How to register for Universal Pension Scheme

The government has launched the much-talked-about universal pension scheme with an aim to bring every citizen of the country aged above 18 under the pension coverage.

Prime Minister Sheikh Hasina virtually rolled out the scheme from her official residence Gono Bhaban today.

A website called 'Upension' has been launched for universal pension scheme.

People interested to register for the scheme can do it by visiting the National Pension Authority's website: www.upension.gov.bd.

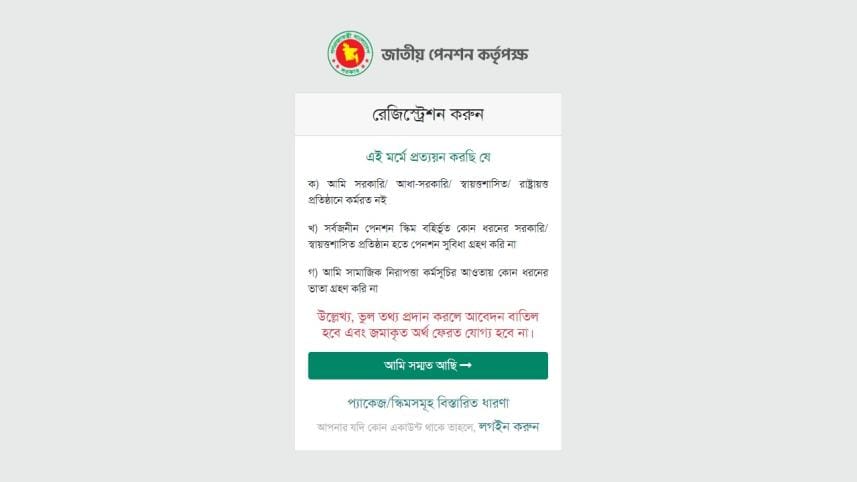

Interested persons have to fill up each part of the registration process with accurate information. The application will be cancelled and the money deposited will not be refunded if the registration is done with inaccurate or false information.

Each new participant has to register first by clicking on the Pensioner Registration button placed on the top right corner of the "Upension" website.

A new screen will pop up here where there will be two options. One will be "I agree" and just below it there will be another option, which will ask to "Login" if the person has any account.

The third pop-up window will ask the person to go for registration by selecting the scheme first and then putting in his/her national identity number, date of birth, mobile number and e-mail address.

This window will take the person to the next window after filling up the Captcha portion.

Successful filling up of the Captcha will open a window, which will ask the person to insert the one-time password or OTP that has been sent to the mobile number mentioned in the previous window.

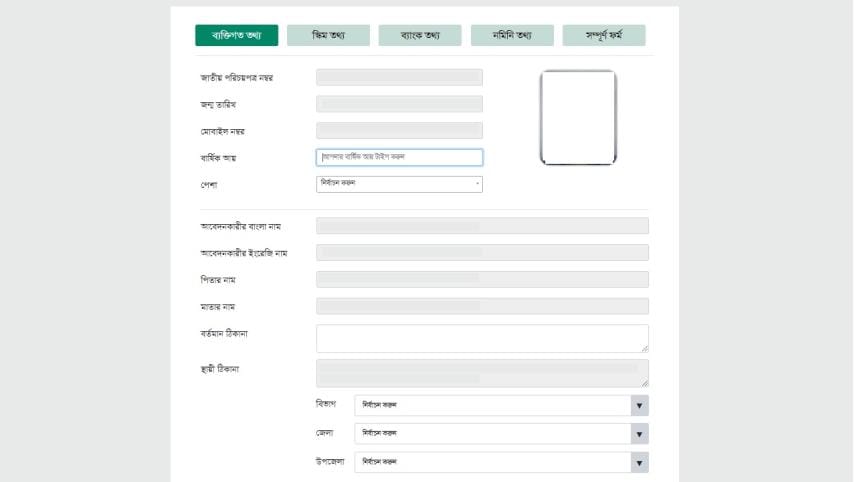

Here the window number five will open where the person has to give detailed information about him/her in five separate tabs, namely: Personal Information, Scheme Information, Bank Information, Nominee Information and the Whole Form.

This page will show the applicant's NID number, photo, Bengali and English name, father's name, mother's name, current and permanent address according to the NID data given on the previous page.

Here the amount of the applicant's annual income should be mentioned and the name of his profession, division, district and upazila should be selected.

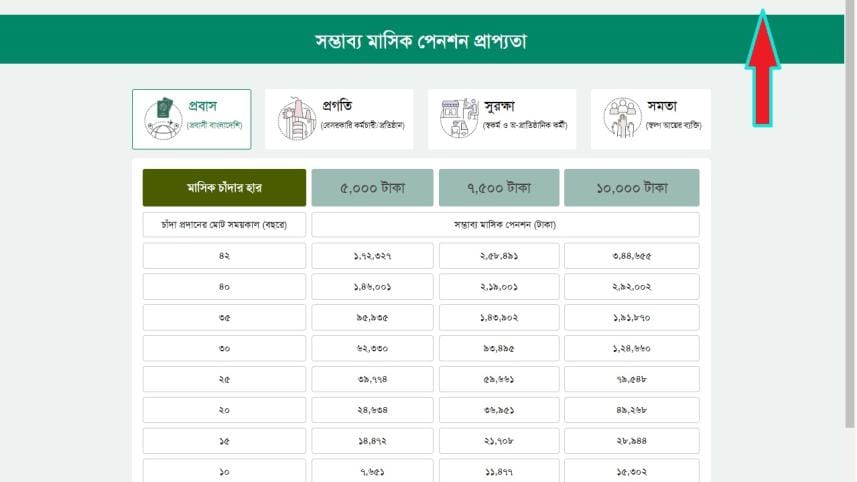

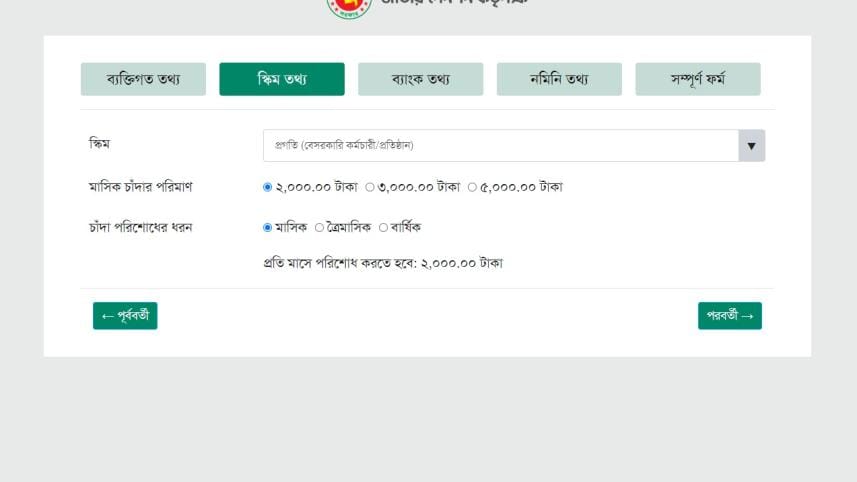

At the end of this step, there will be another page called 'Scheme Information'. Here the person has to choose the amount of monthly donation and the time of payment. There will be three options for payment monthly, quarterly and annually.

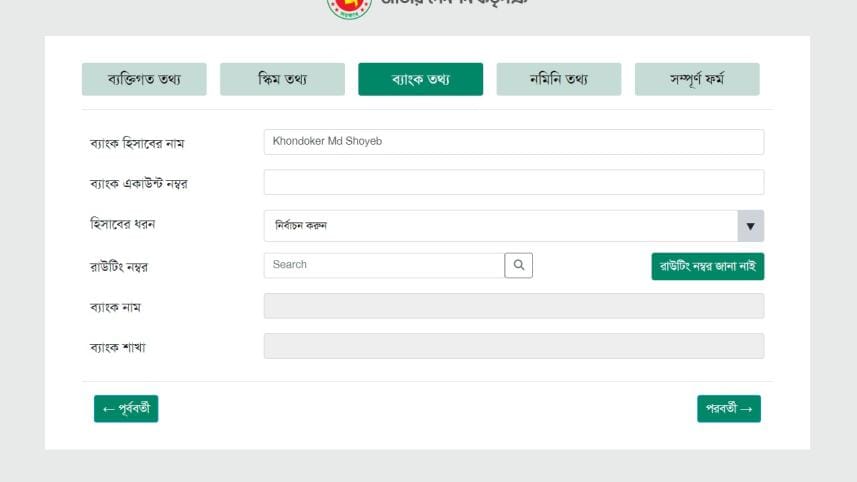

Then the bank information has to be inserted. On this page, the applicant should mention the name and number of the bank account, the type of account (savings or current), the name and branch of the bank and routing number.

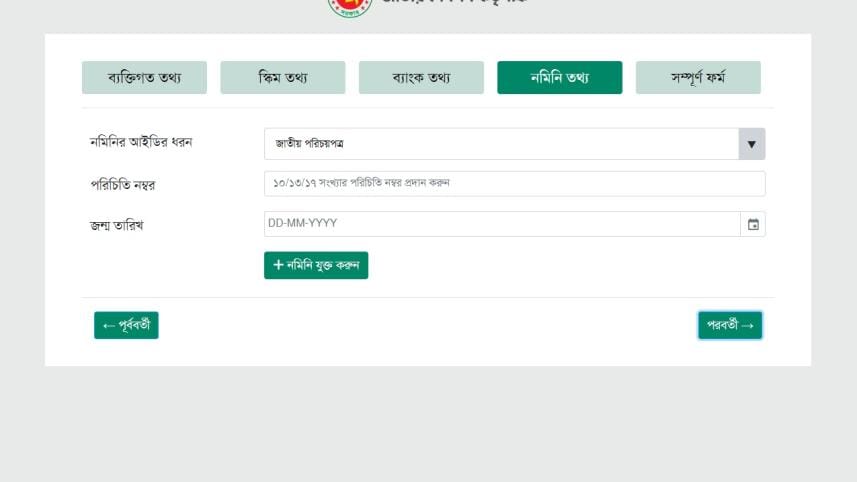

The nominee information should be given on the next page. The nominee's national identity card number and date of birth should be mentioned.

There is option for adding more than one nominee. On this page, the nominee's mobile number, relationship with the nominee, etc. should be mentioned.

Now comes the last step of registration, which is called 'Full Form'. The applicant will be shown personal information, scheme, bank information and nominee information.

The applicant can correct if any error is found on this 'Full Form' page. If there is no mistake, the registration process will end if the person gives consent.

The government has introduced four different schemes: Progoti, Surokkha, Somota and Probash to bring citizens from all walks of life under the pension facility.

Progoti

This scheme is for employees of private companies. Any employee working in a private organisation or the owner of that organisation can participate in it.

Surokkha

People working in the informal sector such as farmers, rickshaw pullers, labourers, blacksmiths, potters, fishers and weavers can participate in this scheme.

Somota

Low-income people living below the poverty line, who currently earn a maximum of Tk 60,000 a year, can participate in this scheme. Who will fall under the poverty line will be determined by the income limit published by the Bangladesh Bureau of Statistics.

Probash

Any Bangladeshi citizen working or living abroad can participate in this scheme by depositing the prescribed amount in foreign currency.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments