Bangladesh expands offshore banking in hunt for forex

Offshore banking is increasingly becoming a key window for banks in Bangladesh to facilitate investments and international trade by attracting deposits in foreign currencies.

Industry people say offshore banking can even play a crucial role in mitigating the persisting foreign currency crisis in the country by extending liquidity support and stabilising the local currency.

"Deposits of offshore banking will be a major source for US dollars," said Mashrur Arefin, managing director and chief executive officer of City Bank, which has stepped up efforts to draw foreign deposits through offshore banking operations (OBOs).

Offshore banking is not new in Bangladesh.

It started its journey in 1985 as the central bank created financing opportunities for factories at the export processing zones – the estates set up to drive the country's export earnings – by providing banking service to importers, exporters, and financial institutions.

The segment received more attention in recent years, particularly after Bangladesh began to feel the pinch following a sharp depletion of foreign currency reserves.

In March this year, parliament passed the Offshore Banking Act 2024 to give a much-needed boost to the country's desperate efforts to improve the US dollar supply, which has squeezed in the past two years owing to higher outflows compared to inflows.

The BB has relaxed rules and policies to allow both Bangladeshis and foreign nationals to avail the service. It has permitted domestic commercial banks' OBOs to offer an interest or profit rate markup over a benchmark rate for term deposits in foreign currencies to eligible customers.

The customers include individuals and entities residing outside the country, non-resident Bangladeshis, persons of Bangladesh origin, foreign nationals, companies registered and operating abroad, and external institutional investors.

The central bank has allowed domestic banking units to receive funds from OBOs up to 40 percent of their regulatory capital to settle payment obligations.

OBOs can be executed in five currencies: the US dollar, the British pound, the euro, the yen, and the yuan.

Currently, about 40 banks have offshore units. At the end of September, the total outstanding loans of OBUs stood at Tk 83,826 crore.

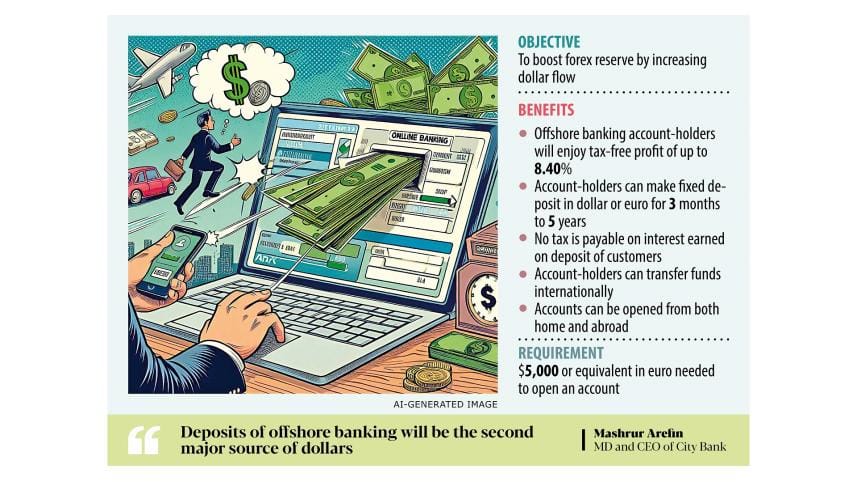

Investors enjoy tax-free profit of up to 8.40 percent on fixed deposits in the USD or the euro for terms ranging from three months to five years. They are also able to transfer funds internationally without any restriction along with profit.

"The offshore banking system has become a new avenue for the dollar supply apart from exports and remittance. Offshore banks' fixed deposits can be used to cover the cost of imports," Arefin said, adding that the dollars obtained through OBOs are sold on the interbank foreign exchange market.

Currently, City Bank has deposits amounting to $23 million under its offshore banking unit. "Our target is to raise it to $1 billion," the noted banker said.

There are two ways to open offshore banking accounts: one is for those residing in Bangladesh and the other is for those who live abroad.

Any representative of expatriates, such as family members and relatives, or partner of a foreign investor residing in Bangladesh can open accounts. Similarly, expatriates and foreign investors can do the same.

"We call it international bank accounts. City Bank mobilised $29 lakh through the accounts opened from abroad," Arefin said.

City Bank is providing the facility to open dollar accounts for offshore deposits at its 175 branches.

Mohammad Ali, managing director and CEO of Pubali Bank, said the offshore banking has a huge potential in Bangladesh.

"Our reserves are small. If we can promote it properly, every bank can mobilise billions of dollars through the offshore banking."

Pubali Bank is developing software and a mobile app so that anyone can open accounts and do banking from abroad.

"We hope to complete all procedures by next two months."

Mohammad Ali said if Bangladeshi expatriates deposit money at OBOs, import obligations can be met with the funds as well as from remittance and export earnings.

"Then, the forex reserves will go up automatically."

Speaking about the prospect of offshore banking, both Arefin and Mohammad Ali gave the example of Mauritius, an Indian ocean island nation with only about 1.3 million population.

"This country has a balance of $800 billion under offshore banking," Arefin said.

"We have a huge economy with 17 crore population. If more people are informed about the advantages of this banking relationship, there is a possibility of bringing $50 billion under OBOs."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments