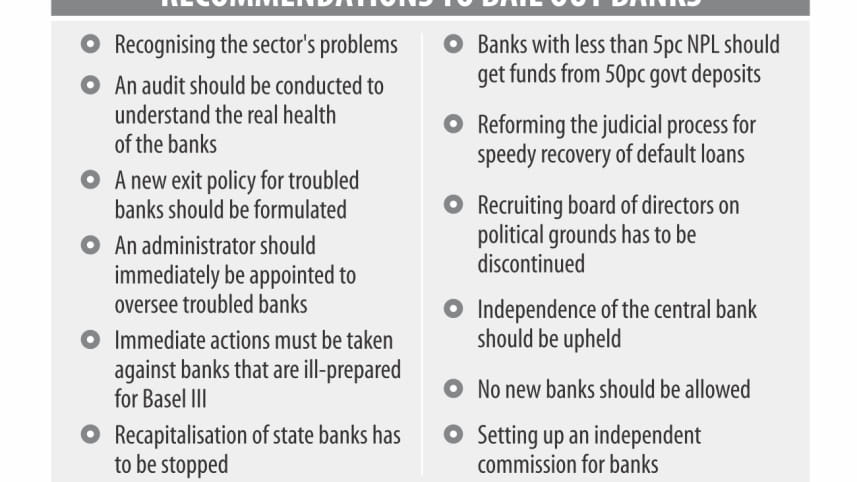

The report comes just three weeks before the national elections scheduled for December 30. The think-tank said it felt the need to bring forth the issues of banking sector to the political parties. The report highlighted the banks' loss-making spree stretching years and the rising nonperforming loan (NPL) ratio.

The banking sector's NPLs reached nearly Tk 1 lakh crore at the end of September, which is 11.45 percent of the total outstanding loans. And 48.38 percent of the amount belongs to half a dozen state-owned banks. “The actual percentage of classified loans would be higher if loans were not written off,” said the report.

The CPD criticised the government for recurrent recapitalisation of state banks with taxpayers' money. The think-tank estimated that Tk 15,705 crore was injected to state banks between 2008-09 and 2016-17.

Poor management pushed state-owned banks' expenditure-income ratio higher than the maximum thumb rule of 50 percent, it said. Banks' declining return on asset, equity and expenditure to income ratio and volatility in the liquidity situation during the past decade was also discussed in the report.

As of June, return on asset and equity of the banking industry stood 0.3 percent and 5.3 percent respectively.

“Banks' inefficiency in liquidity management was also evident as the banking industry faced more than two unusual incidences of both liquidity surpluses and shortages.”

ICB Islamic Bank (formerly known as Oriental Bank), Farmers Bank and state-owned BASIC Bank, which are making losses for the last three years, are seriously under-capitalised, posing a potential threat to their existence.

“Losses made by BASIC Bank alone were greater than the losses of all other banks combined.”

Between 2016 and 2018, BASIC's NPL ratio stood at 50 percent and ICB Islamic Bank's 60 percent.

Farmers Bank, which was set up in 2013, had to be bailed out by five state-owned lenders with Tk 765 crore.

Monopolisation of banking—which was not only limited to corporations but also spread to families—has deteriorated the governance in the sector, the think-tank said.

A single business group gained control of seven private banks in the country.

Two detrimental amendments in the banking laws -- the increase in the tenure of directors to 9 years from 6 years and the number of family members who can be directors to 4 from 2 -- have undermined the cause of good governance.

Under this situation, the CPD believes there is no need for new banks in Bangladesh.

“Mexico had only 47 commercial banks in 2016 though its GDP was 7.4 times higher than Bangladesh.”

Though the central bank has the sole authority to grant licences to new banks, this principle is not being followed in Bangladesh, the report said.

The CPD also shed light on the reforms carried out in the banking sector since 2009.

Of the reforms, anti-terrorism law, guidelines on risk-based capital adequacy for banks, whistleblowers' protection law, customers' interest protection centre at all banks, corporate governance, money laundering prevention law and some changes in electronic payments and settlements were mention worthy.

Fahmida Khatun, executive director of CPD, presented the report at the programme, which was chaired by noted economist Wahiduddin Mahmud.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments