Bangladesh turning into a consumer electronics manufacturing hub

Bangladesh is turning into a manufacturing hub for consumer electronics thanks to its affordable wage structure, expertise in information technology and light engineering industries, according to Singer Bangladesh.

The country's sole listed multinational consumer electronics producer made the assessment against the backdrop of the domination of locally manufactured and assembled televisions with a 90 percent market share, according to industry operators.

This is a significant change from that just over a decade ago, when Bangladesh was fully dependent on imports.

Furthermore, this enhancement in manufacturing capacity is being catalysed by the government's thrust on domestic manufacturing, boosting local value addition and ensuring lower reliance on imports, added Singer 2023 annual report which was published recently.

Since fiscal year 2010-11, the government has reduced import duties and other taxes to encourage domestic manufacturing of goods, including consumer electronics, to facilitate growth and attract investment, said industry insiders.

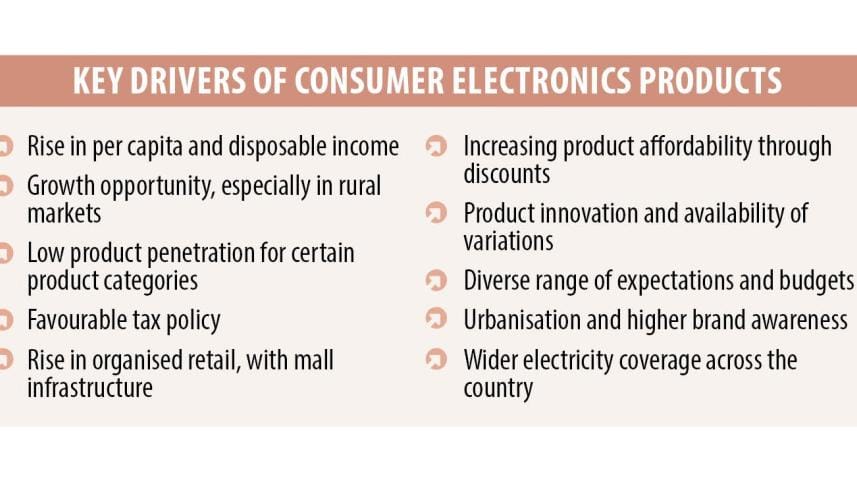

A rise in per capita and disposable income is raising demand for consumer electronics and the growth opportunity in rural markets prevails for high remittance earnings, said Singer.

There are a few key trends shaping Bangladesh's consumption story, signalling long-term demand -- a large population pool, demographic advantages, low product penetration, replacement demand and urbanisation, it said.

Riding the long-term consumption wave of a developing economy in itself bodes well for future long-term prospects of the industry, said Singer.

Walton, the largest local home appliance maker, sees prospects too.

Domestically produced air conditioners (ACs) currently account for 70 percent to 75 percent of the Bangladesh market sales, said Walton Hi-tech Industries in its annual report for 2022-23.

In case of refrigerators too local manufacturing meets over 80 percent of the demand.

Just a decade ago Bangladesh was almost fully dependent on imports to meet its demand for refrigerators, according to industry operators.

Before 2010, prior to the rise in local manufacturing, the refrigerator market was seeing annual sales of at best 7 lakh to 8 lakh units, said Walton.

It peaked to 40 lakh in 2019 but due to the pandemic and inflation brought about by the Ukraine-Russia war, market sales have recently shrunk to around 30 lakh units, it said.

According to Walton, $2.4 billion-worth home appliances were sold in Bangladesh in 2021.

The figure has been increasing at an average rate of 14 percent per annum over the past decade.

Sales of local consumer electronics, meaning those for communication, entertainment, or information purposes, are expected to grow to $5.17 billion by 2025, said Walton.

Sales of home appliances, meaning machine which assists in household functions, are expected to rise to $10 billion by 2030, it said.

"The future of the consumer durables market looks bright as the GDP growth is set to continue in the upward trajectory which in turn will increase the purchasing power of the population," it said.

Electricity coverage has reached 99 percent of the country's people, including those in rural areas, for which there is likely to be high demand from semi-urban and rural areas for consumer durables.

Annual sales of home and kitchen appliance products such as washing machines, ovens, blenders and juicers, rice and electric cookers, kettles and gas stoves currently stand at over Tk 2,000 crore, said Walton.

This will reach around Tk 3,000 crore by fiscal year 2027-28 with a consistent market growth rate of around 7 percent, Walton said.

Sales of electrical appliances such as fans, LED lights and electrical accessories stood at over Tk 15,000 crore last fiscal year.

This year it is expected to reach around Tk 18,000 crore with a 23 percent growth rate.

This will continue to rise at an estimated average growth rate of 19 percent till fiscal year 2027-28.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments