Budget spending jumps amid rising interest payments

Overall budget expenditure jumped nearly 25 percent year-on-year in the first five months of the current fiscal year, driven by soaring interest payments and subsidies despite lower development spending.

Between July and November, the government spent Tk 194,793 crore out of the Tk 788,422 crore annual budget, according to the latest report from the finance ministry.

Of this amount, operating expenditure rose to Tk 170,491 crore, marking a 40 percent increase compared to the same period in the preceding year.

However, development expenditure, including the Annual Development Programme (ADP), declined by 28 percent to Tk 24,302 crore during the same period.

As the country faces mounting debt from both domestic and foreign sources, interest payments have been the primary cause of the increase in operating expenditure.

In the first five months of FY25, the government's interest payments surged by 76 percent year-on-year.

From July to November this fiscal year, interest payments amounted to Tk 71,213 crore, up from Tk 40,445 crore in the same period of the preceding year.

Of this amount, Tk 63,624 crore—accounting for 89 percent of the total—was paid on domestic borrowing, while the remainder covered foreign loans.

The sharp rise in interest expenses is attributed to several factors, including the fact that some mega projects are nearing completion, which has increased interest payment obligations.

Rising interest rates in both domestic and international markets have further strained government finances.

Interest rates in the local banking sector have surged by approximately 500 basis points over the past five years, escalating the government's interest payment obligations to unsustainable levels.

An analysis of interest payment trends reveals a significant shift in the government's debt-servicing burden. Between FY10 and FY20, interest payments consistently remained below 20 percent of the total revenue budget.

In fiscal year 2010, it stood at 18.65 percent, rising to 21 percent in FY21.

The situation worsened following the pandemic, as the government rushed to secure substantial budgetary support from foreign sources, leading to a growing debt burden.

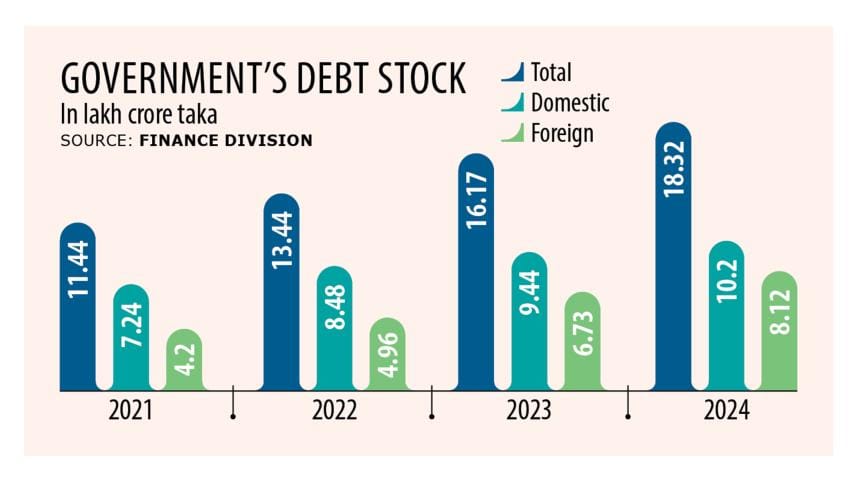

As of June 2024, government debt had risen to a record Tk 1,832,282 crore, up from Tk 1,144,296 crore in June 2021.

Apart from interest payments, subsidy costs have also surged significantly.

Due to the recent spike in global prices, the government had to allocate a substantial amount for subsidies as well as to clear arrears.

During the July-November period, the government spent Tk 27,979 crore on subsidies—nearly twice as much as the previous year.

At the same time, rising government expenditures have not been matched by local revenue collection, with Bangladesh's tax-to-gross domestic product (GDP) ratio remaining alarmingly low.

Currently, Bangladesh's tax-to-GDP ratio stands at around 8 percent—far behind India's 12 percent and Nepal's 17 percent. The country's ratio is also significantly lower than the Asia-Pacific average of 19 percent and the 25 percent average for developing nations.

Government spending under the ADP stood at Tk 24,058 crore in the first five months of the fiscal year, down from Tk 32,773 crore in the same period last year, according to finance ministry data.

However, the Implementation Monitoring and Evaluation Division (IMED) reported Tk 30,818 crore in ADP spending for the July-December period, revealing a mismatch of Tk 6,760 crore.

Usually, IMED compiles data from ministries and divisions, while the finance ministry reports actual disbursements through its iBAS++ system.

Meanwhile, development spending under the revenue budget stood at Tk 571 crore, up from Tk 192 crore a year earlier.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments