How to file income tax return online – a step by step guideline

The National Board of Revenue (NBR) has issued a special order regarding the submission of income tax returns online.

According to this order, from the fiscal year 2025-2026, all individual taxpayers must compulsorily file their income tax returns online.

This directive came into effect on August 4 this year, and the deadline for submitting income tax returns for the current fiscal year has been fixed as November 30 this year.

However, the obligation to file returns online will not apply to the following classes of taxpayers:

- Senior taxpayers aged 65 years or above

- Physically disabled taxpayers (subject to submission of a certificate)

- People employed abroad

- Legal representatives of deceased taxpayers

In light of this directive from the National Board of Revenue, every taxpayer must now file their return through the platform www.etaxnbr.gov.bd. However, for many of us, the process of preparing and filing returns online is still new. So let us learn, step by step, how income tax returns can be easily submitted online.

To submit a return online, first visit www.etaxnbr.gov.bd and click on the e-return option. If you are not yet registered, select "I am not yet registered." Then complete the application by providing your Tax Identification Number (TIN) and registered mobile number. After confirming the OTP code received on your mobile and setting a password, your registration will be complete.

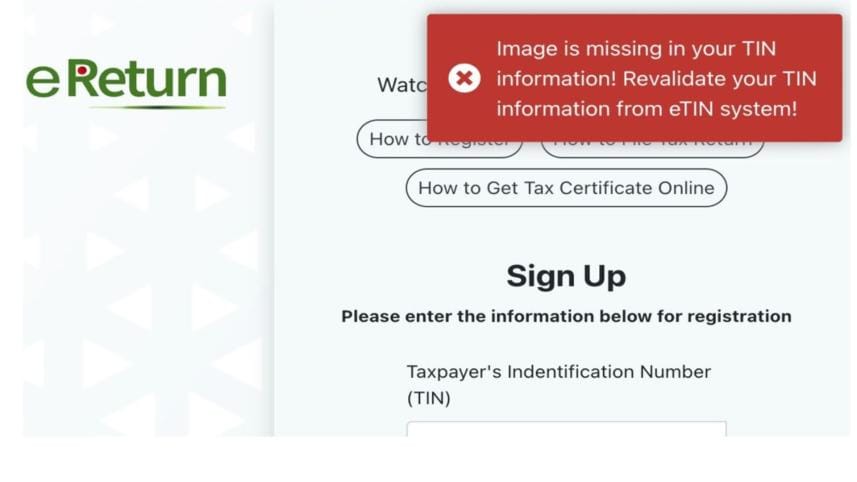

Sometimes, registration may not be completed, and a message may appear: "Image is missing in your TIN information! Revalidate your TIN information from TIN System!"

There is nothing to worry about in this case. To resolve such issues, you must directly contact the IT Division of the National Board of Revenue located at Agargaon or resolve the issue through your legal representative.

Once registration is complete, you will be able to submit your income tax return online by following seven steps. Let us understand what needs to be done in each step.

Step 1: Assessment Information

When you click the Assessment Information tab, your online form will open. Here, "Self Return," the applicable tax year, and assessment year will be automatically filled. Then you must confirm your residential status and whether there is any tax-free income in the relevant assessment year. After selecting the sources of your income, this step will end. Click "Save & Continue" to proceed by providing additional information, such as:

- Location of your income

- Information related to tax rebate

- Information from the IT-10B form

Also, if there is any voluntary income according to the First Schedule, details must be provided in this step.

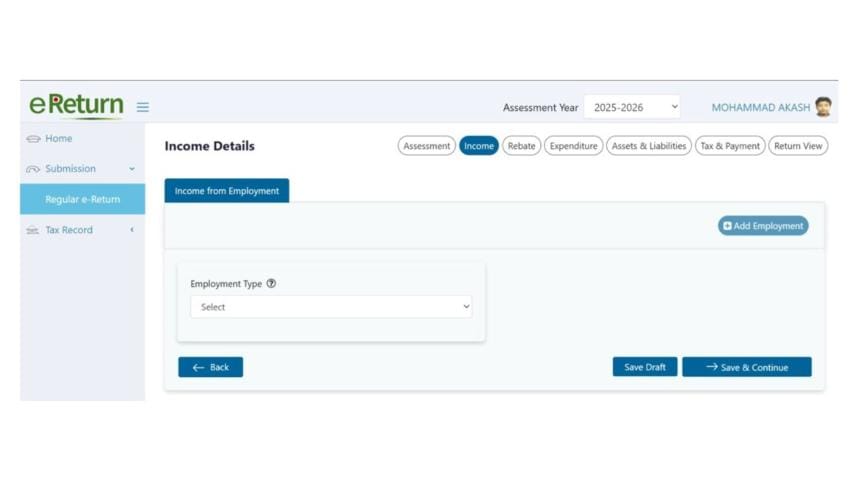

Step 2: Income Details or Statement of Income from Different Sources

In this step, you must provide detailed source-wise information about your income — how much has been earned from which source. For example:

- If you are a salaried officer/employee, mention where you work, your designation, salary and allowances received, and whether you receive any non-cash benefits.

- If you have earned profit from savings certificates along with your salary, provide full details of the savings certificate — registration number, issue date, purchase value, profit received during the assessment year, and tax deducted at source.

Step 3: Investment and Rebate Calculation After providing detailed income information in Step 2 and clicking "Save & Continue," you'll reach one of the most important steps — Investment and Rebate Calculation. Here, you will see different types of investments. Select the correct category and provide the necessary information. For example:

- Life insurance premium

- Deposit Pension Scheme (DPS)

- Approved savings certificates and government securities

- Unit certificates / Mutual fund / ETF / Joint investment scheme

- Listed shares

- General Provident Fund (GPF)

- Recognized Provident Fund (RPF)

- Approved gratuity fund

- Approved welfare fund and group insurance premium

- Zakat fund (under Zakat Fund Management Act, 2023)

- Universal Pension Scheme

- Others

Suppose you have a DPS in a bank or financial institution — you must provide the bank's name, account number, and deposited amount. If your organization has an Approved Provident Fund, mention how much you and your organization deposited in your name during the assessment year.

If all investment information is provided correctly, the system will automatically calculate and display your total actual investment and the amount admissible for rebate.

Step 4: Statement of Expenditure (IT-10BB)

In this step, you must provide information about your various expenditures during the relevant assessment year, including:

- House rent

- Family grocery expenses

- Transportation

- Utility bills

- Education expenses

- Tax payment expenses

- Festival allowance expenses

- Other expenses

After filling in all necessary expenditure information and clicking "Save & Continue," you can proceed to the next step.

Step 5: Statement of Assets and Liabilities (IT-10B) — The Most Important Step

When filing your return, providing accurate information about all your assets and liabilities is crucial. First, mention your total wealth in the last assessment year. Then, add the current year's income and deduct living expenses to determine your total wealth for the current year. After deducting liabilities, your net wealth will be calculated. Remember, incorrect or incomplete information may lead to future complications.

Assets must include:

- Bank deposits

- Investments in savings certificates

- Shares, mutual funds, or other financial investments

- Cash in hand

- Gold, diamonds, gems, and valuables

- Land, flats, or other immovable property

- Furniture, electronics, and equipment

- Business capital

- Assets located outside Bangladesh

- Other non-business funds

Liabilities must include all non-business liabilities, such as:

- Loans from banks or financial institutions

- Personal or unsecured loans

- Credit card dues or other overdrafts/advances

Important Advice: Take special care to ensure consistency between your declared assets and liabilities. Any mismatch or error may trigger an audit. Therefore, prepare in advance and provide all information and calculations accurately.

Once everything is correct, click "Save & Continue" to proceed.

Final Step: Tax Liability

In this step, you will learn how much tax liability has been determined for the current fiscal year.

- If the advance tax paid exceeds your liability, you do not need to pay any additional tax.

- If the advance tax paid is less, you must pay the remaining balance.

You will see a column titled "Updated Tax Payment Status." Provide details of the advance tax paid and update the status. If the paid amount is less than the liability, pay the remaining balance online or offline and adjust it accordingly.

Finally, if the "Final Payment" column shows Payable: ৳0, it means your tax is fully paid. Only then can you successfully submit your online return.

Important Advice Before Submitting Your Return: Before submission, go to the "Return View" option and carefully review your entire return. Check:

- Whether all information has been provided correctly

- Whether any information has been omitted

- Whether assets and liabilities have been properly declared

- Whether the tax payment status has been updated

If everything is correct, submit the return confidently. Upon submission, you will immediately receive an Acknowledgement Slip, which must be preserved as proof of submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments