Funding shortfall threatens renewable energy goals

Despite Bangladesh's lofty aim of generating 40 percent of its energy from renewable sources by 2040, the country faces a significant funding gap, as only 3.6 percent of the required funds were allocated to the sector in 2023, according to a study.

Despite the growing need for sustainable energy solutions, banks and financial institutions are providing minimal financing to this sector, said Khondkar Morshed Millat, a faculty member of the Bangladesh Institute of Bank Management.

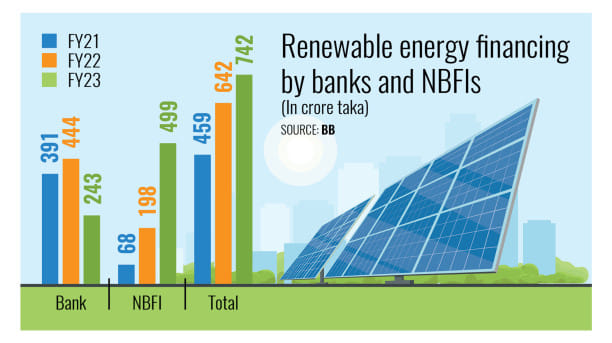

In 2023, banks and non-banking financial institutions (NBFIs) financed Tk 742 crore for renewable energy projects, up by 62 percent from 2021, the study said.

However, quoting the BIBM's research, Millat said Bangladesh required funding of around Tk 20,500 crore in 2023 to stay on course to provide 40 percent of its energy from renewable sources by 2040.

He added that the annual requirement was likely to increase to Tk 49,400 crore in 2041.

"If this trend continues, domestic banks and financial institutions will contribute only 4 to 9 percent of the required annual funding by 2041, jeopardising the country's renewable energy goals," he added.

He raised these concerns while presenting a study titled "Renewable Energy Financing Trends in Bangladesh" during an event organised by Unnayan Shamannay, a think tank, at the Bishwo Shahitto Kendro in the capital's Banglamotor.

Currently, less than 1 percent of term loans from the banking sector go to renewable energy, he added.

The study further mentioned that, as per the central bank's annual report for FY23, total renewable finance by banks and NBFIs accounted for only 0.3 percent of total disbursed term loans.

Millat, also a former director of the Bangladesh Bank's Sustainable Finance Department, added that some policy challenges, including high import duties imposed on inputs and a lack of tax incentives for entrepreneurs, were major barriers to this sector.

He highlighted central bank initiatives, including policies on sustainable finance and refinancing schemes, but emphasised the need for further fiscal, budgetary, and monetary reforms to expand renewable energy financing.

Tashmeem Muntazir Chowdhury, head of sustainable finance at BRAC Bank, pointed out that domestic banks struggle to fund large-scale renewable projects, urging greater involvement from international development partners.

Mostafa Al Mahmud, president of the Bangladesh Sustainable and Renewable Energy Association, stressed Bangladesh's vast potential for small-scale renewable initiatives like rooftop solar set-ups.

However, he lamented the financial constraints that pose a major hurdle to progress. "In some cases, we have to pay 72 percent tax on imported items, which is a major barrier for the renewable energy sector," said Mahmud.

Ragib Ibnul Asif, deputy director of the central bank's Sustainable Finance Department, underscored the importance of raising awareness among bank officials about the benefits of renewable energy to encourage increased funding.

He also highlighted the need to find other financial sources, such as the bond market.

The seminar was moderated by Zahid Rahman, senior project coordinator of Unnayan Shamannay, and featured open discussions with representatives of banks and NBFIs, renewable energy entrepreneurs, researchers, and university students.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments