Bangladeshi card spending falls in India, rises in Thailand, Singapore

Credit card spending by Bangladeshi citizens in India has plummeted in recent months while it is rising in Thailand and Singapore, according to central bank data.

This trend, according to industry people, is linked to India's limited visa issuance, which has reduced the number of Bangladeshi patients and tourists visiting the neighbouring country.

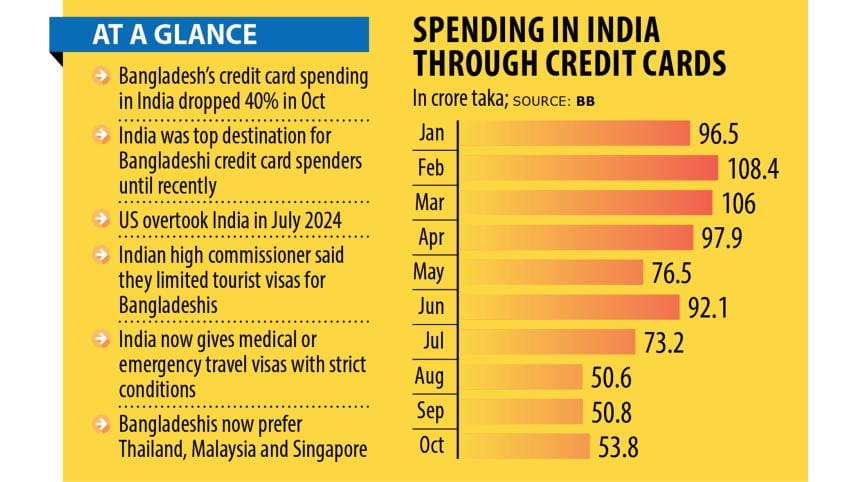

In October this year, credit card spending by Bangladeshis in India declined by over 40 percent year-over-year, dropping from Tk 90.2 crore to Tk 53.8 crore, as per the latest data of the Bangladesh Bank.

India's share of total overseas credit card spending by Bangladeshis fell from 16.50 percent in October 2023 to 10.78 percent in the same month this year.

Meanwhile, credit card usage by Bangladeshis in Thailand and Singapore has increased.

Historically, India has been the top destination for Bangladeshi credit card spending abroad. From March 2023 to June 2024, India consistently held the top spot. However, in July this year, the United States surpassed India.

After the political changeover in August and the formation of the interim government, Indian High Commissioner to Bangladesh Pranay Verma in October clarified that India would not resume tourist visas for Bangladeshis anytime soon.

The envoy said that the Indian High Commission in Dhaka was issuing visas only for emergency cases.

In that month, Randhir Jaiswal, spokesperson for India's external affairs ministry, confirmed at a briefing that the country had limited visa operations in Bangladesh and was only issuing visas for medical and emergency reasons.

Consequently, credit card usage by Bangladeshis in India has declined. Instead of India, Bangladeshis are now opting for Thailand, Malaysia and Singapore for medical and travel purposes.

Thailand has now become the second-largest destination for Bangladeshi credit card spending abroad, according to central bank data.

In September, Bangladeshis spent Tk 42 crore through credit cards in Thailand while the amount surged to Tk 57 crore in October, elevating Thailand to the second position and pushing India to third.

Following Thailand, Singapore has seen significant growth in credit card spending by Bangladeshis. In October, Bangladeshis spent Tk 43 crore in Singapore, up from Tk 30 crore in September.

Syed Mohammad Kamal, country manager for Bangladesh at Mastercard, said that visits from Bangladesh to India have dropped by nearly 90 percent due to visa restrictions.

He said very few people are now able to travel to India for medical treatment as patients must obtain written permission from doctors under strict conditions.

Kamal said tourists who previously chose Kolkata are now heading to Cox's Bazar while those who used to visit Mumbai or other Indian cities are now opting for Thailand, Singapore and Nepal.

The Bangladesh Bank report, titled "An Overview of Credit Cards Usage Pattern Within and Outside Bangladesh", collected extensive data on credit card transactions from 44 scheduled banks and 1 non-bank financial institution in the country.

It showed that domestic credit card transactions increased by 7.41 percent in October, amounting to Tk 28.66 crore compared to Tk 26.68 crore in September.

Similarly, international transactions outside the country totalled Tk 498 crore in October, showing an increase of 18.56 percent from Tk 420 crore in September.

Concurrently, transactions made using credit cards issued by foreign entities but utilised within Bangladesh increased to Tk 129 crore in October from Tk 111 crore in September, indicating a considerable increase of 15.89 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments