FDI sees a modest uptick, but fresh investment still lags behind

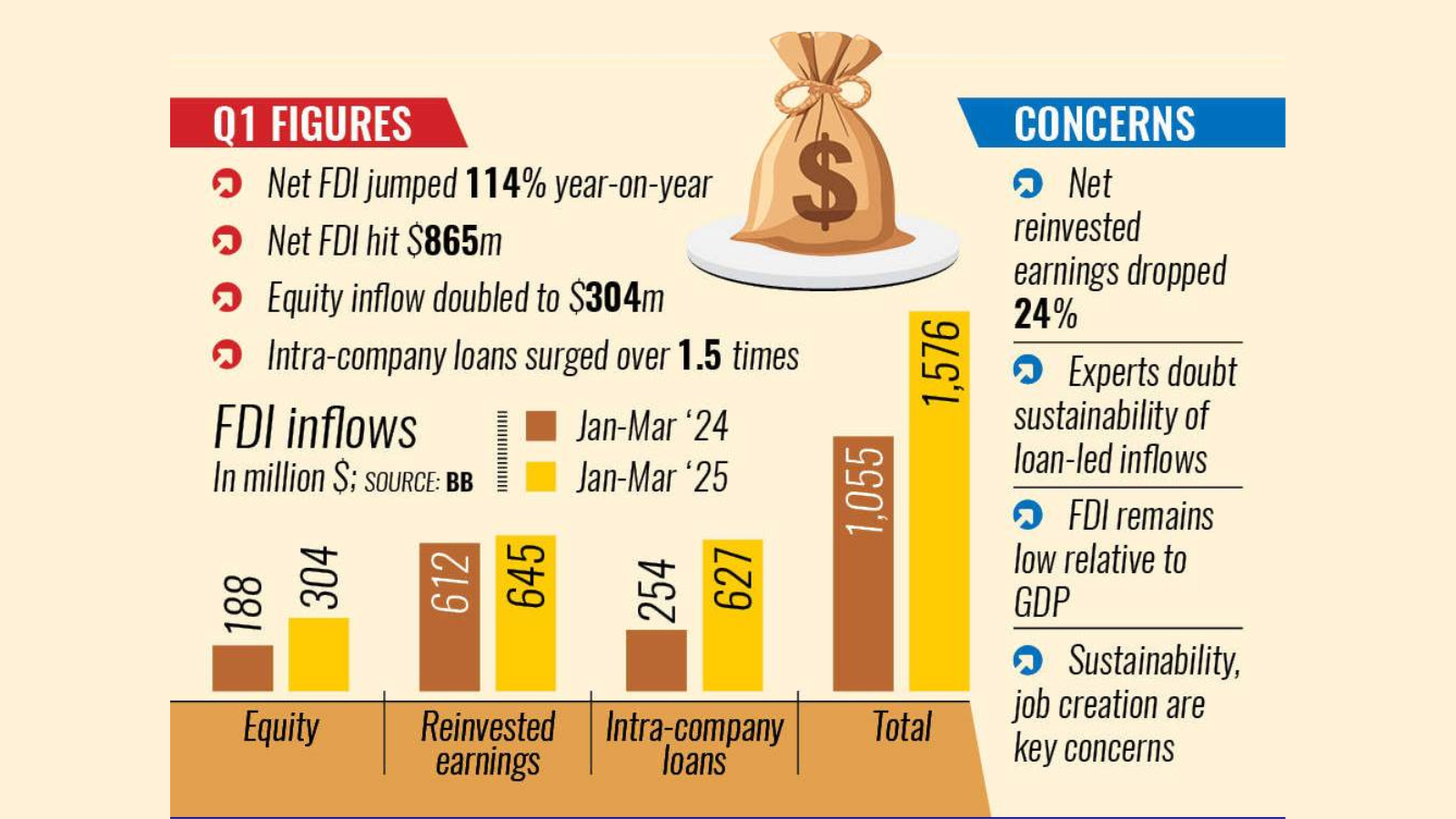

Foreign investment in Bangladesh rose by 11 percent year-on-year to $303 million in the April-June quarter of the 2024-25 fiscal year, powered by a sharp spike in reinvested earnings by existing investors as the flow of equity capital dipped.

Reinvested earnings surged by 600 percent year-on-year to $168 million in the fourth quarter of the previous fiscal year, according to the latest data from the Bangladesh Bank (BB).

Equity capital flow slumped to $81 million in the April-June period this year, down 62 percent year-on-year, while intra-company loans also declined.

During the fourth quarter of FY25, areas outside the export processing zones (EPZs) and economic zones (EZs) received three-quarters of the $303 million in foreign investments.

Of the remaining 25 percent, EPZs logged 22 percent of the investment and the rest went to the EZs, BB data show.

With the fourth-quarter figure, Bangladesh recorded $1.68 billion in foreign investment in FY25, the highest in three years.

The South Asian nation, seeking to lure foreign investment to bolster its economic development, received $1.46 billion in foreign investment in FY24.

M Masrur Reaz, chairman and CEO of Policy Exchange of Bangladesh, said while the 11 percent year-on-year increase in FDI appears encouraging, a closer look at the composition tells a more cautious story.

"Nearly 72 percent of this FDI comprises reinvested earnings and intra-company loans," said Reaz. "This suggests a stagnation in fresh equity inflows—investment that is most critical for creating new capacities, jobs, and export potential."

According to Reaz, the dominance of reinvestment over new equity points to deeper structural issues in the investment ecosystem.

These include regulatory unpredictability, infrastructure inefficiencies, and persistent challenges in energy reliability—especially gas and power, key inputs for industrial growth.

"The country has, for years, struggled with an FDI climate that lacks the consistency and competitiveness needed to attract new investors," he added.

Political uncertainty has also played a role.

Over the past year, investor sentiment has weakened due to electoral transitions and a general 'wait-and-see' approach by both domestic and international players. "When elections are uncertain and reform momentum stalls, investors tend to pause," Reaz noted.

While the modest growth in quarterly FDI may be viewed as a sign of resilience, he emphasized that Bangladesh must do more to attract greenfield and strategic investments.

"To move beyond incremental growth, the country needs bold reforms and a focused effort to restore investor confidence."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments