Bangladesh eyes Pakistan as emerging sourcing destination

Bangladesh stands to benefit from enhanced trade ties with Pakistan as local traders are optimistic about getting more competitive prices and a broader range of raw material sources.

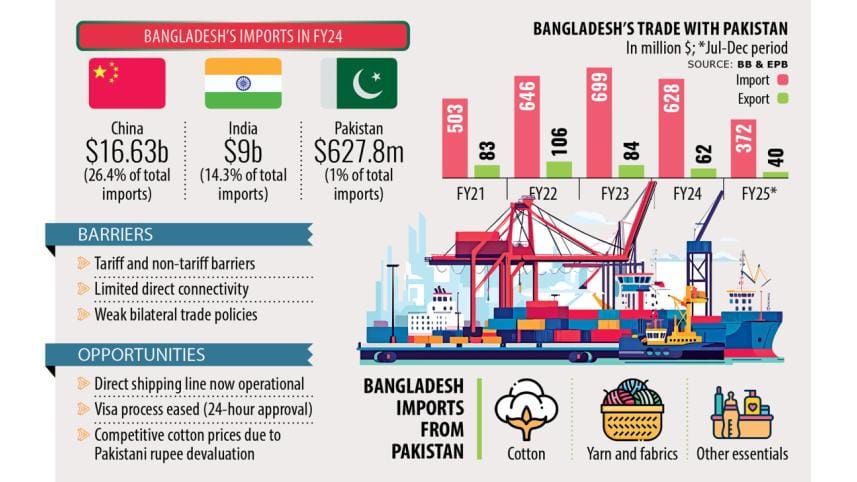

Currently, trade dynamics favour Pakistan, with Bangladesh importing cotton, yarn, fabrics, and essential commodities from the country.

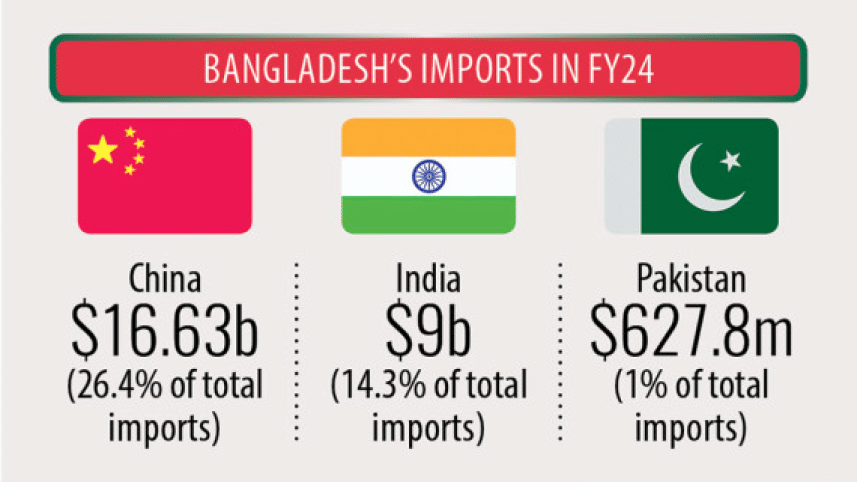

However, these imports are still considerably lower than those from China and India -- Bangladesh's top two trading partners.

Historically, the trade relationship between Bangladesh and Pakistan has been lukewarm, preventing Pakistan from becoming a major sourcing hub.

For instance, Bangladesh exported goods worth $39.77 million to Pakistan in the July–December of the current fiscal year, according to the Export Promotion Bureau (EPB).

In the fiscal year 2023–24, Bangladesh's exports to Pakistan totalled $61.98 million, a 31.78 percent decline from $83.59 million in 2022–23.

This was far outweighed by Bangladesh's imports from Pakistan, which stood at $372.1 million in the July-December period of FY25, according to Bangladesh Bank data. In FY24, imports from Pakistan amounted to $627.8 million, down from $698.7 million in FY23.

Although there are no formal trade restrictions between the two South Asian neighbours, Pakistan has yet to emerge as a major sourcing destination due to weak trade relations.

In FY24, Bangladesh imported goods worth $16.63 billion from China, representing 26.4 percent of the country's total imports for that year. That same year, imports from India stood at $9 billion, accounting for 14.3 percent of Bangladesh's total imports.

By contrast, imports from Pakistan amounted to just $627.8 million, or 1 percent of the total, making Pakistan Bangladesh's 20th largest import destination.

A majority of this amount, $476.3 million, was spent on cotton imports.

Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development, said that Bangladesh needs a reliable, competitive and diversified supply of key commodities, including food and energy, for future economic growth.

Pakistan could be a valuable sourcing destination in this regard, increasing competition among supplying countries, he added.

The economist said that tariff and non-tariff barriers should be discussed and rationalised between the two governments.

Although Bangladesh enjoys trade privileges with Pakistan under the South Asian Free Trade Agreement as a least developed country, the benefit remains minimal due to low export volumes.

Razzaque does not see an immediate need for a Free Trade Agreement with Pakistan, saying such deals may be prioritised with major trading partners. Moreover, a boost in trade between Bangladesh and Pakistan could also enhance intra-regional commerce in South Asia.

Currently, intra-regional trade accounts for less than 5 percent of South Asia's total overseas trade, partly due to the limited effectiveness of the South Asian Association for Regional Cooperation (Saarc), which was established in 1985 to increase economic collaboration.

Abul Kasem Khan, former president of the Dhaka Chamber of Commerce and Industry (DCCI), said Bangladesh would benefit from expanding trade with Pakistan, which has been largely stagnant for the past 15 years.

"It would be a positive development for business," he said, highlighting price competitiveness as a key factor.

Khan said Bangladesh could source Pakistani cotton and denim fabrics at lower, more competitive prices.

Mir Nasir Hossain, a former president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), echoed a similar view.

Expanding trade with Pakistan would offer Bangladesh more sourcing options and diversified connectivity, he said, adding that Bangladesh could also increase its exports of jute and tea to Pakistan.

He recalled that during his tenure as FBCCI president in 2005, bilateral trade talks between the two countries gained momentum, but negotiations later stalled.

An FTA between Pakistan and Bangladesh was first proposed in 2002 and discussed again at the 2004 Saarc summit. However, it was not finalised as Pakistan did not accept Bangladesh's request for unilateral and unconditional market access, according to The Atlantic Council, an American think tank in the field of international affairs.

The Pakistan Business Council (PBC), a pan-industry advocacy forum based in Karachi, conducted a study titled "Trade and Investment Opportunities in a Pakistan–Bangladesh Free Trade Agreement (FTA)" in 2022.

The report highlights the longstanding trade imbalance in favour of Pakistan.

Pakistani exports to Bangladesh declined from $947.23 million in 2011 to $583.44 million in 2020, while imports from Bangladesh fell from $82.73 million in 2011 to $61.94 million in 2020.

In 2020, Pakistan recorded a trade surplus of $521.5 million with Bangladesh, the biggest in the past decade.

According to the PBC's analysis, Pakistan has an export potential of at least $2.95 billion in Bangladesh, mainly in textiles, agriculture, foodstuffs, chemicals, base metals, plastics and cement products.

The top 25 commodities alone had an estimated export potential of $1.24 billion in 2020, yet Pakistan's actual exports for these items amounted to just $435.78 million, according to the analysis.

To strengthen bilateral trade, the Federation of Pakistan Chambers of Commerce and Industry and the FBCCI signed a memorandum of understanding on 13 January this year to form the Pakistan–Bangladesh Joint Business Council (PBJBC).

FBCCI Administrator Md Hafizur Rahman, who led the Bangladeshi delegation at the joint meeting, acknowledged the potential for increased trade.

However, he pointed out that trade volumes remained low, possibly due to political factors.

He also cited weak connectivity as a challenge, saying that the lack of a direct shipping line and visa complications had hampered trade in the past.

However, now Pakistan has eased its visa process for Bangladeshis, offering approval within 24 hours of application.

A direct shipping line is also now in place, so trade with Pakistan is expected to grow significantly, increasing connectivity and engagement between businesses in both countries, he added.

Regarding Pakistan as a sourcing destination for cotton, yarn, and fabrics, Rahman said local textile and garment manufacturers diversified their sourcing strategies a few years ago, with Pakistan becoming one of several key suppliers.

He said Bangladeshi spinners and traders now import cotton from Argentina, Australia, Brazil, the US, several African nations and Pakistan, reducing their dependency on India.

Showkat Aziz Russell, president of the Bangladesh Textile Mills Association, said Bangladeshi cotton traders and spinners were importing more cotton from Pakistan due to its competitive pricing.

"Pakistani cotton is much cheaper now because of the heavy devaluation of its currency," he said.

Previously, bulk imports from Pakistan were limited due to weak bilateral relations, but with strengthened trade ties, higher volumes are expected, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments