Foreign investors continue to sell shares

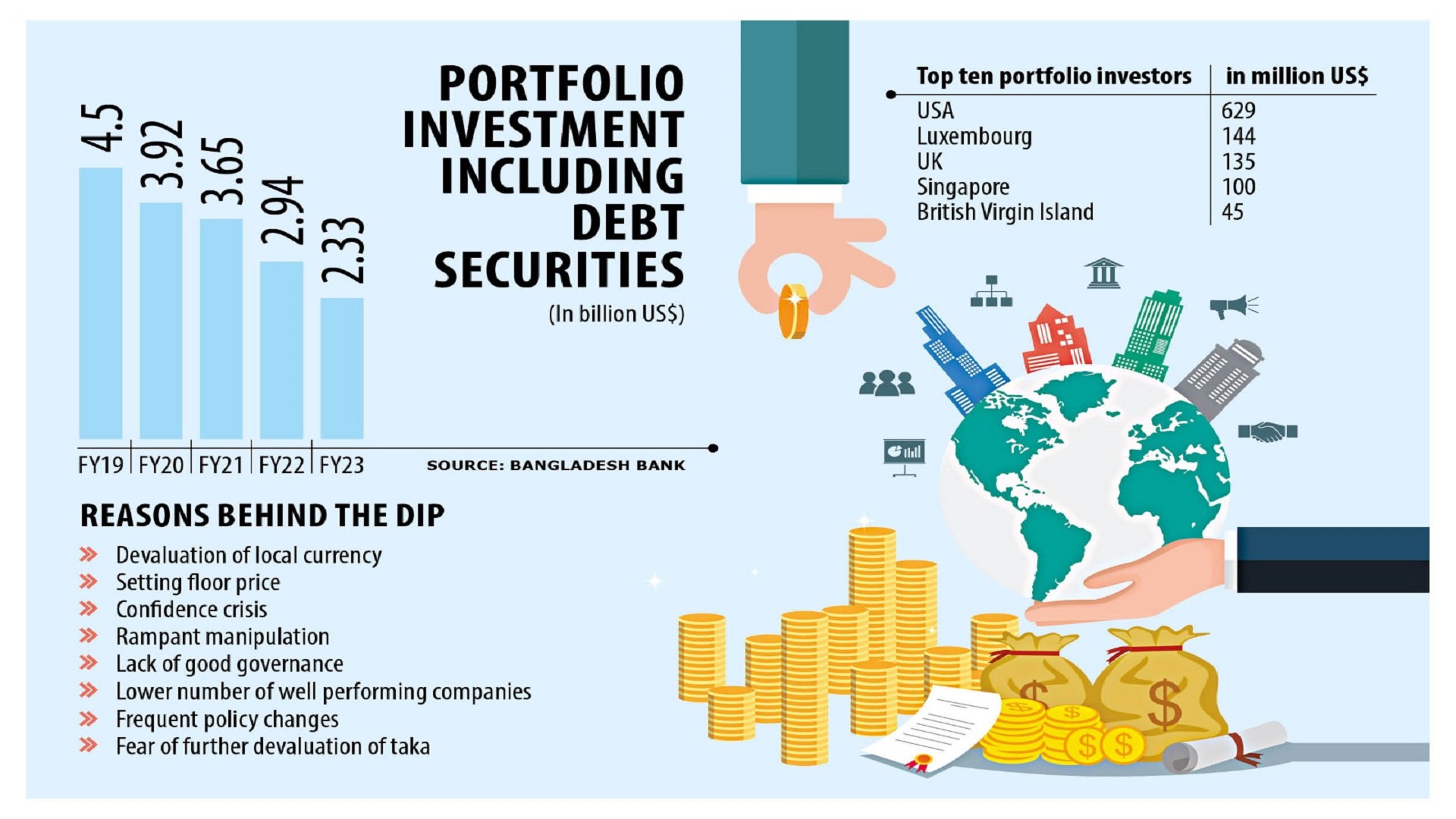

The net foreign portfolio investment in Bangladesh continued to fall in the July-March period of fiscal year 2023-24 due to the negative economic outlook, repeated devaluation of the local currency against the US dollar, and policy instability.

During those nine months, the country's net foreign portfolio investment stood at $89 million in the negative compared to $45 million in the negative in the same period the year prior, according to Bangladesh Bank data.

Foreigners started offloading their shares in 2020, when they predicted that the local currency may face significant devaluations.

Seeing the huge selling pressure, the Dhaka Stock Exchange (DSE) stopped providing data on foreign investments upon receiving verbal instructions from the Bangladesh Securities and Exchange Commission (BSEC).

The main reason for the massive sale of shares held by foreigners was currency instability and the imposition of the floor price mechanism, said Saiful Islam, president of the DSE Brokers Association of Bangladesh.

When the local currency is devalued, foreign investors incur losses. So, they sold their shares when they forecasted that the currency would be devalued.

Besides, the ongoing foreign currency crunch in the country has made it difficult for foreign investors to repatriate profits.

"This also fuelled them to sell shares," he added.

Bangladesh's forex reserve has almost halved in the past two years. At the same time, the taka depreciated by around 35 percent compared to the US dollar, as per central bank data.

Furthermore, when the BSEC launched floor prices in 2020 to stop the freefall of market indices, it went against the regulatory guidelines of many other countries.

This was because they recognised that the mechanism had rendered the local market illiquid as share selling was tough due to floor prices.

The floor prices were gradually removed but were brought back in mid-2022 amid the Russia-Ukraine war.

"So, this was another major reason for their share sales," Islam said.

However, he hopes that the selling pressure from foreign investors will reduce now as they have already sold a large portion of their holdings.

The net selling trend of foreign investors started in FY21 and still persists. Their net sales were $30 million in the negative in FY23, $158 million in the negative in FY22 and $269 million in the negative in FY21, central bank data showed.

Due to the huge sell-off, shares of blue-chip companies and well-performing companies dropped massively as foreigners mostly held such stocks, said Islam, who is also a director of Brac EPL Stock Brokerage Ltd.

Local investors do not have adequate liquidity to absorb this selling pressure, he added.

A top official of a leading brokerage that deals with a large portion of foreign trade said foreign investors are forecasting that the country's macroeconomic indicators may deteriorate further.

"This means the currency may devalue further, so they are selling shares," the official added.

Already, most blue-chip companies and multinational companies have reduced their dividends for 2023 due to the US dollar shortage.

Frequent policy changes also discourage foreigners from keeping funds in the share market, the broker said, adding that the imposition of floor prices totally caught them off guard.

When the floor price mechanism was withdrawn, the lower circuit breaker was reduced to 3 percent to stop the indices from falling.

"This was another blow," the broker said

Citing how foreign investors never invest in a stock market where the exit system is strict, he said floor prices, the stringent circuit breaker, and the US dollar shortage were all barriers in this regard, he said.

"What has been done by the BSEC to attract investors except narrowing their selling system by launching these policies?" he asked. "Only a few companies where foreigners can invest got listed in the last 15 years. So, why they will invest in the market?"

By simply arranging road shows, foreign investors will not come to the market, he added.

In the past, foreign investors have experienced many sudden policy changes that impacted their investment.

For instance, the Bangladesh Telecommunication Regulatory Commission banned Grameenphone, the largest listed company in the country, from selling SIMs in June 2022, citing its failure to improve the quality of its services.

The restriction was withdrawn after six months, but the decision dented the company's share price and foreign investors lost confidence.

Before that, in 2015, the Bangladesh Energy Regulatory Commission cut the distribution charge for Titas Gas. As a result, the utility company lost more than Tk 3,000 crore in market value over a period of five months.

On those occasions, foreign investors held a major part of the companies' stocks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments